Your Real estate modelling and forecasting images are ready. Real estate modelling and forecasting are a topic that is being searched for and liked by netizens today. You can Download the Real estate modelling and forecasting files here. Download all royalty-free vectors.

If you’re searching for real estate modelling and forecasting images information linked to the real estate modelling and forecasting keyword, you have visit the ideal blog. Our website frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly search and find more informative video content and images that match your interests.

Real Estate Modelling And Forecasting. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. Real Estate Modelling and Forecasting. The regression analysis topics of chapters 4 to 6 are fundamental to conducting empirical research in real estate. In this chapter you will learn how to.

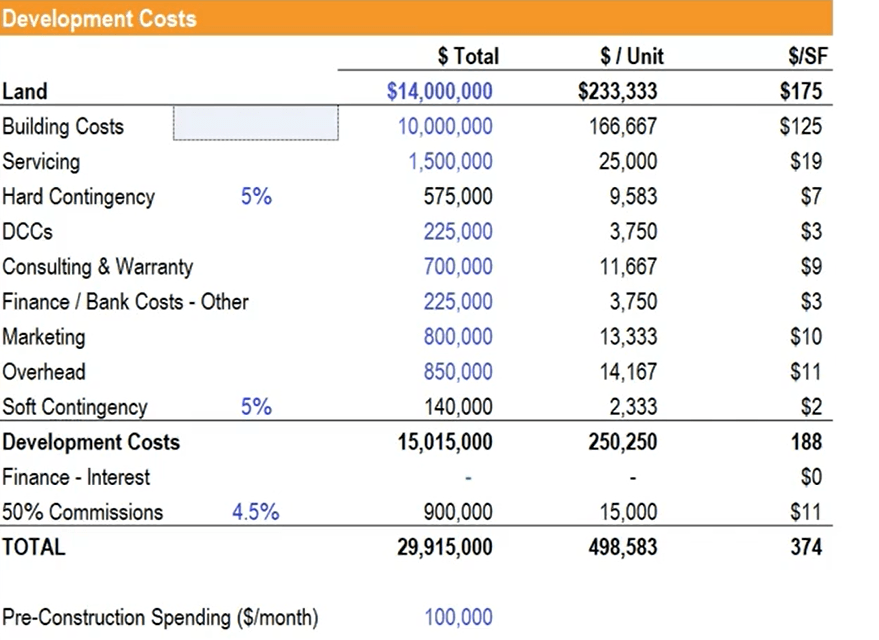

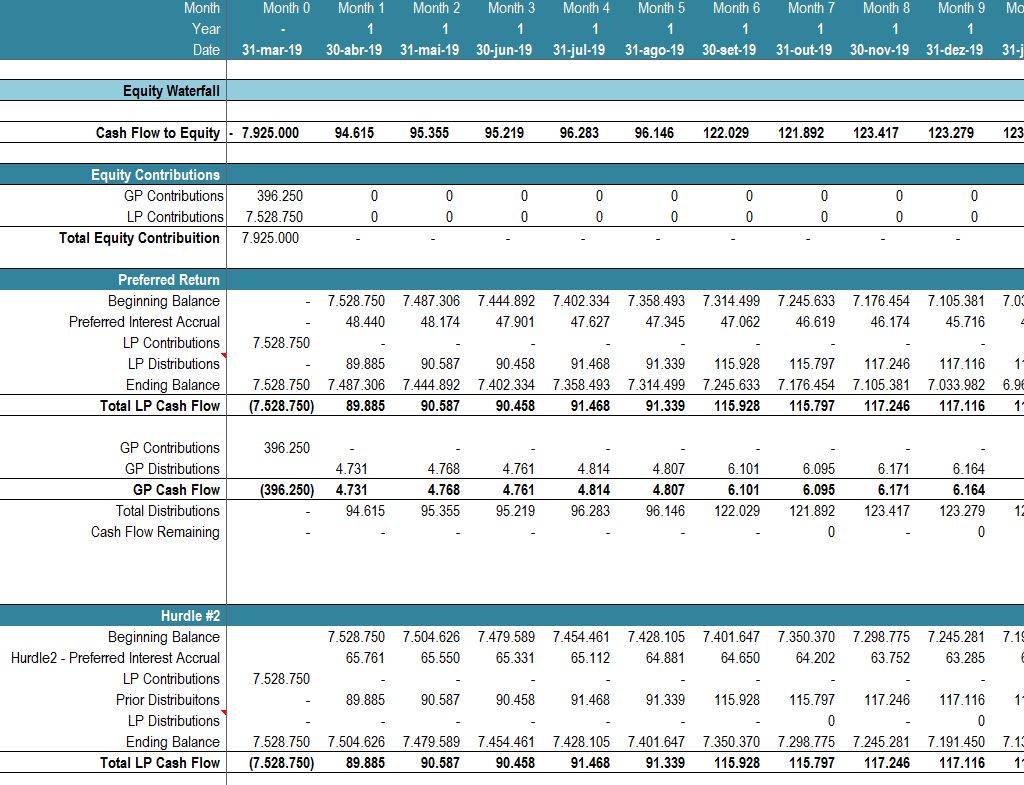

Real Estate Development Model Overview Guide And Steps From corporatefinanceinstitute.com

Real Estate Development Model Overview Guide And Steps From corporatefinanceinstitute.com

Real Estate Modelling and Forecasting Brooks Chris Tsolacos Sotiris ISBN. Brooks Chris Tsolacos Sotiris. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. Real estate investment Statistical methods. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. Real Estate Modelling and Forecasting As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting.

As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets.

The regression analysis topics of chapters 4 to 6 are fundamental to conducting empirical research in real estate. Undertake all the stages involved in designing building and evaluating an empirical econometric model in real estate through two detailed examples. Real Estate Modelling and Forecasting Brooks Chris Tsolacos Sotiris ISBN. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. The regression analysis topics of chapters 4 to 6 are fundamental to conducting empirical research in real estate. Buy Real Estate Modelling and Forecasting Illustrated by Brooks Chris Tsolacos Sotiris ISBN.

Source: pinterest.com

Source: pinterest.com

Real Estate Modelling and Forecasting As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting. Brooks Chris Tsolacos Sotiris. This thesis aims to provide an approach to real estate residential modeling and forecasting covering property types correlation time series attributes within a region or a city and socio- economic attributes of preferred real estate locations. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting. The globalisation of real estate capital and the discovery of new markets will prompt a closer examination of the data properties and relationships in these markets.

