Your Real estate taxes st clair county il images are ready in this website. Real estate taxes st clair county il are a topic that is being searched for and liked by netizens today. You can Find and Download the Real estate taxes st clair county il files here. Get all free images.

If you’re looking for real estate taxes st clair county il pictures information linked to the real estate taxes st clair county il interest, you have come to the ideal site. Our website always provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more enlightening video articles and graphics that fit your interests.

Real Estate Taxes St Clair County Il. The Assessors focus is on value not taxes. The county announced Monday. 0065 - Commercial with Farm. 2020 Real Estate Tax Collection dates 2021 TBD.

The St Clair County Assessors Office located in Belleville Illinois determines the value of all taxable property in St. 0032 - 10-30 Res Vacant Land. Clair County Tax Appraisers office. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the St. Use the tools on this page to find useful information about St. No warranties expressed or implied are provided for data herein.

For comparison the median home value in St.

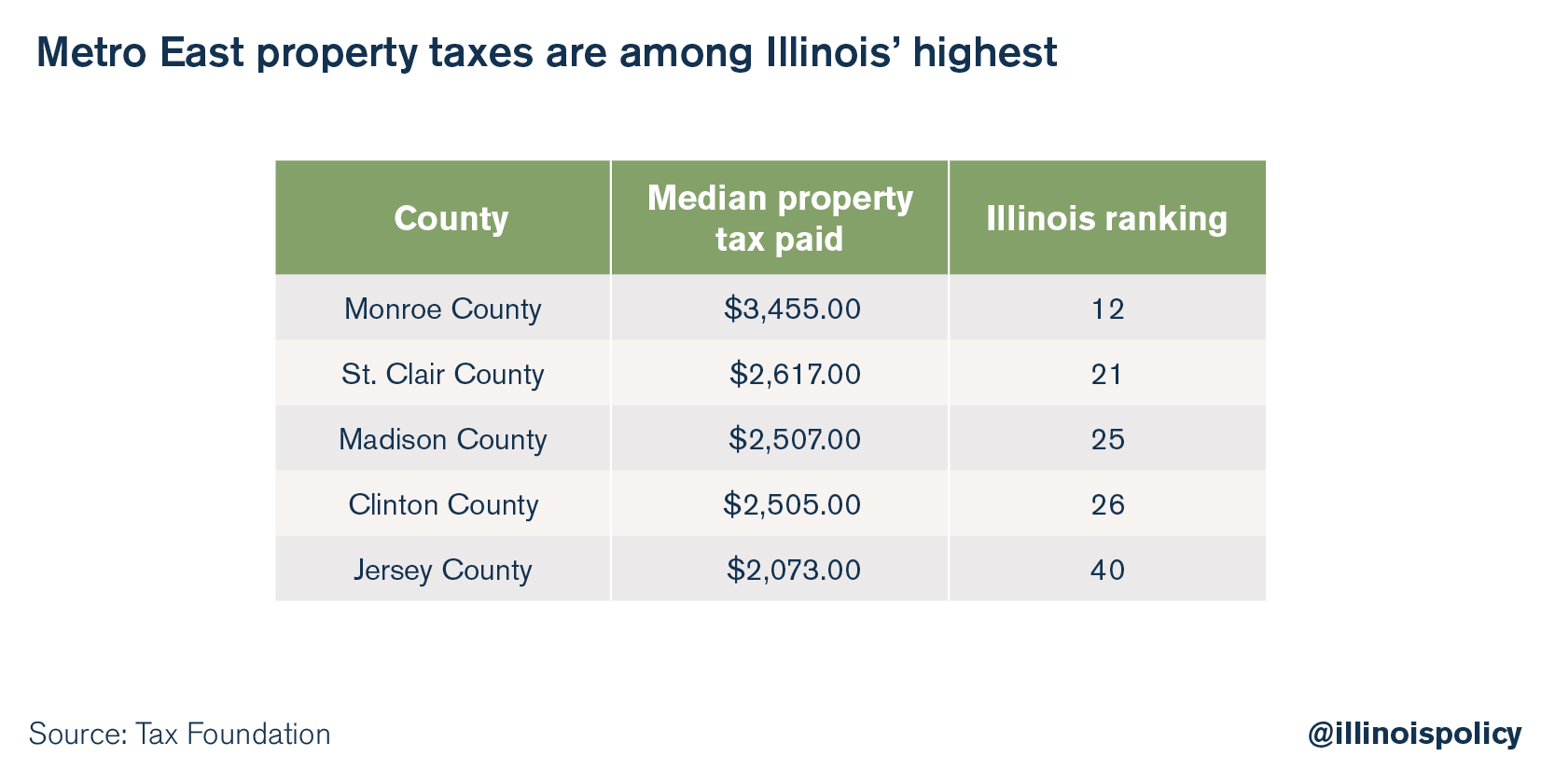

The St Clair County Assessors Office located in Belleville Illinois determines the value of all taxable property in St. The processor retains the fees. 0032 - 10-30 Res Vacant Land. Clair County Illinois is 2291 per year for a home worth the median value of 122400. These records can include St. Clair County is 229100 per year based on a median home value of 12240000 and a median effective property tax rate of 187 of property value.

