Your Real estate taxes hillsborough county florida images are ready. Real estate taxes hillsborough county florida are a topic that is being searched for and liked by netizens now. You can Download the Real estate taxes hillsborough county florida files here. Download all free photos.

If you’re searching for real estate taxes hillsborough county florida pictures information related to the real estate taxes hillsborough county florida interest, you have come to the right site. Our website always provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

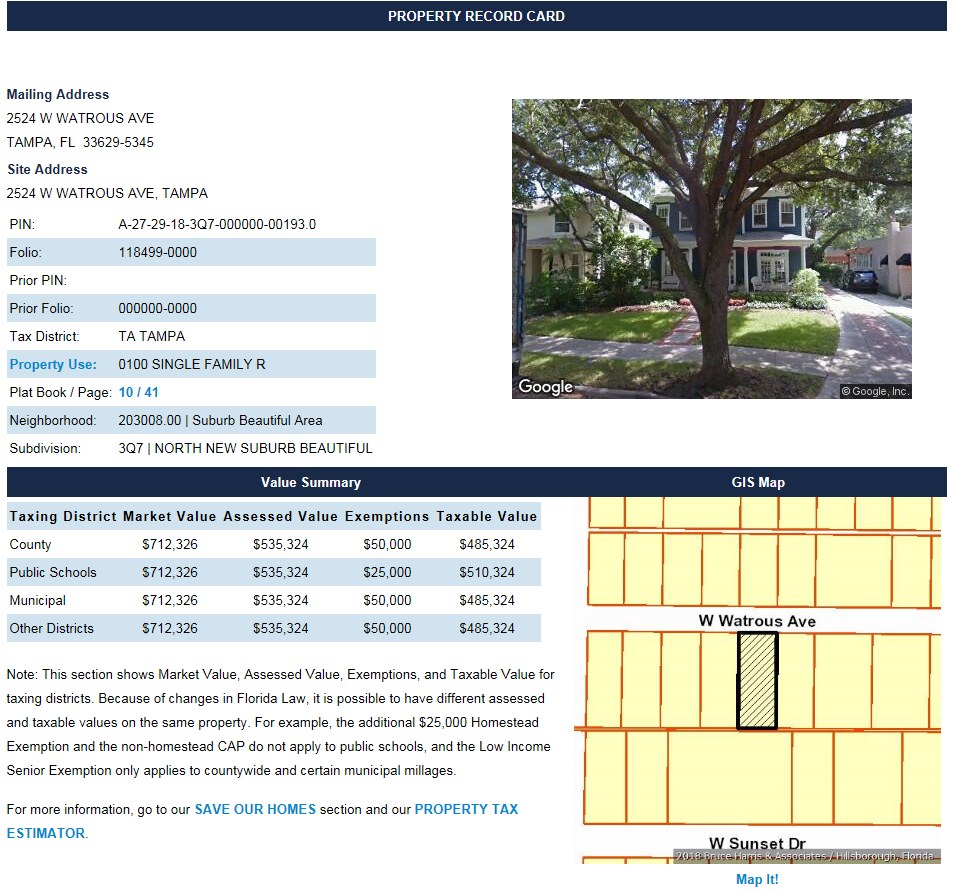

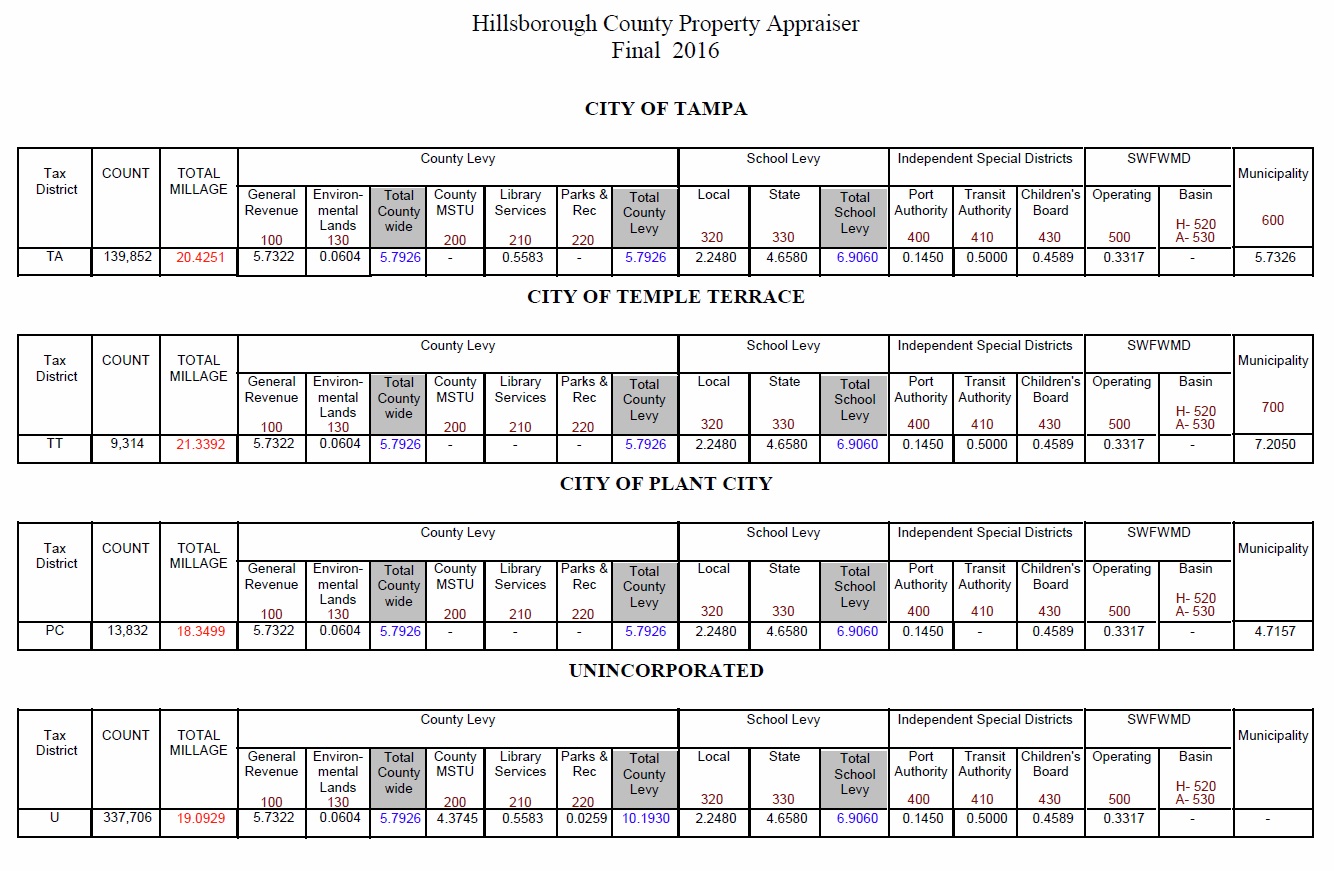

Real Estate Taxes Hillsborough County Florida. Search for Parcel Information. Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. This includes real estate and tangible personal property the equipment machinery and fixtures of businesses. The tax certificates face amount consists of the sum of the following.

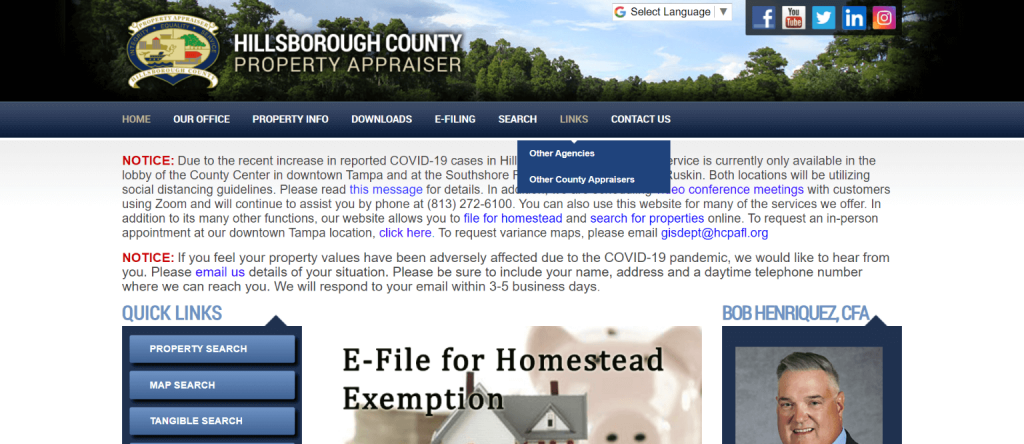

In an effort to provide you and our mutual customers with a convenient and efficient property tax payment solution the Hillsborough County Tax Collectors office have partnered with Grant Street Group to utilize Escrow Express for the upcoming real estate and tangible personal property tax collection cycle. Welcome to our online records search center. They are a valuable tool for the real estate. If you are responsible for remitting property tax. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. No electronic delivery accepted Address.

Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on the delinquent amount and the newspapers advertising charge sale costs or other costs.

6701 N 13th St Tampa FL. The Property Appraiser establishes the taxable value of real estate property. Hillsborough County - Real Estate. For more information call the Property Appraiser at. HOA fees are common within condos and some single-family home neighborhoods. Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on the delinquent amount and the newspapers advertising charge sale costs or other costs.

Source: hillstax.org

Source: hillstax.org

Welcome to our online records search center. Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on the delinquent amount and the newspapers advertising charge sale costs or other costs. No electronic delivery accepted Address. Hillsborough County - Real Estate. For more information call the Property Appraiser at.

Source: tampabay.com

Source: tampabay.com

Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month. They are a valuable tool for the real estate. Newest Price high to low Price low to high Bedrooms Bathrooms. The Hillsborough County Property Appraiser is an elected official charged with the duty and responsibility to appraise all of the property in the County. They are maintained by various government offices in Hillsborough County Florida State and at the Federal level.

Source: mysuperbhome.com

Source: mysuperbhome.com

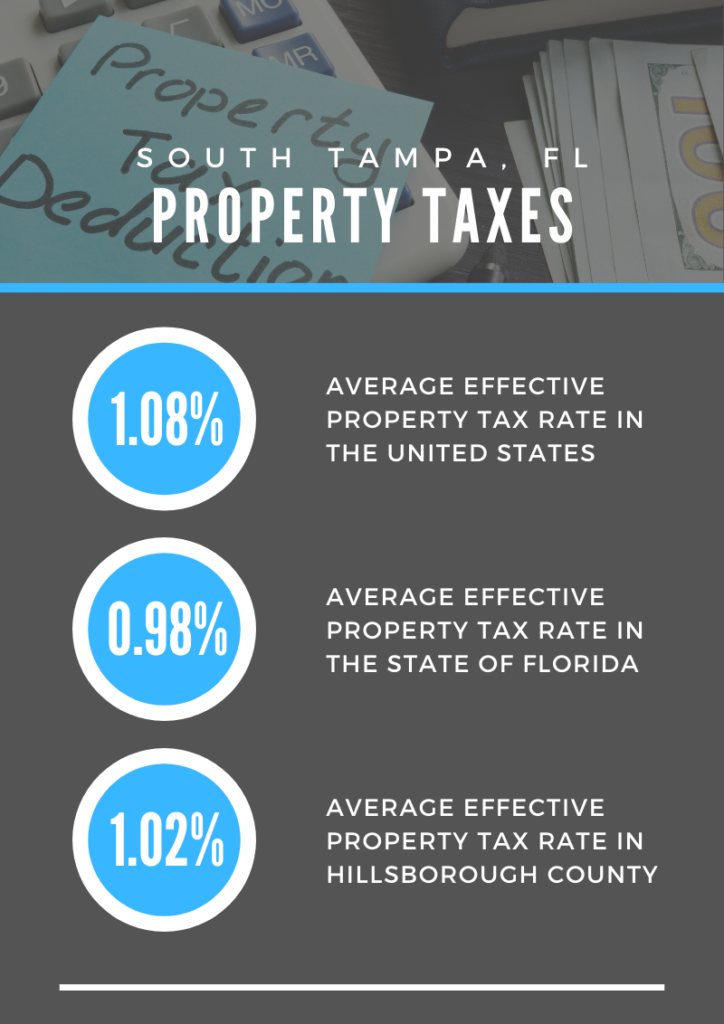

Delinquent real estate tax unpaid amount interest 3 on the delinquent amount Tax Collectors commission 5 on the delinquent amount and the newspapers advertising charge sale costs or other costs. Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. 6701 N 13th St Tampa FL. Hillsborough County Property Records are real estate documents that contain information related to real property in Hillsborough County Florida. The median property tax also known as real estate tax in Hillsborough County is 216800 per year based on a median home value of 19890000 and a median effective property tax rate of 109 of property value.

Source: hcpafl.org

Source: hcpafl.org

6701 N 13th St Tampa FL. Hillsborough County Tax Collector Nancy C. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. Hillsborough County Property Records are real estate documents that contain information related to real property in Hillsborough County Florida. The interest on a tax certificate will vary up to 18 and begins accruing June 1.