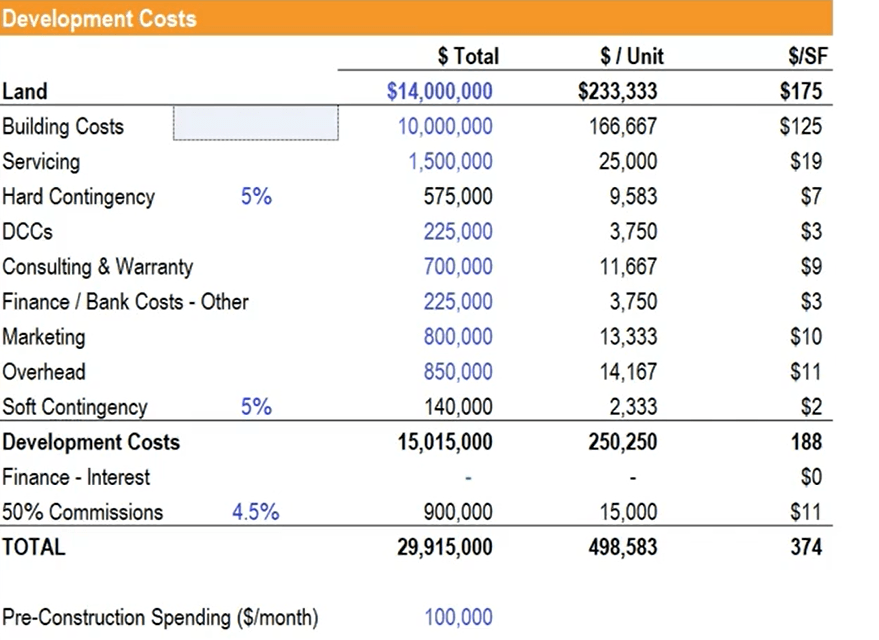

Source: eloquens.com

Source: eloquens.com

9780521873390 Kostenloser Versand für alle Bücher mit Versand und Verkauf duch Amazon. Real estate investment Statistical methods. Real Estate Modelling and Forecasting. In this chapter you will learn how to. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets.

Source: pinterest.com

Source: pinterest.com

Real Estate Modelling and Forecasting Chris Brooks ICMA Centre University of Reading Sotiris Tsolacos Property and Portfolio Research CAMBRIDGE UNIVERSITY PRESS. This thesis aims to provide an approach to real estate residential modeling and forecasting covering property types correlation time series attributes within a region or a city and socio- economic attributes of preferred real estate locations. There are several reasons why modelling and forecasting work in the real estate field will grow and become a more established practice. The regression analysis topics of chapters 4 to 6 are fundamental to conducting empirical research in real estate. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets.

