Your Real estate taxes prince william county va images are available in this site. Real estate taxes prince william county va are a topic that is being searched for and liked by netizens today. You can Find and Download the Real estate taxes prince william county va files here. Download all royalty-free photos and vectors.

If you’re searching for real estate taxes prince william county va pictures information related to the real estate taxes prince william county va topic, you have pay a visit to the right site. Our website always provides you with hints for downloading the highest quality video and image content, please kindly surf and find more informative video articles and images that fit your interests.

Real Estate Taxes Prince William County Va. The Finance Departments public-facing offices are Taxpayer Services and Real Estate Assessments. Enter the Tax Account numbers listed on the billing statement. 4 Zeilen In-depth Prince William County VA Property Tax Information. Press 1 for Personal Property Tax.

Use both House Number and House Number High fields when searching for range of house numbers Street Name. 134 Zeilen The average effective property tax in the county is 105. Certain types of Tax Records are available to the general public while some Tax. Press 1 for Personal Property Tax. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes.

The automated system will prompt you for the information it needs to process your payment.

09 of home value Yearly median tax in Prince William County The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. They are maintained by various government offices in Prince William County Virginia State and at the Federal level. Virginias median income is 73565 per year so the median yearly property tax paid by Virginia residents amounts to approximately of their yearly income. The Finance Departments public-facing offices are Taxpayer Services and Real Estate Assessments. Real Estate Assessments is open to the public by appointment only. Prince William County re-opened county facilities to the public on Wednesday July 1 2020 in accordance with Governor Northams authorization of Phase 3.

Source: potomaclocal.com

Source: potomaclocal.com

Virginias median income is 73565 per year so the median yearly property tax paid by Virginia residents amounts to approximately of their yearly income. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Included on the real estate tax bills is the special district tax for the gypsy moth abatement program. Press 1 for Personal Property Tax.

Source: pwar.com

Source: pwar.com

The County also levies a supplemental real estate tax on newly-constructed improvements completed after the beginning of. The Finance Departments public-facing offices are Taxpayer Services and Real Estate Assessments. This tax is based on property value and is billed on the first-half and second-half tax bills. Prince William County re-opened county facilities to the public on Wednesday July 1 2020 in accordance with Governor Northams authorization of Phase 3. Included on the real estate tax bills is the special district tax for the gypsy moth abatement program.

Real Estate Assessments is open to the public by appointment only. 09 of home value Yearly median tax in Prince William County The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Real Estate Assessments is open to the public by appointment only. When prompted enter Jurisdiction Code 1036 for Prince William County. The automated system will prompt you for the information it needs to process your payment.

Source: niche.com

Source: niche.com

Face coverings as defined below will be enforced in all County buildings. You can pay a bill without logging in using this screen. COVID-19 Update June 30 2020. 425 per 100 of Assessed Value. Click here to register for an account or here to login if you already have an account.

COVID-19 Update June 30 2020. Enter the house or property number. Enter street name without street direction NSEW or suffix StDrAvetc. The real estate tax is paid in two annual installments as shown on the tax calendar. 010 per 100 of Assessed Value.

Source: insidenova.com

Source: insidenova.com

You can pay a bill without logging in using this screen. Real estate in Prince William. Median Property Taxes Mortgage 3893. 09 of home value Yearly median tax in Prince William County The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Click here to register for an account or here to login if you already have an account.

Source: princewilliamliving.com

Source: princewilliamliving.com

These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes. Prince William County re-opened county facilities to the public on Wednesday July 1 2020 in accordance with Governor Northams authorization of Phase 3. Real estate in Prince William. The County also levies a supplemental real estate tax on newly-constructed improvements completed after the beginning of. Median Property Taxes No Mortgage 3767.

Source: insidenova.com

Source: insidenova.com

Prince William County collects on average 09 of a propertys assessed fair market value as property tax. Real estate in Prince William. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month Open house Must have open house Parking spots Any1234 Must have garage Square Feet Any. – Select Tax Type – Business License Business Tangible Property. Prince William County Property Records are real estate documents that contain information related to real property in Prince William County Virginia.

Source: realtor.com

Source: realtor.com

– Select Tax Type – Business License Business Tangible Property. COVID-19 Update June 30 2020. Taxpayer Services is fully operational for walk-in visitors with the exception of the Ferlazzo building location which will remain closed until further notice due to COVID-19. Face coverings as defined below will be enforced in all County buildings. 425 per 100 of Assessed Value.

Source: whatsupwoodbridge.com

Source: whatsupwoodbridge.com

425 per 100 of Assessed Value. Prince William County Property Records are real estate documents that contain information related to real property in Prince William County Virginia. Virginia is ranked 29th of the 50 states for property taxes. 213 per 100 of Assessed Value. Daily Rental Tax Short Term Rental Business 1 of the gross proceeds arising from rental of tangible personal property.

Source: wtop.com

Source: wtop.com

By creating an account you will have access to balance and account information notifications etc. Virginia is ranked 29th of the 50 states for property taxes. Use both House Number and House Number High fields when searching for range of house numbers Street Name. By creating an account you will have access to balance and account information notifications etc. Daily Rental Tax Heavy Equipment Rental Business 15 of the gross proceeds arising from rental of heavy equipment property.

Source: wtop.com

Source: wtop.com

They are maintained by various government offices in Prince William County Virginia State and at the Federal level. 4 Zeilen In-depth Prince William County VA Property Tax Information. Virginia is ranked number twenty one out of the fifty states in order of the average amount of property taxes collected. Certain types of Tax Records are available to the general public while some Tax. Use both House Number and House Number High fields when searching for range of house numbers Street Name.

