Your Real estate taxes miami dade county florida images are ready. Real estate taxes miami dade county florida are a topic that is being searched for and liked by netizens today. You can Get the Real estate taxes miami dade county florida files here. Find and Download all free images.

If you’re searching for real estate taxes miami dade county florida pictures information connected with to the real estate taxes miami dade county florida topic, you have come to the ideal site. Our website always gives you suggestions for refferencing the maximum quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

Real Estate Taxes Miami Dade County Florida. The countywide taxable value for 2020 increased by 51 compared to 2019. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. The exact property tax levied depends on the county in Florida the property is located in. Notice concerning False Official Statements.

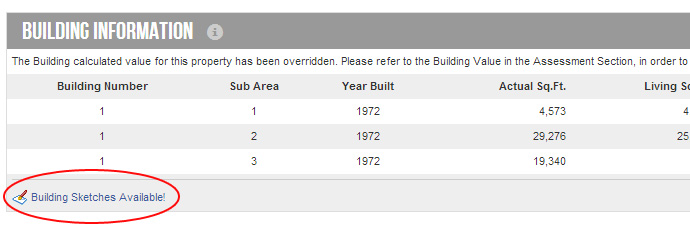

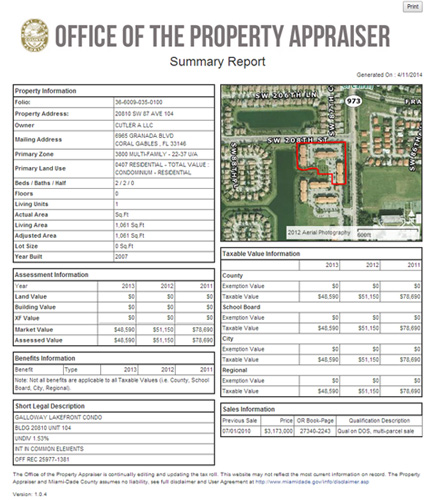

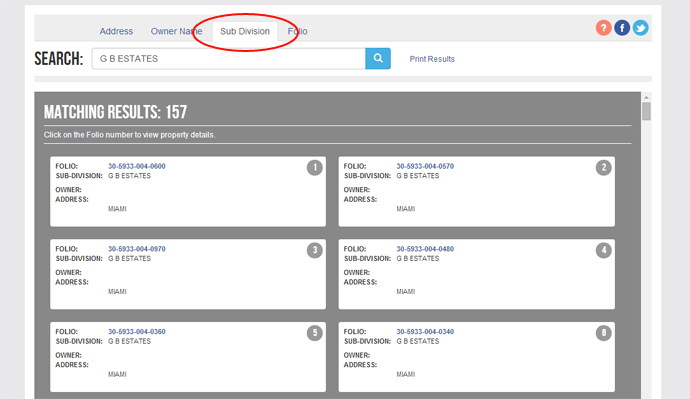

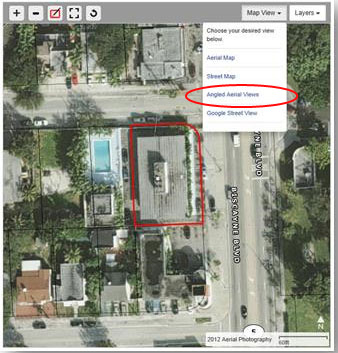

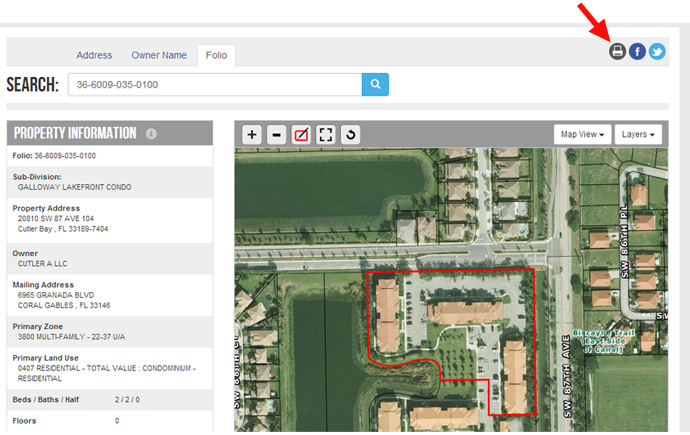

Property Search Help Miami Dade County From miamidade.gov

Property Search Help Miami Dade County From miamidade.gov

The Office of the Property Appraiser released the July 1st Preliminary Certification of Taxable Values to taxing authorities across Miami-Dade County totaling 324362997164. 83706 FS Whoever knowingly makes a false statement in writing with the intent to mislead a public servant in the performance of his or her official duty shall be guilty of a misdemeanor of the second. A change in ownership may reset the assessed value of the property to full market value which could result in higher property taxes. Transfer taxes would come out to. Clark Center 111 NW 1st Street Suite 710 Miami FL 33128 305-375-4712. Property owners are encouraged to.

