Your Riverside county ca real estate taxes images are available in this site. Riverside county ca real estate taxes are a topic that is being searched for and liked by netizens today. You can Download the Riverside county ca real estate taxes files here. Get all royalty-free images.

If you’re looking for riverside county ca real estate taxes pictures information related to the riverside county ca real estate taxes keyword, you have pay a visit to the right site. Our website always gives you suggestions for viewing the highest quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

Riverside County Ca Real Estate Taxes. It is our hope that this directory will assist in locating the site. Riverside County collects on average 08 of a propertys assessed fair market value as property tax. Additionally the City of Riverside has enacted the Real Property Transfer Tax Ordinance and charges an additional tax of 55 per each 50000 or fraction thereof. The county most of the countys incorporated cities school districts and all other taxing agencies located in the county including special districts eg.

Understanding California S Property Taxes From lao.ca.gov

Understanding California S Property Taxes From lao.ca.gov

However it is important to know that if you choose to purchase a home in Palm Springs or Cathedral City. Also a 3500 per-parcel-won administrative fee will be added to. If you have further questions please contact our office at 951955-3900 or e. In-depth Riverside CA Property Tax Information. Any No HOA Fee 50month100month200month300. The median property tax in Riverside County California is 2618 per year for a home worth the median value of 325300.

The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

The county most of the countys incorporated cities school districts and all other taxing agencies located in the county including special districts eg. The county most of the countys incorporated cities school districts and all other taxing agencies located in the county including special districts eg. Areas such as Palm Springs and Cathedral City are located in the jurisdiction of Riverside County. Riverside CA 92501 Phone. It is our hope that this directory will assist in locating the site. Riverside Office of The Treasurer-Tax Collector Tax Records httpstaxpaymentscoriversidecaustaxpaymentsSearchaspx Search Riverside Office of the Treasurer-Tax Collector property tax database by address or assessment.

Source:

Source:

The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more. Enjoy the pride of homeownership for less than it costs to rent before its too late. And until last fall the county relied on. However it is important to know that if you choose to purchase a home in Palm Springs or Cathedral City.

Source: lao.ca.gov

Source: lao.ca.gov

Any No HOA Fee 50month100month200month300. Riverside County collects on average 08 of a propertys assessed fair market value as property tax. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. The average property tax bill was 4572 in 2018 while the national average was almost 3500placing Riverside County 69th out of 141 of the largest metropolitan areas in the US. The countys average effective tax rate is 095.

Source: homes.com

Source: homes.com

Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. However it is important to know that if you choose to purchase a home in Palm Springs or Cathedral City. Any No HOA Fee 50month100month200month300. The median property tax in Riverside County California is 2618 per year for a home worth the median value of 325300. Welcome to the Riverside County Property Tax Portal.

Source: upnest.com

Source: upnest.com

SEE Detailed property tax report for 5130 Chequers CT Riverside County CA. The countys average effective tax rate is 095. Affordability of Living in Riverside County CA Homes are typically worth 624sqft. Find Riverside County residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

Source: upnest.com

Source: upnest.com

Riverside County Property Taxes Home values in California are high and theres not much to do to get around that. Taxes in the district are capped at 125 of assessed value. However rates can vary. Any No HOA Fee 50month100month200month300. It is our hope that this directory will assist in locating the site.

Source: zillow.com

Source: zillow.com

The median property tax in Riverside County California is 2618 per year for a home worth the median value of 325300. If you have further questions please contact our office at 951955-3900 or e. Riverside County taxpayers face some of the highest property tax rates in California. Free Riverside County Property Tax Records Search. Taxes in the district are capped at 125 of assessed value.

Source: lao.ca.gov

Source: lao.ca.gov

The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce taxpayers to the organizations that handle the property tax process in Riverside County. If you have further questions please contact our office at 951955-3900 or e. Riverside County Property Taxes Home values in California are high and theres not much to do to get around that. However rates can vary. Any No HOA Fee 50month100month200month300.