Source: hillstax.org

Source: hillstax.org

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. The median property tax on a 19890000 house is 216801 in Hillsborough County The median property tax on a 19890000 house is 192933 in Florida The median property tax on a 19890000 house is 208845 in the United States. For more information call the Property Appraiser at. 109 of home value Yearly median tax in Hillsborough County The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900. They are a valuable tool for the real estate.

Source: mysuperbhome.com

Source: mysuperbhome.com

If you are responsible for remitting property tax. In an effort to provide you and our mutual customers with a convenient and efficient property tax payment solution the Hillsborough County Tax Collectors office have partnered with Grant Street Group to utilize Escrow Express for the upcoming real estate and tangible personal property tax collection cycle. County Real Estate and Facility Services Attn. Search for Parcel Information. Newest Price high to low Price low to high Bedrooms Bathrooms.

Source: tampabaytitle.com

Source: tampabaytitle.com

This includes real estate and tangible personal property the equipment machinery and fixtures of businesses. No electronic delivery accepted Address. Taxes are normally payable beginning November 1 of that year. HCPA Employment Opportunities PROPERTY OWNER BILL OF RIGHTS. Hillsborough County Tax Collector Nancy C.

Source: dmz.hcpafl.org

Source: dmz.hcpafl.org

Taxes are normally payable beginning November 1 of that year. HCPA Employment Opportunities PROPERTY OWNER BILL OF RIGHTS. Mail or hand deliver the complete package to Hillsborough County Real Estate and Facilities Services by 9 AM on the auction date posted for that parcel. You will be able to download the tax roll submit request files and submit payment files via the web. Hillsborough County Property Records are real estate documents that contain information related to real property in Hillsborough County Florida.

Source: fishhawkranchrealestate.net

Source: fishhawkranchrealestate.net

Taxes are normally payable beginning November 1 of that year. The interest on a tax certificate will vary up to 18 and begins accruing June 1. HCPA Employment Opportunities PROPERTY OWNER BILL OF RIGHTS. Hillsborough County Tax Collector. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email.

