Your Residential real estate depreciation calculator images are available. Residential real estate depreciation calculator are a topic that is being searched for and liked by netizens now. You can Download the Residential real estate depreciation calculator files here. Download all royalty-free vectors.

If you’re searching for residential real estate depreciation calculator pictures information connected with to the residential real estate depreciation calculator keyword, you have visit the ideal site. Our site always gives you hints for seeing the maximum quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

Residential Real Estate Depreciation Calculator. A useful life span is different. Keep in mind real estate depreciation begins when the property is placed in service meaning when you rent it out not when you purchase it. It also displays a graph so you can see your depreciation during the course of multiple years all the way up to 275 years for residential property. Irs Depreciation Calculator Real Estate.

Residential Rental Property Depreciation Calculation Depreciation Guru From depreciationguru.com

Residential Rental Property Depreciation Calculation Depreciation Guru From depreciationguru.com

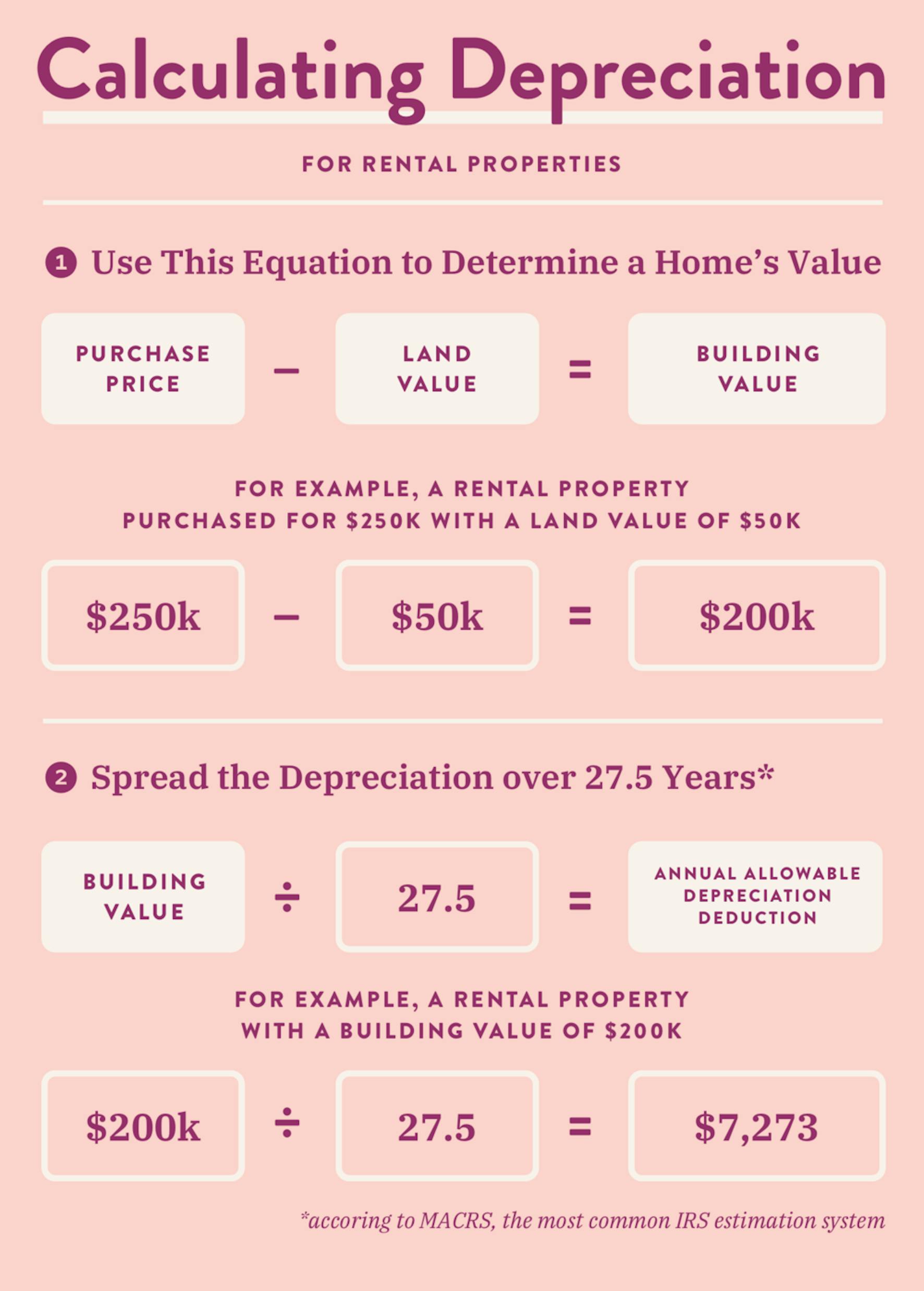

In these cases the unused depreciation is carried forward to the year it can get used. As the name suggests straight-line depreciation requires that the original value of the improvements be spread out evenly. Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation for residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. When it comes to a property the IRS has set 275 years of useful life as the depreciation period for residential real estate. The amount of the depreciation deduction is determined each year and depends on the useful life span of the asset which is specified in your areas tax code. Only the value of buildings can be depreciated.