Source: lukinski.com

Source: lukinski.com

The average property tax bill was 4572 in 2018 while the national average was almost 3500placing Riverside County 69th out of 141 of the largest metropolitan areas in the US. The average property tax bill was 4572 in 2018 while the national average was almost 3500placing Riverside County 69th out of 141 of the largest metropolitan areas in the US. Areas such as Palm Springs and Cathedral City are located in the jurisdiction of Riverside County. Riverside Office of The Treasurer-Tax Collector Tax Records httpstaxpaymentscoriversidecaustaxpaymentsSearchaspx Search Riverside Office of the Treasurer-Tax Collector property tax database by address or assessment. Affordability of Living in Riverside County CA Homes are typically worth 624sqft.

Source: lao.ca.gov

Source: lao.ca.gov

Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Property taxes are collected by the county although they are governed by California State Law. Free Riverside County Property Tax Records Search. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

Source: firstteam.com

Source: firstteam.com

Affordability of Living in Riverside County CA Homes are typically worth 624sqft. Also a 3500 per-parcel-won administrative fee will be added to. The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce taxpayers to the organizations that handle the property tax process in Riverside County. Riverside County keeps track of a million parcels each year with an assessed value of 286 billion. If you have further questions please contact our office at 951955-3900 or e.

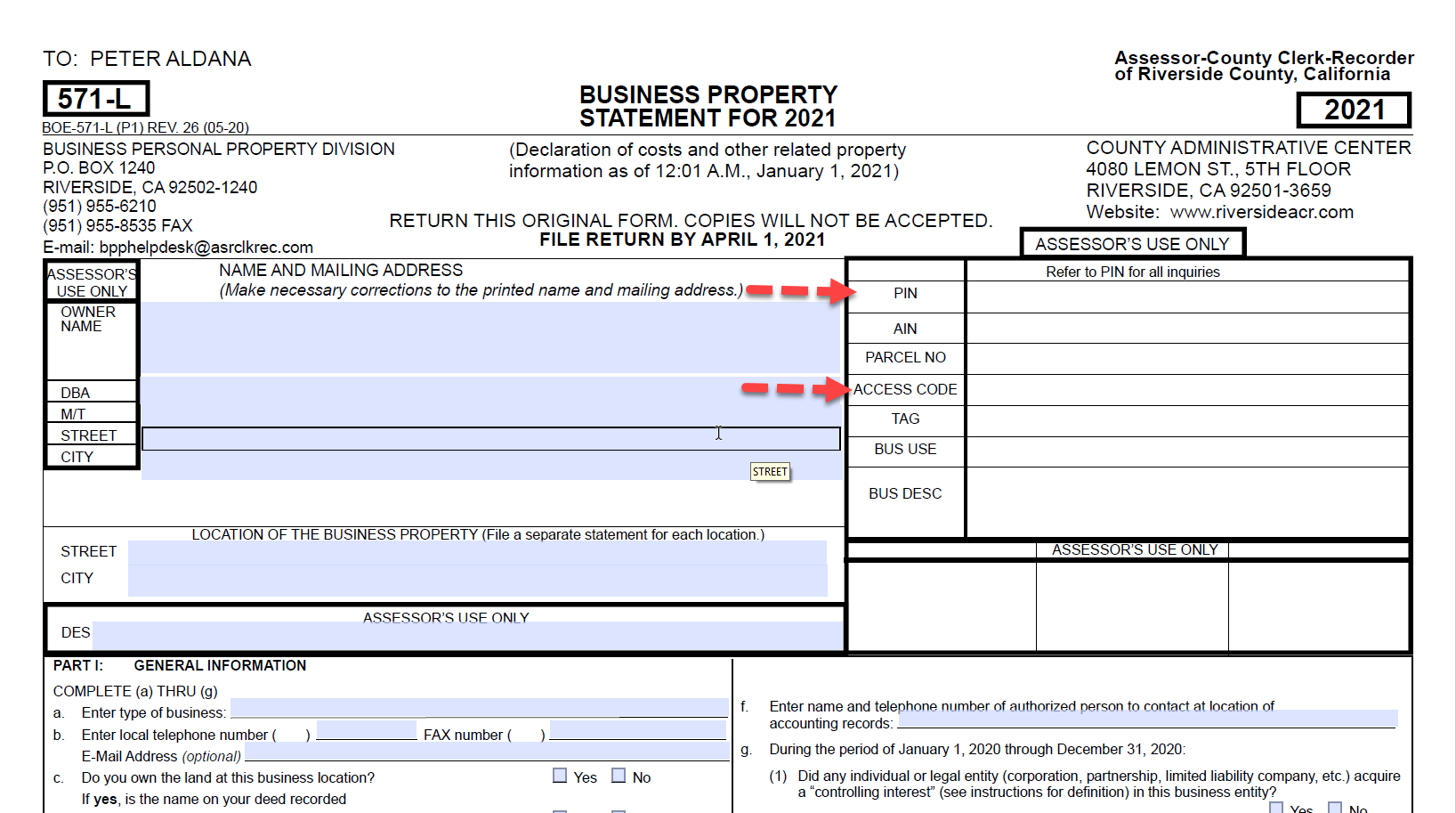

Source: asrclkrec.com

Source: asrclkrec.com

It is our hope that this directory will assist in locating the site. It bills taxpayers for 38 billion in property taxes. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Areas such as Palm Springs and Cathedral City are located in the jurisdiction of Riverside County. The county most of the countys incorporated cities school districts and all other taxing agencies located in the county including special districts eg.

Source:

Source:

Areas such as Palm Springs and Cathedral City are located in the jurisdiction of Riverside County. The countys average effective tax rate is 095. Riverside County collects on average 08 of a propertys assessed fair market value as property tax. Also a 3500 per-parcel-won administrative fee will be added to. Property taxes are collected by the county although they are governed by California State Law.

And until last fall the county relied on. Any No HOA Fee 50month100month200month300. Free Riverside County Property Tax Records Search. If you have further questions please contact our office at 951955-3900 or e. Riverside County Property Taxes Home values in California are high and theres not much to do to get around that.

