Your Richland county real estate taxes images are ready in this website. Richland county real estate taxes are a topic that is being searched for and liked by netizens today. You can Find and Download the Richland county real estate taxes files here. Get all royalty-free photos.

If you’re searching for richland county real estate taxes pictures information related to the richland county real estate taxes keyword, you have visit the ideal site. Our site frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

Richland County Real Estate Taxes. These records can include Richland County property tax assessments and assessment challenges appraisals and income taxes. Sep 18 2020 802 AM OLNEY The Richland County Treasurers office will be mailing out certified notices for delinquent real estate and mobile home taxes a week from today on Friday September 25. The Richland County Treasurers Office offers several convenient ways to pay your taxes. Richland County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Richland County Wisconsin.

Richland County Wi Recently Sold Homes Realtor Com From realtor.com

Richland County Wi Recently Sold Homes Realtor Com From realtor.com

107 North Sycamore St. The average yearly property tax paid by Richland County residents amounts to about 239 of their yearly income. The Office of the Richland County Treasurer has many responsibilities. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. 803 576-2610 or 576-2611. The general duties of the Assessor are to appraise all property at fair market value and place them on the tax rolls to generate revenue for Richland County.

The general duties of the Assessor are to appraise all property at fair market value and place them on the tax rolls to generate revenue for Richland County.

You also can get a comparable sales report for a fee from private companies that specialize in real estate data or find comparable sales information available on various real estate Internet sites. In order to avoid additional penalties the delinquent real estate and mobile home taxes must be paid in full before next Friday the 25th. July Treasurers Office mails delinquent notices for all unpaid current taxes. No name available Richland County. Interest is 1 of gross tax per month for each month taxes are delinquent. 50 Park Avenue East Mansfield Ohio 44902.

Source: realtor.com

Source: realtor.com

Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. In addition to paying your taxes in person through the mail or at Synovus bank locations throughout the Midlands we now accept credit card payments with MasterCard Visa Discover and American Express or by electronic check. Richland County collects on average 152 of a propertys assessed fair market value as property tax. Richland County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Richland County Wisconsin. Any No HOA Fee 50month100month200month300.

Source:

Source:

Questions regarding eligibility status and application procedures should be directed to. We also classify property at a 4 ratio for your legal residence meaning that you own and occupy the property as your primary residence or at a 6 ratio for commercial property or non-owner occupied. One time penalty is 5 of gross tax due. Fees for conveyances and vendor licenses are also paid in the Treasurers Office. Either of the aforementioned qualification s - age disability or blindness - makes one eligible for the exemption.

Source: realtor.com

Source: realtor.com

Richland County collects on average 152 of a propertys assessed fair market value as property tax. 107 North Sycamore St. Legal Residence refers to the special 4 assessment ratio for owner occupied homes. This results in a tax savings of one-third of the tax bill compared to the 6 ratio if application for the special assessment is not made. Any No HOA Fee 50month100month200month300.

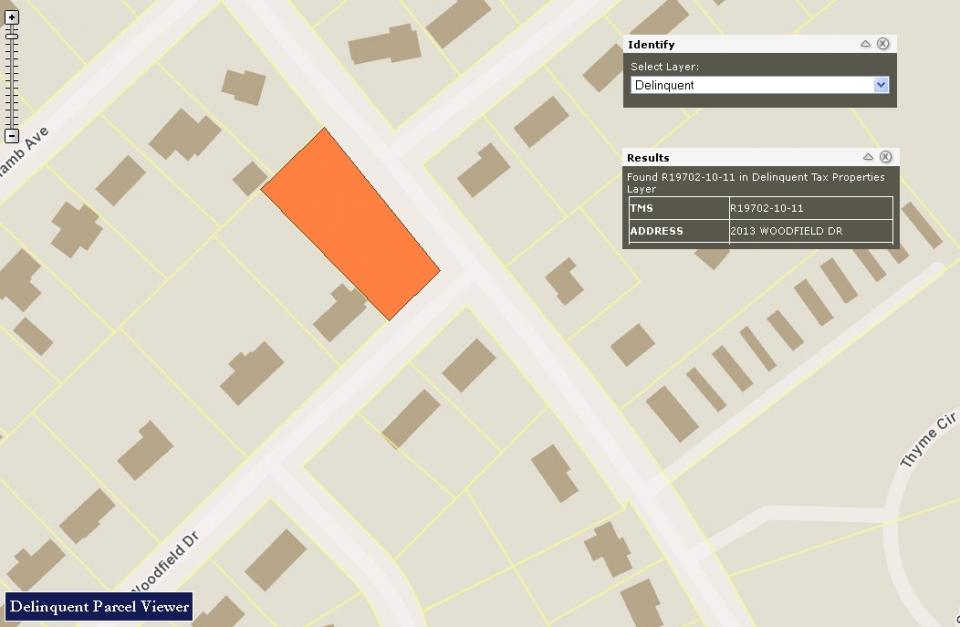

Source: richlandmaps.com

Source: richlandmaps.com

Sep 18 2020 802 AM OLNEY The Richland County Treasurers office will be mailing out certified notices for delinquent real estate and mobile home taxes a week from today on Friday September 25. The Richland County Treasurers Office offers several convenient ways to pay your taxes. One time penalty is 5 of gross tax due. Questions regarding eligibility status and application procedures should be directed to. 50 Park Avenue East Mansfield Ohio 44902.