For residential properties take your cost basis or.

A useful life span is different. 1 days ago The real estate depreciation calculator shows you how much your depreciation is during the course of one year and the propertys useful life according to the general MACRS depreciation method. There are several options to calculate depreciation. Keep in mind real estate depreciation begins when the property is placed in service meaning when you rent it out not when you purchase it. You will get the exact amount of. Depreciation on real estate investment Verified Just Now.

Source: depreciationguru.com

Source: depreciationguru.com

Depreciation on real estate investment Verified Just Now. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2020 is 18100 if the special depreciation allowance applies or 10100 if the special depreciation allowance does not apply. Depreciation on real estate investment Verified Just Now. This is due to depreciation recapture tax rate being higher than capital gains tax. By convention most US.

Source: hotelzodiacobolsena.site

Source: hotelzodiacobolsena.site

Keep in mind real estate depreciation begins when the property is placed in service meaning when you rent it out not when you purchase it. You cannot depreciate land. Your entire house has 1800 square feet of floor space. When it comes to a property the IRS has set 275 years of useful life as the depreciation period for residential real estate. You will get the exact amount of.

Source: retipster.com

Source: retipster.com

In these cases the unused depreciation is carried forward to the year it can get used. A residential real estate investor who owns single family homes vacation rental properties or condos An investor who owns multifamily property which is typically a property with two or more separate residential. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2020 is 18100 if the special depreciation allowance applies or 10100 if the special depreciation allowance does not apply. 1 days ago The real estate depreciation calculator shows you how much your depreciation is during the course of one year and the propertys useful life according to the general MACRS depreciation method. Only the value of buildings can be depreciated.

Source: hotelzodiacobolsena.site

Source: hotelzodiacobolsena.site

Residential rental property is depreciated at a rate of 3636 each year for 275 years. There are several options to calculate depreciation. Assuming 28 depreciation recapture tax rate and 20 capital gains tax rate Anita owes a total of 30000028 2500002 134000 The outcome from this example is an additional 24000 in taxes. When it comes to a property the IRS has set 275 years of useful life as the depreciation period for residential real estate. For residential properties take your cost basis or.

Source: hotelzodiacobolsena.site

Source: hotelzodiacobolsena.site

The most straightforward one typically used for home improvements is the straight-line method To do it you deduct the estimated salvage. A residential real estate investor who owns single family homes vacation rental properties or condos An investor who owns multifamily property which is typically a property with two or more separate residential. Rental Property Depreciation Rules All. The amount of the depreciation deduction is determined each year and depends on the useful life span of the asset which is specified in your areas tax code. If you have a four-unit residential property a four-plex and its worth 450000 you can take depreciation of 16364 every year for 275 years.

By convention most US. How Is Depreciation Calculated In This Investment Property Calculator. Houses 8 days ago The real estate depreciation calculator shows you how much your depreciation is during the course of one year and the propertys useful life according to the general MACRS depreciation method It also displays a graph so you can see your depreciation during the course of multiple years all the way up to 275 years for residential. The most straightforward one typically used for home improvements is the straight-line method To do it you deduct the estimated salvage. This is due to depreciation recapture tax rate being higher than capital gains tax.

Source: baymgmtgroup.com

Source: baymgmtgroup.com

Irs Depreciation Calculator Real Estate. But as a real estate investor its often easier to choose. 1 days ago The real estate depreciation calculator shows you how much your depreciation is during the course of one year and the propertys useful life according to the general MACRS depreciation method. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2020 is 18100 if the special depreciation allowance applies or 10100 if the special depreciation allowance does not apply. You will get the exact amount of.

Source: hotelzodiacobolsena.site

Source: hotelzodiacobolsena.site

These are the useful lives that the IRS deems for both types of properties. Sum-of-Years Digits Depreciation Calculator. Irs Depreciation Calculator Real Estate. 1 days ago The real estate depreciation calculator shows you how much your depreciation is during the course of one year and the propertys useful life according to the general MACRS depreciation method. In order to calculate the amount that can be depreciated each year divide the basis by the recovery period.