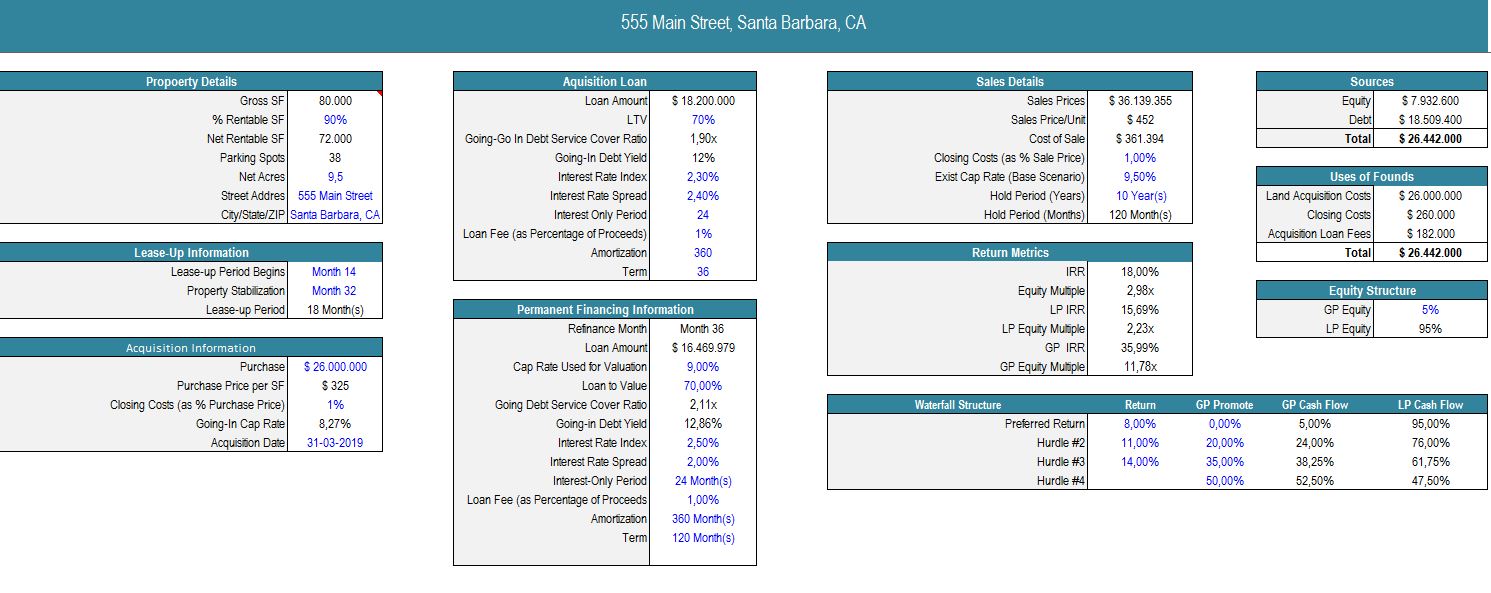

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Real estate modelling and forecasting Chris Brooks Sotiris Tsolacos. In this chapter you will learn how to. Real Estate Modelling and Forecasting Chris Brooks ICMA Centre University of Reading Sotiris Tsolacos Property and Portfolio Research CAMBRIDGE UNIVERSITY PRESS. 9780521873390 from Amazons Book Store. Brooks Chris Tsolacos Sotiris.

Source:

Source:

The regression analysis topics of chapters 4 to 6 are fundamental to conducting empirical research in real estate. Real Estate Modelling and Forecasting Brooks Chris Tsolacos Sotiris ISBN. In this chapter you will learn how to. Undertake all the stages involved in designing building and evaluating an empirical econometric model in real estate through two detailed examples. Real estate investment Statistical methods.

Source: pinterest.com

Source: pinterest.com

Real Estate Modelling and Forecasting As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting. Real Estate Modelling and Forecasting Chris Brooks ICMA Centre University of Reading Sotiris Tsolacos Property and Portfolio Research CAMBRIDGE UNIVERSITY PRESS. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. Real estate modelling and forecasting Chris Brooks Sotiris Tsolacos. Buy Real Estate Modelling and Forecasting Illustrated by Brooks Chris Tsolacos Sotiris ISBN.

Source: pinterest.com

Source: pinterest.com

Real Estate Modelling and Forecasting. 9780521873390 from Amazons Book Store. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. This thesis aims to provide an approach to real estate residential modeling and forecasting covering property types correlation time series attributes within a region or a city and socio- economic attributes of preferred real estate locations. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets.