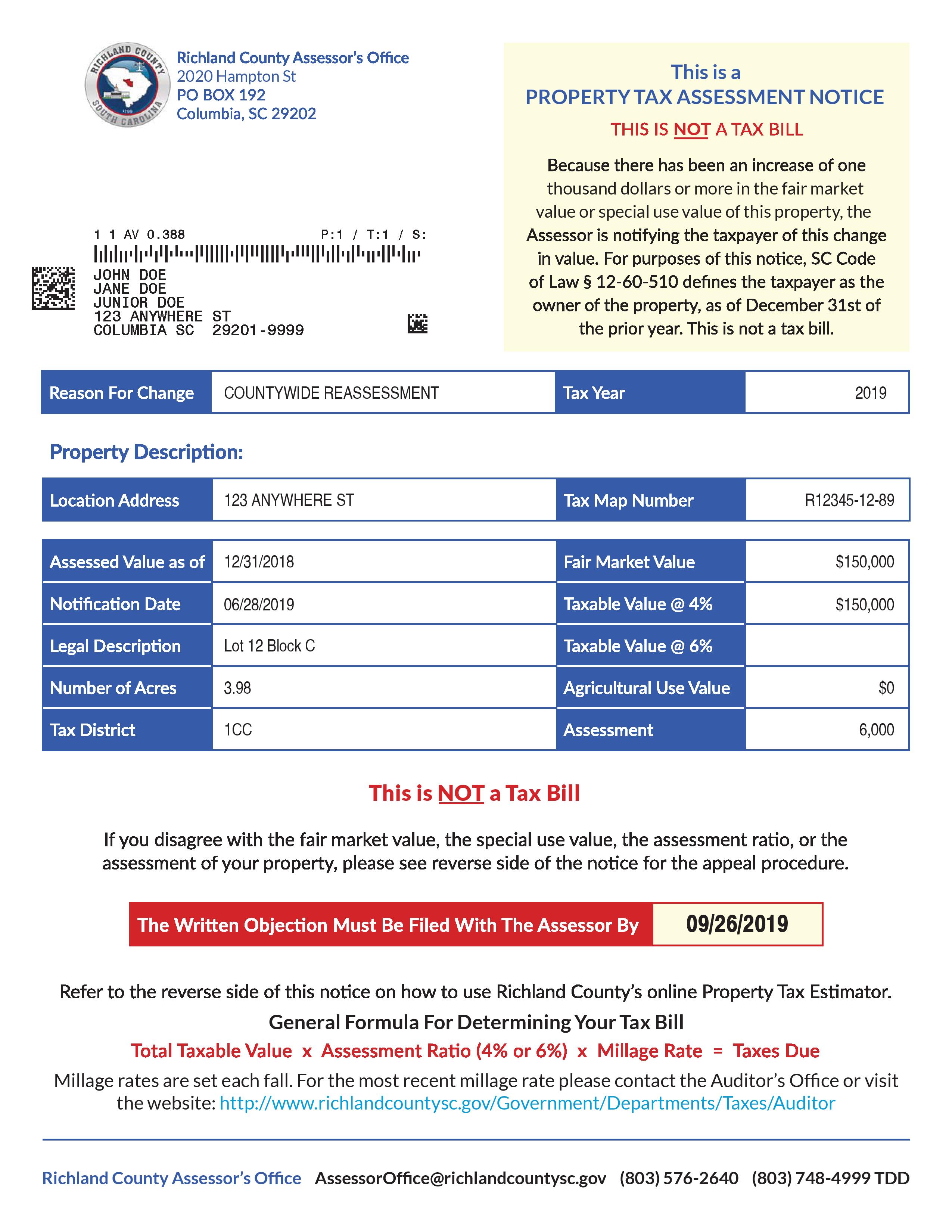

Source: richlandcountysc.gov

Source: richlandcountysc.gov

Either of the aforementioned qualification s - age disability or blindness - makes one eligible for the exemption. One time penalty is 5 of gross tax due. These records can include Richland County property tax assessments and assessment challenges appraisals and income taxes. Richland Township EIT tax is 100 Richland Township PSD code political subdivision is. Fees for conveyances and vendor licenses are also paid in the Treasurers Office.