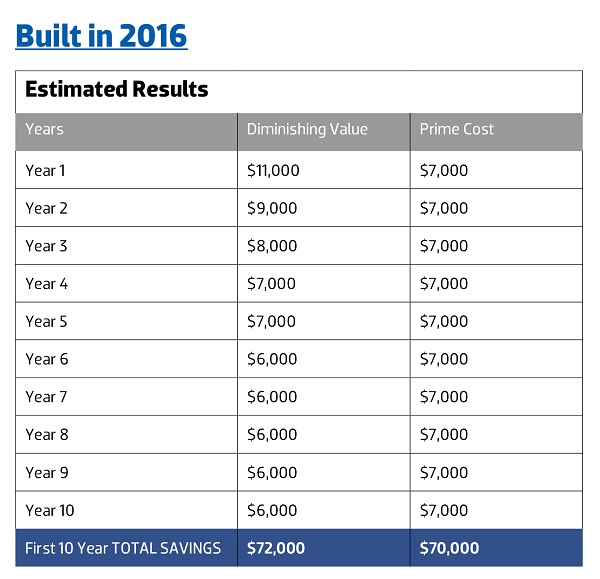

Source: yourinvestmentpropertymag.com.au

Source: yourinvestmentpropertymag.com.au

Sometimes an investment property wont have enough income to deduct the full depreciation expense. If you own a rental property for an entire calendar year calculating depreciation is straightforward. A residential real estate investor who owns single family homes vacation rental properties or condos An investor who owns multifamily property which is typically a property with two or more separate residential. In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year. These are the useful lives that the IRS deems for both types of properties.

Source: realestate.com.au

Source: realestate.com.au

When it comes to a property the IRS has set 275 years of useful life as the depreciation period for residential real estate. Depreciation on real estate investment Verified Just Now. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2020 is 18100 if the special depreciation allowance applies or 10100 if the special depreciation allowance does not apply. You can deduct as a rental expense 10 of any expense that must be divided between rental use and personal use. That means if you have a property worth 200000 you can deduct.

Source: retipster.com

Source: retipster.com

That means if you have a property worth 200000 you can deduct. A useful life span is different. Depreciation is calculated straight line over 275 years for residential property. Houses 8 days ago The real estate depreciation calculator shows you how much your depreciation is during the course of one year and the propertys useful life according to the general MACRS depreciation method It also displays a graph so you can see your depreciation during the course of multiple years all the way up to 275 years for residential. You can deduct as a rental expense 10 of any expense that must be divided between rental use and personal use.

Source: depreciationguru.com

Source: depreciationguru.com

In these cases the unused depreciation is carried forward to the year it can get used. Depreciation on real estate investment Verified Just Now. In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year. In most cases straight-line depreciation is applied to real estate. You can deduct as a rental expense 10 of any expense that must be divided between rental use and personal use.

Source: depreciationguru.com

Source: depreciationguru.com

If you own a rental property for an entire calendar year calculating depreciation is straightforward. Depreciation is calculated straight line over 275 years for residential property. Your entire house has 1800 square feet of floor space. In most cases straight-line depreciation is applied to real estate. If your heating bill for the year for the entire house was 600 60 600.

Source: vertex42.com

Source: vertex42.com

If you own a rental property for an entire calendar year calculating depreciation is straightforward. A useful life span is different. In these cases the unused depreciation is carried forward to the year it can get used. You cannot depreciate land. Irs Depreciation Calculator Real Estate.

Source: calculator-online.net

Source: calculator-online.net

The room is 12 15 feet or 180 square feet. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2020 is 18100 if the special depreciation allowance applies or 10100 if the special depreciation allowance does not apply. There are several options to calculate depreciation. A residential real estate investor who owns single family homes vacation rental properties or condos An investor who owns multifamily property which is typically a property with two or more separate residential. Sum-of-Years Digits Depreciation Calculator.

If you have a four-unit residential property a four-plex and its worth 450000 you can take depreciation of 16364 every year for 275 years. A rental property depreciation calculator is typically right for. How Is Depreciation Calculated In This Investment Property Calculator. If you have a four-unit residential property a four-plex and its worth 450000 you can take depreciation of 16364 every year for 275 years. You cannot depreciate land.

Source: wealthfit.com

Source: wealthfit.com

When it comes to a property the IRS has set 275 years of useful life as the depreciation period for residential real estate. A useful life span is different. If it is a residential real estate you will divide the value of the real estate by 275 in order to get the amount of depreciation for a single year. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2020 is 18100 if the special depreciation allowance applies or 10100 if the special depreciation allowance does not apply. By convention most US.

Source: hotelzodiacobolsena.site

Source: hotelzodiacobolsena.site

You will get the exact amount of. In these cases the unused depreciation is carried forward to the year it can get used. The amount of the depreciation deduction is determined each year and depends on the useful life span of the asset which is specified in your areas tax code. In this case since residential rental property can be depreciated for 275 years you would depreciate 4589 per year. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and first placed in service in 2020 is 18100 if the special depreciation allowance applies or 10100 if the special depreciation allowance does not apply.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title residential real estate depreciation calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.