Source: andersonadvisors.com

Source: andersonadvisors.com

The countys average effective tax rate is 095. Proposition 13 enacted in 1978 forms the basis. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. The countys average effective tax rate is 095. Any No HOA Fee 50month100month200month300.

Source: lao.ca.gov

Source: lao.ca.gov

The median property tax in Riverside County California is 2618 per year for a home worth the median value of 325300. However rates can vary. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage. Riverside County taxpayers face some of the highest property tax rates in California. Areas such as Palm Springs and Cathedral City are located in the jurisdiction of Riverside County.

Source: lao.ca.gov

Source: lao.ca.gov

Also a 3500 per-parcel-won administrative fee will be added to. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law. The county most of the countys incorporated cities school districts and all other taxing agencies located in the county including special districts eg. Riverside Office of The Treasurer-Tax Collector Tax Records httpstaxpaymentscoriversidecaustaxpaymentsSearchaspx Search Riverside Office of the Treasurer-Tax Collector property tax database by address or assessment. The average property tax bill was 4572 in 2018 while the national average was almost 3500placing Riverside County 69th out of 141 of the largest metropolitan areas in the US.

Source: lao.ca.gov

Source: lao.ca.gov

Riverside CA 92501 Phone. Affordability of Living in Riverside County CA Homes are typically worth 624sqft. The Tax Collector of Riverside County collects taxes on behalf of the following entities. Riverside County keeps track of a million parcels each year with an assessed value of 286 billion. Co-ops also have monthly fees Common Charges and Maintenance Fees which may also include real estate taxes and a portion of the buildings underlying mortgage.

Source: lao.ca.gov

Source: lao.ca.gov

If you have further questions please contact our office at 951955-3900 or e. However it is important to know that if you choose to purchase a home in Palm Springs or Cathedral City. Find Riverside County residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. Enjoy the pride of homeownership for less than it costs to rent before its too late. The California Constitution mandates that all property is subject to taxation unless otherwise exempted by state or federal law.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title riverside county ca real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.