Source:

Source:

The Richland County Treasurers Office offers several convenient ways to pay your taxes. In order to avoid additional penalties the delinquent real estate and mobile home taxes must be paid in full before next Friday the 25th. Illinois is ranked 1228th of the 3143 counties in the United States in order of the median amount of property taxes collected. 107 North Sycamore St. This results in a tax savings of one-third of the tax bill compared to the 6 ratio if application for the special assessment is not made.

Source: trinity-partners.com

Source: trinity-partners.com

June 1st Delinquent tax period begins. The Office of the Richland County Treasurer has many responsibilities. In addition to real estate taxes the Treasurers Office collects personal property mobile home and estate taxes. The general duties of the Assessor are to appraise all property at fair market value and place them on the tax rolls to generate revenue for Richland County. Richland County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Richland County Illinois.

Source: zillow.com

Source: zillow.com

You also can get a comparable sales report for a fee from private companies that specialize in real estate data or find comparable sales information available on various real estate Internet sites. Richland County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Richland County Ohio. The Richland County Treasurers Office collects and receipts postponed and delinquent real estate tax payments and calculates balances and administers tax settlements for all taxing jurisdictions. The Richland County Treasurers Office offers several convenient ways to pay your taxes. You also can get a comparable sales report for a fee from private companies that specialize in real estate data or find comparable sales information available on various real estate Internet sites.

Source: foreclosure.com

Source: foreclosure.com

Richland Township EIT tax is 100 Richland Township PSD code political subdivision is. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Richland County South Carolina 2020 Hampton Street POBox 192 Columbia SC 29201. In addition to real estate taxes the Treasurers Office collects personal property mobile home and estate taxes. 50 Park Avenue East Mansfield Ohio 44902.

Source: realtor.com

Source: realtor.com

These records can include Richland County property tax assessments and assessment challenges appraisals and income taxes. Richland County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Richland County Wisconsin. The Richland County Treasurers Office collects and receipts postponed and delinquent real estate tax payments and calculates balances and administers tax settlements for all taxing jurisdictions. The Richland County Treasurers Office offers several convenient ways to pay your taxes. June 30th Annual deadline to apply for Senior Citizen Tax Relief.

Source: richlandmaps.com

Source: richlandmaps.com

Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. 50 Park Avenue East Mansfield Ohio 44902. In addition to real estate taxes the Treasurers Office collects personal property mobile home and estate taxes. We also classify property at a 4 ratio for your legal residence meaning that you own and occupy the property as your primary residence or at a 6 ratio for commercial property or non-owner occupied. Richland Township EIT tax is 100 Richland Township PSD code political subdivision is.

Source: foreclosure.com

Source: foreclosure.com

Questions regarding eligibility status and application procedures should be directed to. Richland County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Richland County Wisconsin. Richland County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Richland County Illinois. The Richland County Treasurers Office collects and receipts postponed and delinquent real estate tax payments and calculates balances and administers tax settlements for all taxing jurisdictions. You also can get a comparable sales report for a fee from private companies that specialize in real estate data or find comparable sales information available on various real estate Internet sites.

Source: zillow.com

Source: zillow.com

The Office of the Richland County Treasurer has many responsibilities. Sep 18 2020 802 AM OLNEY The Richland County Treasurers office will be mailing out certified notices for delinquent real estate and mobile home taxes a week from today on Friday September 25. In order to avoid additional penalties the delinquent real estate and mobile home taxes must be paid in full before next Friday the 25th. The Richland County Treasurers Office offers several convenient ways to pay your taxes. Questions regarding eligibility status and application procedures should be directed to.

Source: zillow.com

Source: zillow.com

These records can include Richland County property tax assessments and. This results in a tax savings of one-third of the tax bill compared to the 6 ratio if application for the special assessment is not made. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. These records can include Richland County property tax assessments and assessment challenges appraisals and income taxes. July Treasurers Office mails delinquent notices for all unpaid current taxes.

Source: destinationmansfield.com

Source: destinationmansfield.com

No name available Richland County. June 1st Delinquent tax period begins. Fees for conveyances and vendor licenses are also paid in the Treasurers Office. No name available Richland County. Richland County collects on average 152 of a propertys assessed fair market value as property tax.

Source:

Source:

803 576-2610 or 576-2611. You also can get a comparable sales report for a fee from private companies that specialize in real estate data or find comparable sales information available on various real estate Internet sites. June 30th Annual deadline to apply for Senior Citizen Tax Relief. These records can include Richland County property tax assessments and assessment challenges appraisals and income taxes. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

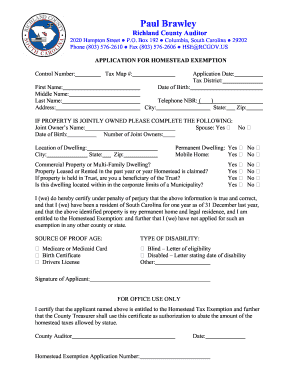

Source: signnow.com

Source: signnow.com

One time penalty is 5 of gross tax due. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. The average yearly property tax paid by Richland County residents amounts to about 239 of their yearly income. The Richland County Treasurers Office collects and receipts postponed and delinquent real estate tax payments and calculates balances and administers tax settlements for all taxing jurisdictions. These records can include Richland County property tax assessments and assessment challenges appraisals and income taxes.