St Clair County accepts no responsibility for the consequences of the inappropriate use or the interpretation of data. M-F 830am - 430pm. The Parcel Inquiry will allow you to access information directly from the Assessors and Treasurers parcel database. For comparison the median home value in St. By proceeding with a property search you are stating that the notice has been read and that you understand and agree with its contents.

Source: co.st-clair.il.us

Source: co.st-clair.il.us

No warranties expressed or implied are provided for data herein. 0030 - Vac Lots-Lands6 units. The median property tax also known as real estate tax in St. 0041 - Model Home 10-25. Clair County The median property tax in St.

0041 - Model Home 10-25. Delinquent Real Estate Taxes. Use the tools on this page to find useful information about St. It is the function of the Assessor to administer an accurate equitable and timely assessment of all real property in St. St Clair County accepts no responsibility for the consequences of the inappropriate use or the interpretation of data.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

0040 - Improved Lots. Real estate property tax bills that are usually sent out in May and collected in two installments in late June and August. IF THROUGH SOME UNAVOIDABLE ERROR YOUR PROPERTY IS ADVERTISED PLEASE CONTACT THE COUNTY TREASURERS OFFICE IMMEDIATELY. These records can include St. No warranties expressed or implied are provided for data herein.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the St. Clair County Property Records Search. IF THROUGH SOME UNAVOIDABLE ERROR YOUR PROPERTY IS ADVERTISED PLEASE CONTACT THE COUNTY TREASURERS OFFICE IMMEDIATELY. The Parcel Inquiry will allow you to access information directly from the Assessors and Treasurers parcel database. Clair County The median property tax in St.

Source: mapsforyoufree.blogspot.com

Source: mapsforyoufree.blogspot.com

0065 - Commercial with Farm. 0030 - Vac Lots-Lands6 units. Clair County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in St. The median property tax also known as real estate tax in St. Clair County is 229100 per year based on a median home value of 12240000 and a median effective property tax rate of 187 of property value.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

The county announced Monday. Clair County property tax assessments and assessment challenges appraisals and income taxes. ACH Electronic Check Convenience Fee 200. No warranties expressed or implied are provided for data herein. These records can include St.

Delinquent Real Estate Taxes. Dates anticipated to be set mid-May. Belleville IL 62220 618 825-2707 618 825-2274 - Fax treasurercost-clairilus Business Hours. Clair County is 12240000. The Parcel Inquiry will allow you to access information directly from the Assessors and Treasurers parcel database.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. The Supervisor of Assessments DOES NOT calculate taxes determine tax rates or collect taxes. The median property tax also known as real estate tax in St. 0041 - Model Home 10-25. 0030 - Vac Lots-Lands6 units.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. Clair County Tax Appraisers office. Clair County property tax assessments and assessment challenges appraisals and income taxes. Clair County residential property records including property owners sales transfer history deeds titles property taxes. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

Source: realtor.com

Source: realtor.com

0030 - Vac Lots-Lands6 units. M-F 830am - 430pm. The processor retains the fees. The average homeowner in St. You can get data on parcel assessments taxes and ownership.

Source: metroeastsun.com

Source: metroeastsun.com

Visa Debit - Convenience Fee 395. IF THROUGH SOME UNAVOIDABLE ERROR YOUR PROPERTY IS ADVERTISED PLEASE CONTACT THE COUNTY TREASURERS OFFICE IMMEDIATELY. Delinquent Real Estate Taxes. 0041 - Model Home 10-25. Clair County levies taxes on real estate to support the county government as well as cities and schools.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

It is the function of the Assessor to administer an accurate equitable and timely assessment of all real property in St. The Parcel Inquiry will allow you to access information directly from the Assessors and Treasurers parcel database. 0060 - Improved Commercial. 0062 - 10-30 Comm. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. These records can include St. You can get data on parcel assessments taxes and ownership. Last day to avoid publication. By proceeding with a property search you are stating that the notice has been read and that you understand and agree with its contents.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

Clair County is 12240000. Clair County property tax assessments and assessment challenges appraisals and income taxes. Clair County Treasurers Office. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. St Clair County accepts no responsibility for the consequences of the inappropriate use or the interpretation of data.

0052 - 10-30 Comm. Use the tools on this page to find useful information about St. These records can include St. The median property tax also known as real estate tax in St. 0052 - 10-30 Comm.

Source: mapscatalogonline.blogspot.com

Source: mapscatalogonline.blogspot.com

For comparison the median home value in St. The processor retains the fees. Any No HOA Fee 50month100month200month300. Clair County Treasurers Office. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the St.

Source: co.st-clair.il.us

Last day to avoid publication. Clair County Tax Appraisers office. Clair County Treasurers Office. 0065 - Commercial with Farm. Clair County The median property tax in St.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title real estate taxes st clair county il by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.