Miami-Dade County has one of the highest median property taxes in the United States and is ranked 210th of the 3143 counties in order of median property taxes.

A change in ownership may reset the assessed value of the property to full market value which could result in higher property taxes. Miami-Dade County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Miami-Dade County Florida. Our regular business hours are 800 am. Payment files from entities that paid more than 20000 of property taxes last year will not be. Obtaining a homestead exemption will qualify you for two tax benefits. The Property Appraiser does not send tax bills and does not set or collect taxes.

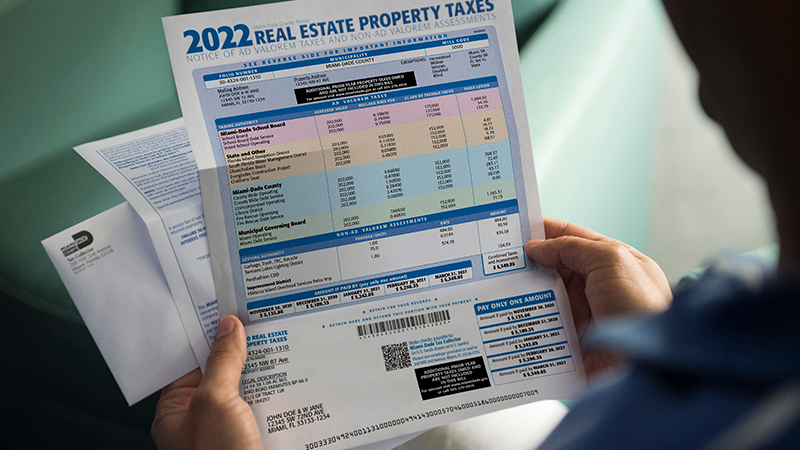

Source: upnest.com

Source: upnest.com

Please use our Tax Estimator to approximate your new property taxes. Transfer taxes would come out to. TaxSys - Miami-Dade County Tax Collector. Miami-Dade County collects the highest property tax in Florida levying an average of 275600 102 of median home value yearly in property taxes while Dixie County has the lowest property tax in the state collecting an average tax of 50300 051 of median home value per year. Thats slightly lower than the 107 national average.

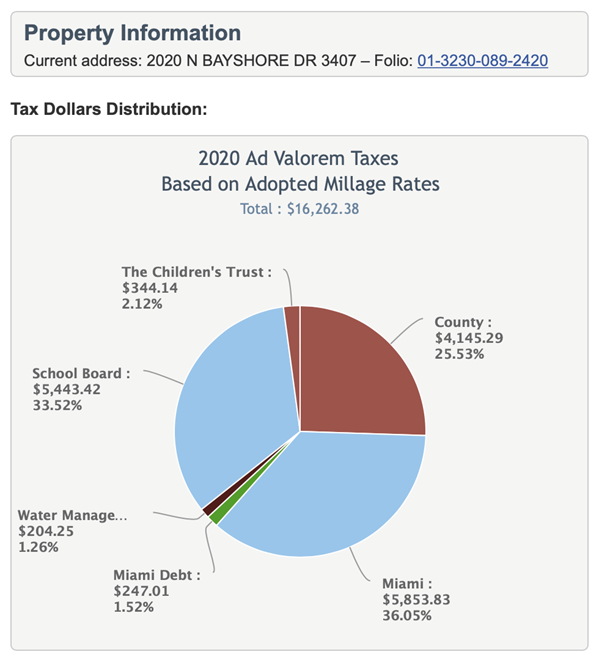

Source: miamidade.gov

Source: miamidade.gov

Please visit the Tax. The exact property tax levied depends on the county in Florida the property is located in. HOA fees are common within condos and some single-family home neighborhoods. Certain types of Tax Records are available to the general public while some Tax. Thats slightly lower than the 107 national average.