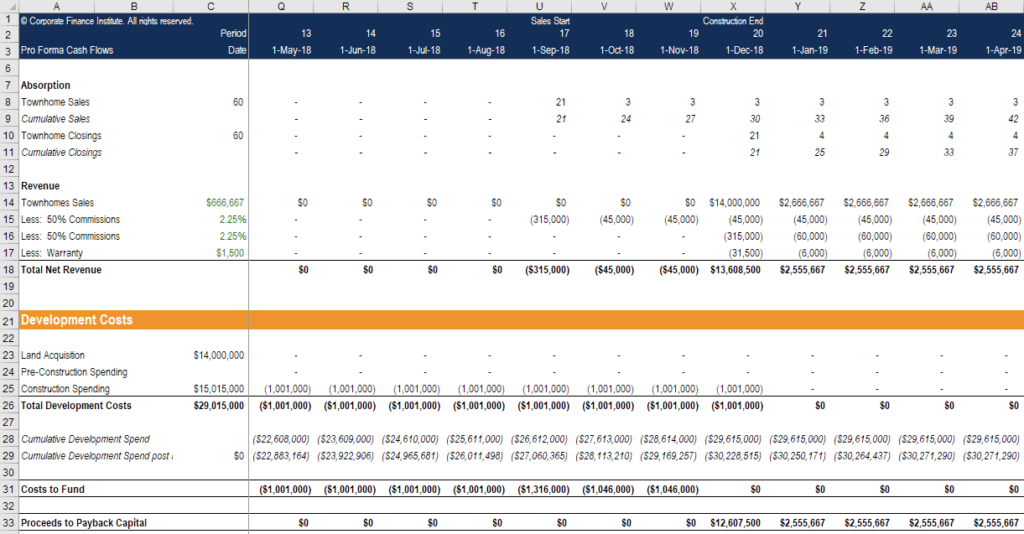

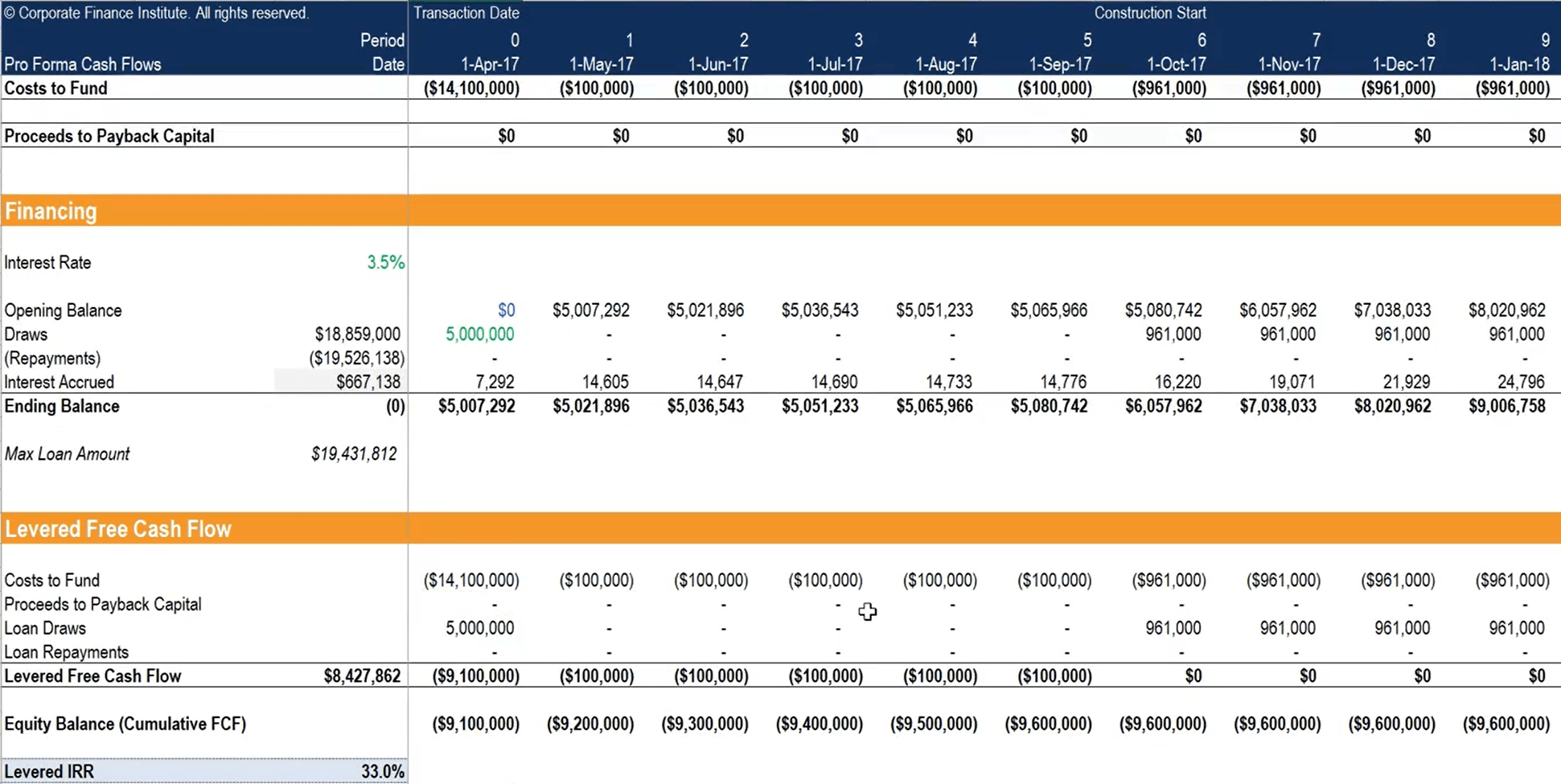

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. Real Estate Modelling and Forecasting As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting. An third approach to forecasting real estate returns is to consider additional explanatory variables that explicitly incorporate analysts expectations about business conditions in a vector autoregressive VAR model framework.