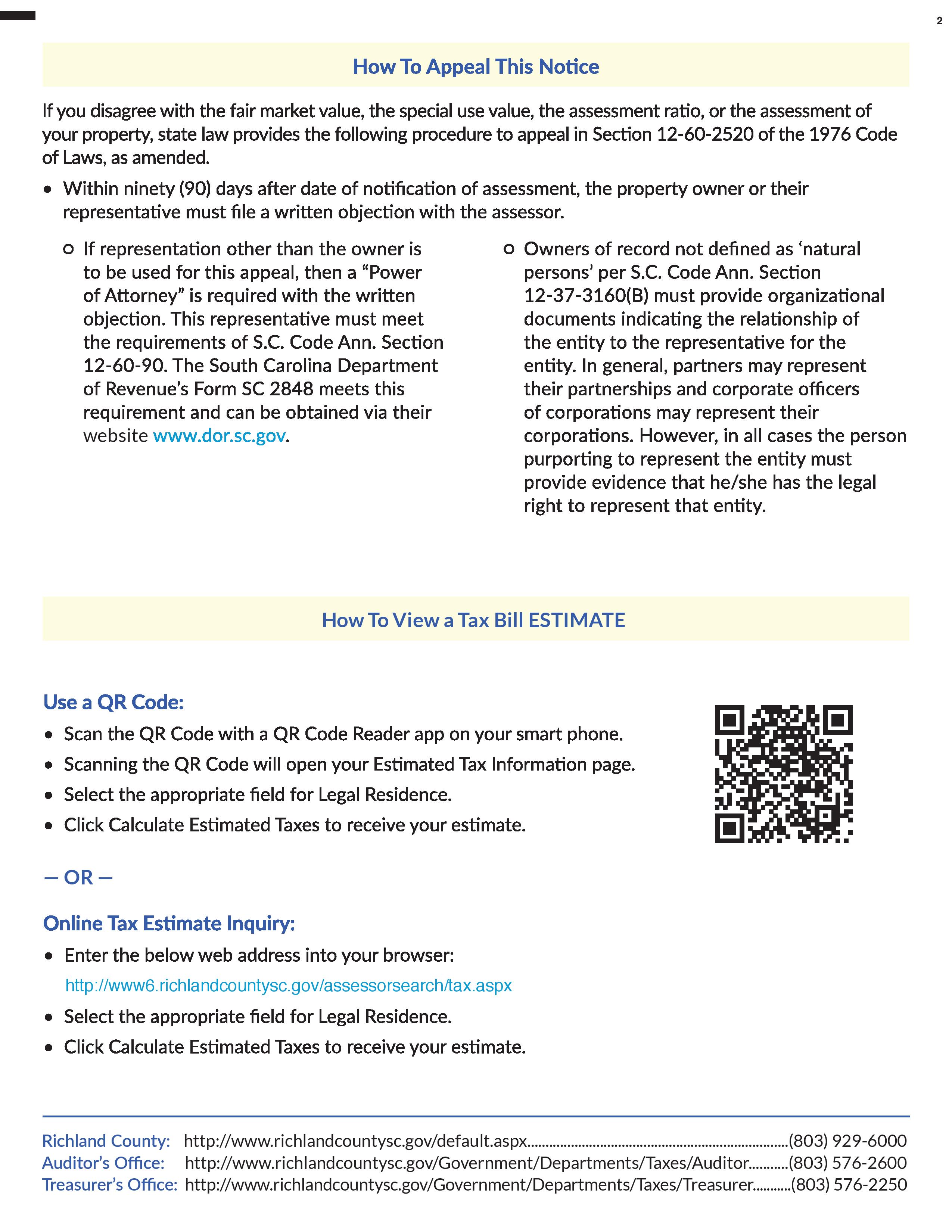

Source: richlandcountysc.gov

Source: richlandcountysc.gov

The Richland County Treasurers Office offers several convenient ways to pay your taxes. Richland County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Richland County Ohio. June 30th Annual deadline to apply for Senior Citizen Tax Relief. The Richland County Treasurers Office collects and receipts postponed and delinquent real estate tax payments and calculates balances and administers tax settlements for all taxing jurisdictions. The Richland County Treasurers Office offers several convenient ways to pay your taxes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title richland county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.