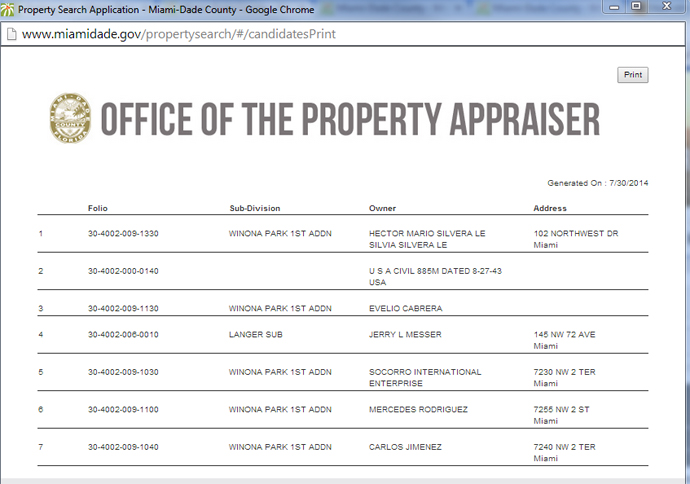

Source: miamidade.gov

Source: miamidade.gov

Monday through Friday or you may call us at 305-375-4712 if you have any questions that do not require an in-person visit. The county has an effective property tax rate of 097. Please visit the Tax. The rate in this county is lower than it is in other counties in Florida. A change in ownership may reset the assessed value of the property to full market value which could result in higher property taxes.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Obtaining a homestead exemption will qualify you for two tax benefits. In accordance with Florida Statute 213755 and Department of Revenues Rule 12D-13021 the Miami-Dade County Tax Collectors office requires all tax paying agents and escrow companies that paid more than 20000 of property taxes last year to upload payment files for 2021 through EscrowExpress. You may schedule a visit online today. Payment files from entities that paid more than 20000 of property taxes last year will not be. If you live in Miami-Dade County or youre transferring property here youre in a bit of luck.

Source: miamidade.gov

Source: miamidade.gov

Notice concerning False Official Statements. Transfer taxes would come out to. In accordance with Florida Statute 213755 and Department of Revenues Rule 12D-13021 the Miami-Dade County Tax Collectors office requires all tax paying agents and escrow companies that paid more than 20000 of property taxes last year to upload payment files for 2021 through EscrowExpress. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Payment files from entities that paid more than 20000 of property taxes last year will not be.

Source: miamidade.gov

Source: miamidade.gov

You may schedule a visit online today. Miami-Dade County collects on average 102 of a propertys assessed fair market value as property tax. When buying real estate property do not assume property taxes will remain the same. Notice concerning False Official Statements. The countywide taxable value for 2020 increased by 51 compared to 2019.

Source: miamism.com

Source: miamism.com

Payment files from entities that paid more than 20000 of property taxes last year will not be. Miami-Dade County is the southernmost county in the mainland US and its home to some of the most beautiful beach-front property in the world. Payment files from entities that paid more than 20000 of property taxes last year will not be. If you live in Miami-Dade County or youre transferring property here youre in a bit of luck. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

Source: miamidade.gov

Source: miamidade.gov

Monday through Friday or you may call us at 305-375-4712 if you have any questions that do not require an in-person visit. Please visit the Tax. When buying real estate property do not assume property taxes will remain the same. The Real Estate Division gathers and evaluates data regarding all real property located within Miami-Dade County and utilizes recognized appraisal techniques in the annual valuation process. Certain types of Tax Records are available to the general public while some Tax.

Source: condoblackbook.com

Source: condoblackbook.com

Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month. These records can include Miami-Dade County property tax assessments and assessment challenges appraisals and income taxes. Miami-Dade County collects on average 102 of a propertys assessed fair market value as property tax. The Property Appraiser does not send tax bills and does not set or collect taxes. In Miami-Dade County your rate is 60 cents per 100.

Source: miamidade.gov

Source: miamidade.gov

Transfer taxes would come out to. Obtaining a homestead exemption will qualify you for two tax benefits. The Tax Collector is part of Miami-Dade Countys Finance Department. Within Miami-Dade County. Miami-Dade Property Appraiser Pedro J.

Source: propertyshark.com

Source: propertyshark.com

The county has an effective property tax rate of 097. Please enter the information below for the current tax year to view and pay your bill. TaxSys - Miami-Dade County Tax Collector. Obtaining a homestead exemption will qualify you for two tax benefits. When buying real estate property do not assume property taxes will remain the same.

Contact Us About Us. The rate in this county is lower than it is in other counties in Florida. A change in ownership may reset the assessed value of the property to full market value which could result in higher property taxes. Miami-Dade County Property Appraiser 111 NW 1st Street Suite 710 Miami FL 33128-1984. Payment files from entities that paid more than 20000 of property taxes last year will not be.

Source: miamidade.gov

Source: miamidade.gov

The Real Estate Division gathers and evaluates data regarding all real property located within Miami-Dade County and utilizes recognized appraisal techniques in the annual valuation process. Please enter the information below for the current tax year to view and pay your bill. We administer state laws local ordinances and policies to properly collect current and delinquent real and personal property taxes as well as delinquent accounts for various County departments. Miami-Dade County Property Appraiser 111 NW 1st Street Suite 710 Miami FL 33128-1984. The county has an effective property tax rate of 097.