Source: youtube.com

Source: youtube.com

9780521873390 from Amazons Book Store. The globalisation of real estate capital and the discovery of new markets will prompt a closer examination of the data properties and relationships in these markets. Brooks Chris Tsolacos Sotiris. The regression analysis topics of chapters 4 to 6 are fundamental to conducting empirical research in real estate. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets.

Source:

Source:

Real Estate Modelling and Forecasting. The regression analysis topics of chapters 4 to 6 are fundamental to conducting empirical research in real estate. Real Estate Modelling and Forecasting. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. Includes bibliographical references and index.

Source: pinterest.com

Source: pinterest.com

There are several reasons why modelling and forecasting work in the real estate field will grow and become a more established practice. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting. 9780521873390 Kostenloser Versand für alle Bücher mit Versand und Verkauf duch Amazon. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. Real Estate Modelling and Forecasting Chris Brooks ICMA Centre University of Reading Sotiris Tsolacos Property and Portfolio Research CAMBRIDGE UNIVERSITY PRESS.

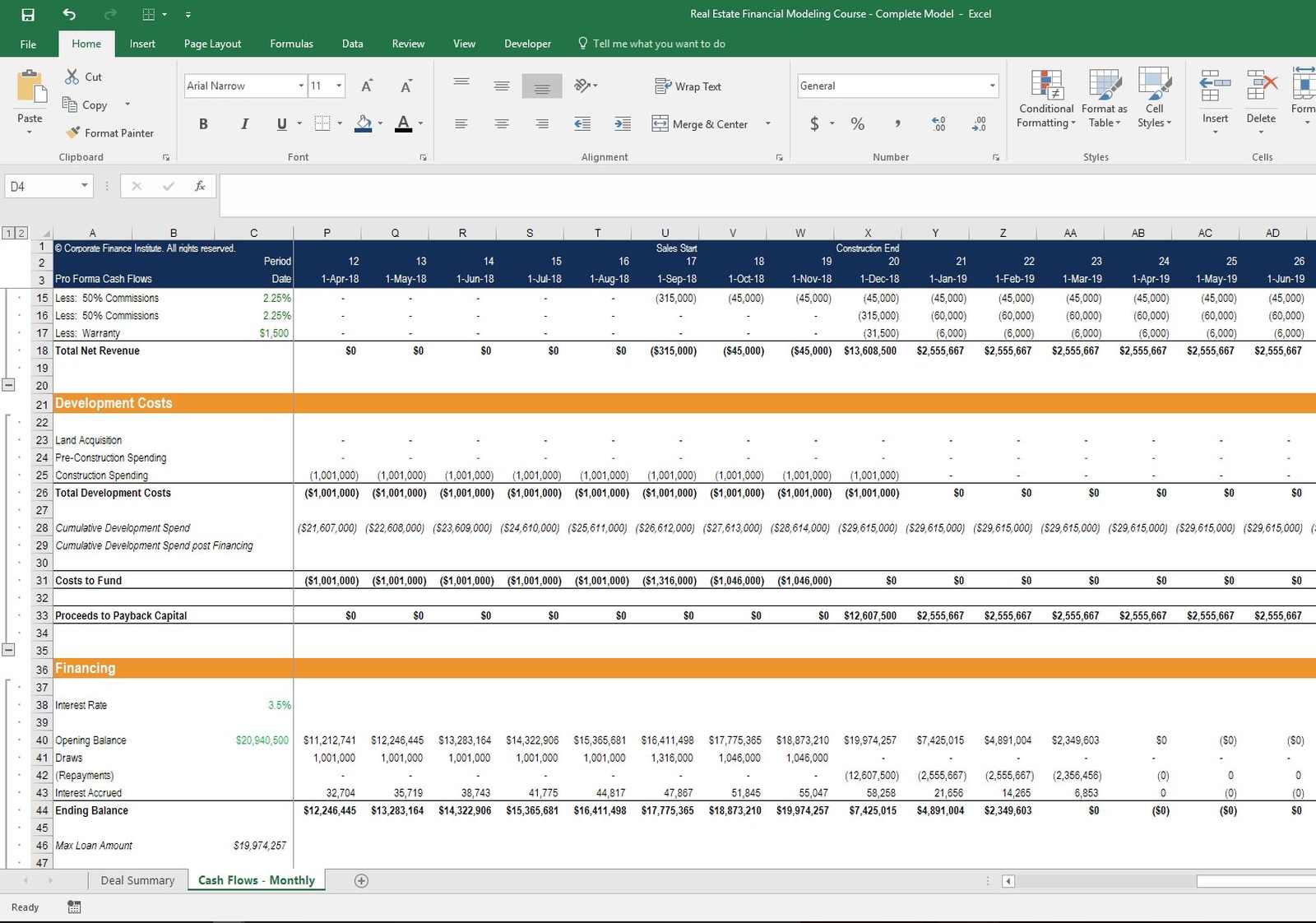

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. 9780521873390 Kostenloser Versand für alle Bücher mit Versand und Verkauf duch Amazon. The regression analysis topics of chapters 4 to 6 are fundamental to conducting empirical research in real estate. The globalisation of real estate capital and the discovery of new markets will prompt a closer examination of the data properties and relationships in these markets. Brooks Chris Tsolacos Sotiris.

Source: breakingintowallstreet.com

Source: breakingintowallstreet.com

In this chapter you will learn how to. An third approach to forecasting real estate returns is to consider additional explanatory variables that explicitly incorporate analysts expectations about business conditions in a vector autoregressive VAR model framework. Real Estate Modelling and Forecasting Brooks Chris Tsolacos Sotiris ISBN. Real estate modelling and forecasting Chris Brooks Sotiris Tsolacos. This thesis aims to provide an approach to real estate residential modeling and forecasting covering property types correlation time series attributes within a region or a city and socio- economic attributes of preferred real estate locations.