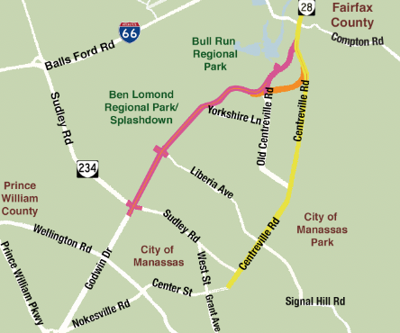

Source: bristowbeat.com

Source: bristowbeat.com

Enter street name without street direction NSEW or suffix StDrAvetc. Real estate in Prince William. Real Estate Assessments is open to the public by appointment only. Prince William County Property Records are real estate documents that contain information related to real property in Prince William County Virginia. Certain types of Tax Records are available to the general public while some Tax.

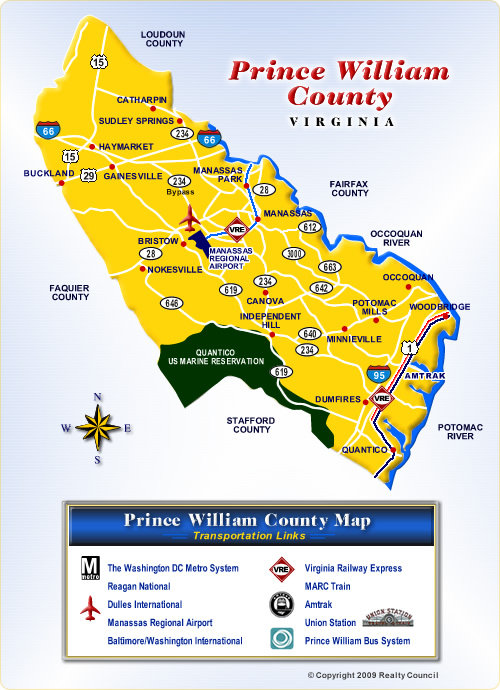

Source: realtycouncil.com

Source: realtycouncil.com

425 per 100 of Assessed Value. 213 per 100 of Assessed Value. The County also levies a supplemental real estate tax on newly-constructed improvements completed after the beginning of. Prince William County collects on average 09 of a propertys assessed fair market value as property tax. The Finance Departments public-facing offices are Taxpayer Services and Real Estate Assessments.

Source:

Source:

Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month Open house Must have open house Parking spots Any1234 Must have garage Square Feet Any. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month Open house Must have open house Parking spots Any1234 Must have garage Square Feet Any. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes. Prince William County re-opened county facilities to the public on Wednesday July 1 2020 in accordance with Governor Northams authorization of Phase 3.

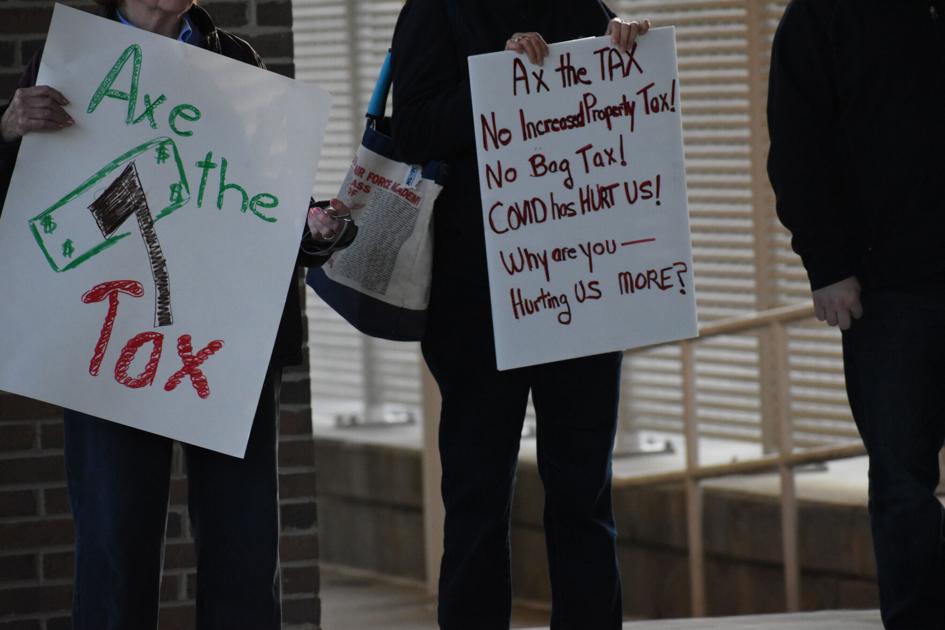

Source: insidenova.com

Source: insidenova.com

They are maintained by various government offices in Prince William County Virginia State and at the Federal level. You can pay a bill without logging in using this screen. Machinery and Tools Manufacturer Only 150 per 100 of Assessed Value. – Select Tax Type – Business License Business Tangible Property. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes.

Source: smartsettlements.com

Source: smartsettlements.com

They are a valuable tool for the real estate. These records can include Prince William County property tax assessments and assessment challenges appraisals and income taxes. – Select Tax Type – Business License Business Tangible Property. Any No HOA Fee 50month100month200month300month400month500month600month700month800month900month1000month Open house Must have open house Parking spots Any1234 Must have garage Square Feet Any. Prince William County Virginia Home.

Source: pwconserve.org

Source: pwconserve.org

Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia. If you have questions about this site please email the Real Estate Assessments Office. Median Property Taxes Mortgage 3893. Prince William County collects very high property taxes and is among the top 25 of counties in the. Virginias median income is 73565 per year so the median yearly property tax paid by Virginia residents amounts to approximately of their yearly income.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title real estate taxes prince william county va by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.