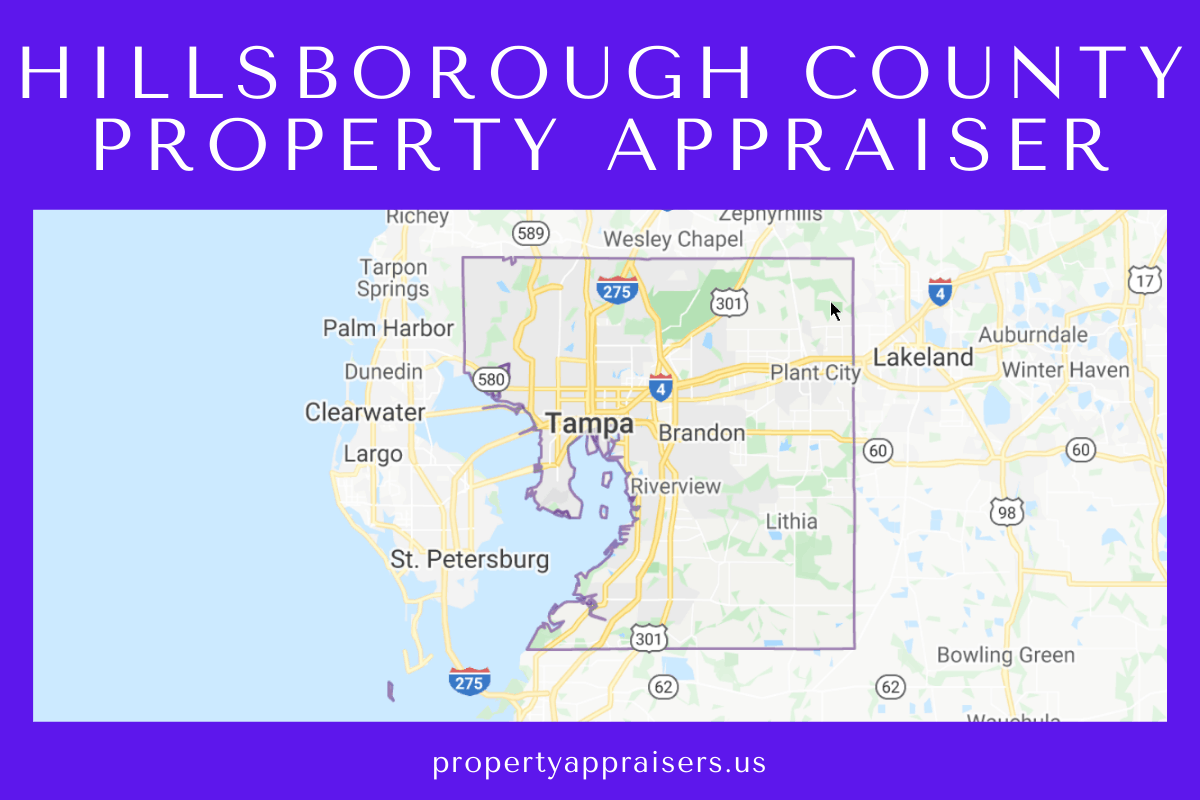

Source: propertyappraisers.us

Source: propertyappraisers.us

No electronic delivery accepted Address. Millan reminds Hillsborough County property owners that 2020 property and tangible taxes are due by March 31st to avoid penalty. Newest Price high to low Price low to high Bedrooms Bathrooms. You will be able to download the tax roll submit request files and submit payment files via the web. You can find detailed information on a parcel of property including who owns it the assessed and market value and some tax information through the Hillsborough County Property Appraisers website.

Source: yoursouthtampahome.com

Source: yoursouthtampahome.com

The interest on a tax certificate will vary up to 18 and begins accruing June 1. The tax certificates face amount consists of the sum of the following. Mail or hand deliver the complete package to Hillsborough County Real Estate and Facilities Services by 9 AM on the auction date posted for that parcel. Sealed Bid Folio No. County Real Estate and Facility Services Attn.

Source: propertyappraisers.us

Source: propertyappraisers.us

The median property tax on a 19890000 house is 216801 in Hillsborough County The median property tax on a 19890000 house is 192933 in Florida The median property tax on a 19890000 house is 208845 in the United States. Hillsborough County Tax Collector Nancy C. Welcome to our online records search center. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Hillsborough County Property Records are real estate documents that contain information related to real property in Hillsborough County Florida.

Source: hillstax.org

Source: hillstax.org

109 of home value Yearly median tax in Hillsborough County The median property tax in Hillsborough County Florida is 2168 per year for a home worth the median value of 198900. Newest Price high to low Price low to high Bedrooms Bathrooms. Sealed Bid Folio No. The median property tax on a 19890000 house is 216801 in Hillsborough County The median property tax on a 19890000 house is 192933 in Florida The median property tax on a 19890000 house is 208845 in the United States. County Center 23rd Floor 601 East Kennedy Blvd.

Source: hillstax.org

Source: hillstax.org

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Apply for Business Tax account Edit Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. HCPA Employment Opportunities PROPERTY OWNER BILL OF RIGHTS. Hillsborough County Property Records are real estate documents that contain information related to real property in Hillsborough County Florida. You can find detailed information on a parcel of property including who owns it the assessed and market value and some tax information through the Hillsborough County Property Appraisers website. The Property Appraiser establishes the taxable value of real estate property.

Source: tampabayhomes4sale.net

Source: tampabayhomes4sale.net

Simple interest accrues on a monthly basis. Welcome to our online records search center. You can find detailed information on a parcel of property including who owns it the assessed and market value and some tax information through the Hillsborough County Property Appraisers website. Search for Parcel Information. The median property tax also known as real estate tax in Hillsborough County is 216800 per year based on a median home value of 19890000 and a median effective property tax rate of 109 of property value.

Source: mysuperbhome.com

Source: mysuperbhome.com

The Property Appraiser establishes the taxable value of real estate property. Hillsborough County Tax Collector. Millan reminds Hillsborough County property owners that 2020 property and tangible taxes are due by March 31st to avoid penalty. Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. No electronic delivery accepted Address.

They are maintained by various government offices in Hillsborough County Florida State and at the Federal level. If you are responsible for remitting property tax. HOA fees are common within condos and some single-family home neighborhoods. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Mail or hand deliver the complete package to Hillsborough County Real Estate and Facilities Services by 9 AM on the auction date posted for that parcel.

You can find detailed information on a parcel of property including who owns it the assessed and market value and some tax information through the Hillsborough County Property Appraisers website. You can find detailed information on a parcel of property including who owns it the assessed and market value and some tax information through the Hillsborough County Property Appraisers website. The Property Appraiser establishes the taxable value of real estate property. Simple interest accrues on a monthly basis. Mail or hand deliver the complete package to Hillsborough County Real Estate and Facilities Services by 9 AM on the auction date posted for that parcel.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title real estate taxes hillsborough county florida by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.