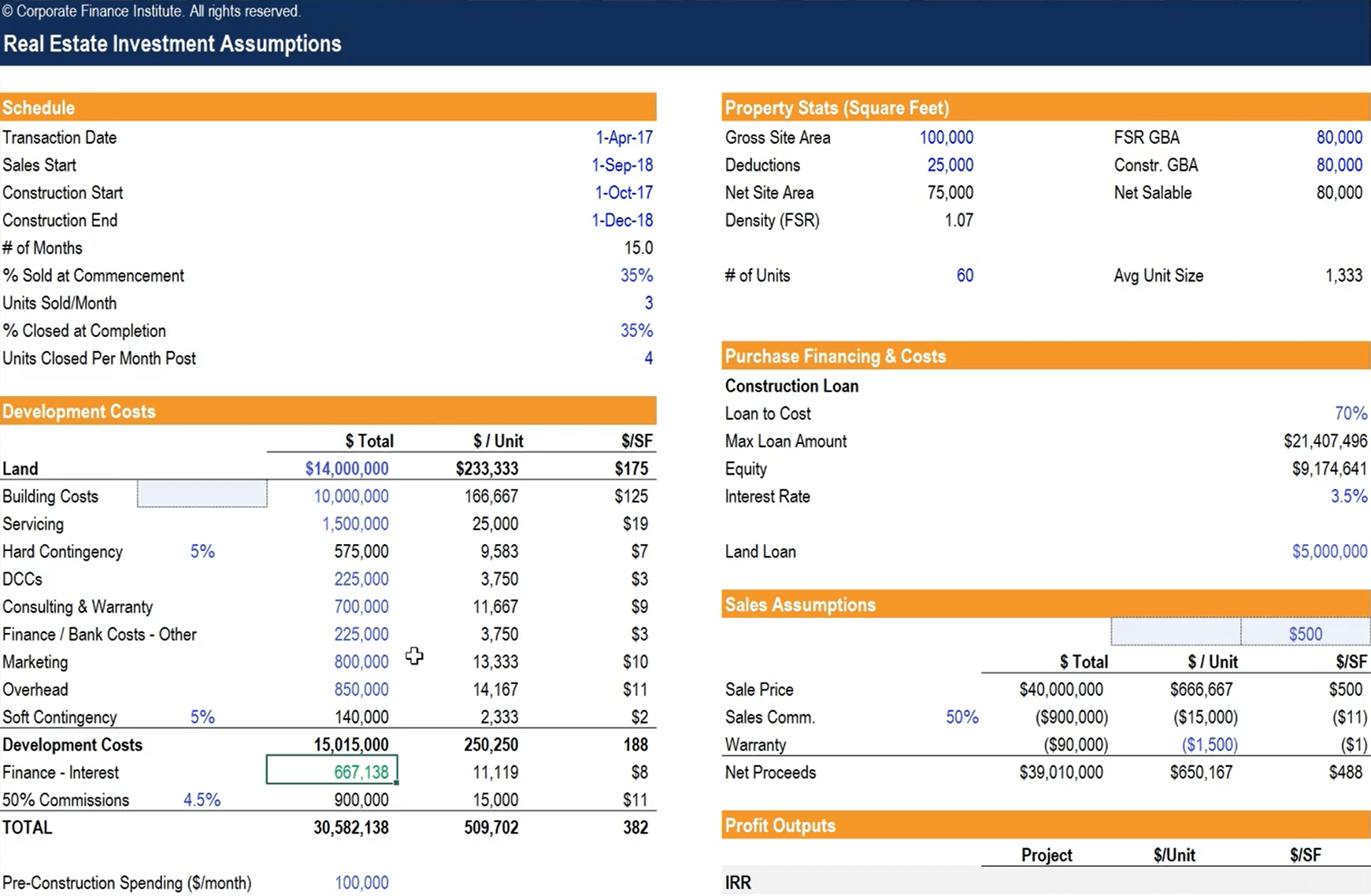

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. Buy Real Estate Modelling and Forecasting Illustrated by Brooks Chris Tsolacos Sotiris ISBN. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. 9780521873390 from Amazons Book Store. The regression analysis topics of chapters 4 to 6 are fundamental to conducting empirical research in real estate.

Source: pinterest.com

Source: pinterest.com

Real Estate Modelling and Forecasting. 9780521873390 from Amazons Book Store. Real estate investment Statistical methods. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. There are several reasons why modelling and forecasting work in the real estate field will grow and become a more established practice.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. There are several reasons why modelling and forecasting work in the real estate field will grow and become a more established practice. 9780521873390 Kostenloser Versand für alle Bücher mit Versand und Verkauf duch Amazon. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. Real Estate Modelling and Forecasting.

Source: breakingintowallstreet.com

Source: breakingintowallstreet.com

Real Estate Modelling and Forecasting As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting. Real Estate Modelling and Forecasting. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting the performance of real estate assets.

Source: pinterest.com

Source: pinterest.com

In this chapter you will learn how to. 9780521873390 Kostenloser Versand für alle Bücher mit Versand und Verkauf duch Amazon. Undertake all the stages involved in designing building and evaluating an empirical econometric model in real estate through two detailed examples. As real estate forms a significant part of the asset portfolios of most investors and lenders it is crucial that analysts and institutions employ sound techniques for modelling and forecasting. The regression analysis topics of chapters 4 to 6 are fundamental to conducting empirical research in real estate.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title real estate modelling and forecasting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.