Source: miamidade.county-taxes.com

Source: miamidade.county-taxes.com

The rate in this county is lower than it is in other counties in Florida. Property owners are encouraged to. The Downtown Miami and the South Dade Government Center will be open to the public by appointment only. In accordance with Florida Statute 213755 and Department of Revenues Rule 12D-13021 the Miami-Dade County Tax Collectors office requires all tax paying agents and escrow companies that paid more than 20000 of property taxes last year to upload payment files for 2021 through EscrowExpress. The Real Estate Division gathers and evaluates data regarding all real property located within Miami-Dade County and utilizes recognized appraisal techniques in the annual valuation process.

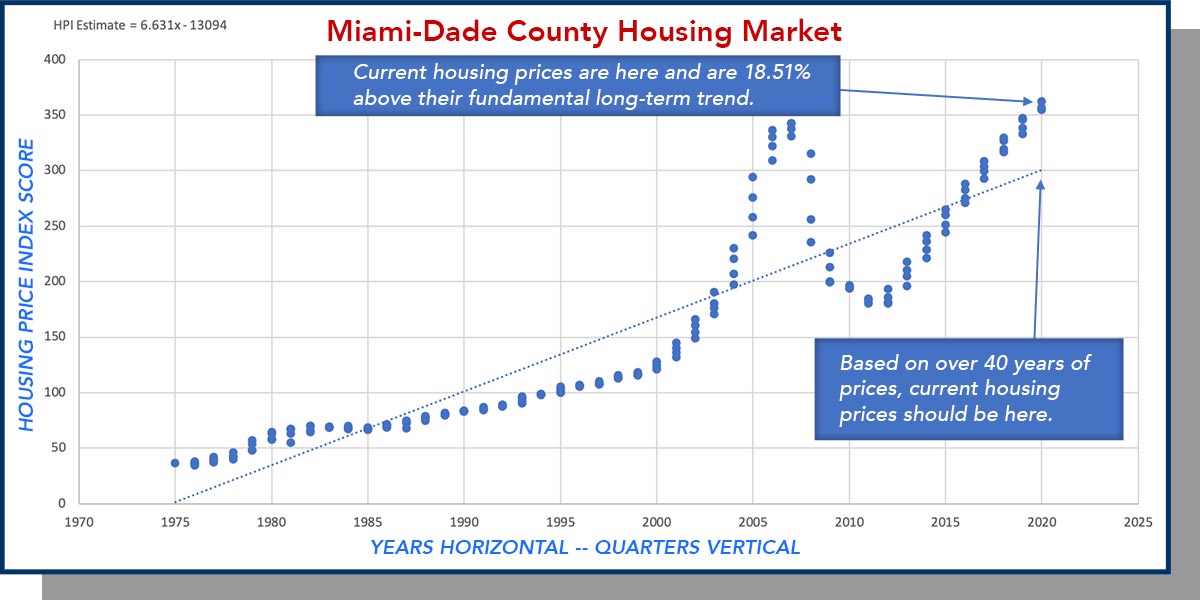

Source: business.fau.edu

Source: business.fau.edu

Property owners are encouraged to. The exact property tax levied depends on the county in Florida the property is located in. These records can include Miami-Dade County property tax assessments and assessment challenges appraisals and income taxes. A change in ownership may reset the assessed value of the property to full market value which could result in higher property taxes. Clark Center 111 NW 1st Street Suite 710 Miami FL 33128 305-375-4712.

Source: greatmiamihomes.com

Source: greatmiamihomes.com

A change in ownership may reset the assessed value of the property to full market value which could result in higher property taxes. In addition we collect special assessments for all local taxing authorities local business tax receipts and convention and tourist taxes. Obtaining a homestead exemption will qualify you for two tax benefits. The rate in this county is lower than it is in other counties in Florida. Thats slightly lower than the 107 national average.

Source: miamidade.gov

Source: miamidade.gov

Notice concerning False Official Statements. The Real Estate Division gathers and evaluates data regarding all real property located within Miami-Dade County and utilizes recognized appraisal techniques in the annual valuation process. Please visit the Tax. The countywide taxable value for 2020 increased by 51 compared to 2019. Miami-Dade County collects the highest property tax in Florida levying an average of 275600 102 of median home value yearly in property taxes while Dixie County has the lowest property tax in the state collecting an average tax of 50300 051 of median home value per year.

Source: rpmmiami.com

Source: rpmmiami.com

The Real Estate Division gathers and evaluates data regarding all real property located within Miami-Dade County and utilizes recognized appraisal techniques in the annual valuation process. TaxSys - Miami-Dade County Tax Collector. In Miami-Dade County your rate is 60 cents per 100. The exact property tax levied depends on the county in Florida the property is located in. In addition we collect special assessments for all local taxing authorities local business tax receipts and convention and tourist taxes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title real estate taxes miami dade county florida by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.