Your Roanoke county real estate tax assessment images are available in this site. Roanoke county real estate tax assessment are a topic that is being searched for and liked by netizens today. You can Get the Roanoke county real estate tax assessment files here. Get all royalty-free photos.

If you’re looking for roanoke county real estate tax assessment pictures information linked to the roanoke county real estate tax assessment topic, you have pay a visit to the right site. Our site always provides you with suggestions for viewing the maximum quality video and picture content, please kindly hunt and find more informative video content and images that fit your interests.

Roanoke County Real Estate Tax Assessment. The appraisals are used to calculate the annual real estate tax bill. 27 days ago roanoke county real estate assessment s continued to decline this year which will result in loss of about 176 million in tax revenue for 2013. Roanoke County has one of the highest median property taxes in the United States and is ranked 614th of the 3143 counties in order of median property taxes. Several government offices in Roanoke and Virginia state maintain Property Records.

You may search for real estate bills using the owners name parcel address or parcel ID. 27 days ago roanoke county real estate assessment s continued to decline this year which will result in loss of about 176 million in tax revenue for 2013. These records can include Roanoke property tax assessments and assessment challenges appraisals and income taxes. In Virginia cities are independent from the surrounding counties and are therefore separate taxing entities. Real Estate Tax Rates. The Real Estate Tax Relief program for Roanoke County is administered by the Commissioner of Revenue.

A Roanoke Property Records Search locates real estate documents related to property in Roanoke Virginia.

The City of Roanoke Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in City of Roanoke. Public Property Records provide information on land homes and commercial properties in Roanoke including titles property deeds mortgages property tax assessment records and other documents. See the Roanoke County Treasurers Office for tax payment methods via walk-in phone or online. It is the taxpayers responsibility to notify the Treasurers Office of address changes. You may search for real estate bills using the owners name parcel address or parcel ID. The appraisals are used to calculate the annual real estate tax bill.

Source: realtor.com

Source: realtor.com

Roanoke - Real Estate GIS. 27 days ago roanoke county real estate assessment s continued to decline this year which will result in loss of about 176 million in tax revenue for 2013. View Roanoke Countys real estate data with our WebPro Application or select the button below to get started. See the Treasurers Tax Dates and Deadlines page for more information about when Roanoke Countys personal property and real estate taxes are due. Tax bills are mailed the last week of August and February.

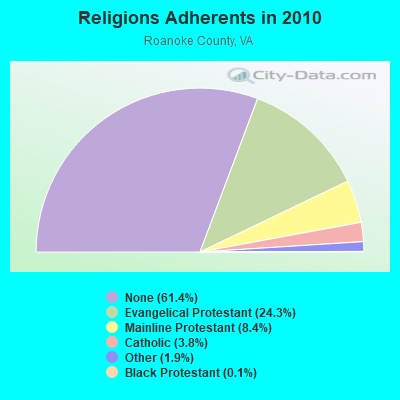

Source: city-data.com

Source: city-data.com

This program freezes Real Estate taxes for qualifying elderly or disabled homeowners within Roanoke County. The City of Roanoke Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in City of Roanoke. View Roanoke Countys real estate data with our WebPro Application or select the button below to get started. System Maintenance will take place on Friday April 23rd from 500 PM until Monday April 26th at 800 AM. The Office of Real Estate Valuation is the City department responsible for appraising all real property at 100 of market value each year.

Source: zillow.com

Source: zillow.com

A Roanoke Property Records Search locates real estate documents related to property in Roanoke Virginia. Real estate assessments are determined by Real Estate Valuation each year based upon the fair market value as of January 1 of that year. Tax Map Real Estate Parcel. See the Roanoke County Treasurers Office for tax payment methods via walk-in phone or online. Roanoke County collects on average 092 of a propertys assessed fair market value as property tax.

Source: zillow.com

Source: zillow.com

Residents of incorporated towns may pay taxes to both the county and town if both provide services. Please complete the Change of Address form. In Virginia cities are independent from the surrounding counties and are therefore separate taxing entities. Tax bills are mailed the last week of August and February. This tax is assessed by the Commissioner of the Revenue while taxes are paid to the Treasurers Office.

Source: realtor.com

Source: realtor.com

Tax Payment Dates and Deadlines. View Real Estate Data Online. How to Pay Taxes. Rate Payment of Real Estate Taxes. Roanoke County collects on average 092 of a propertys assessed fair market value as property tax.

Source: webpro.roanokecountyva.gov

Source: webpro.roanokecountyva.gov

The system will be unavailable during this time. Roanoke Countys Office of Real Estate Valuation 5204 Bernard Drive SW Suite 200D Roanoke Virginia 24018-0798 Phone. Real Estate Tax Rates. Real Estate Valuation appraises all eligible properties within the county for tax purposes. See the Roanoke County Treasurers Office for tax payment methods via walk-in phone or online.

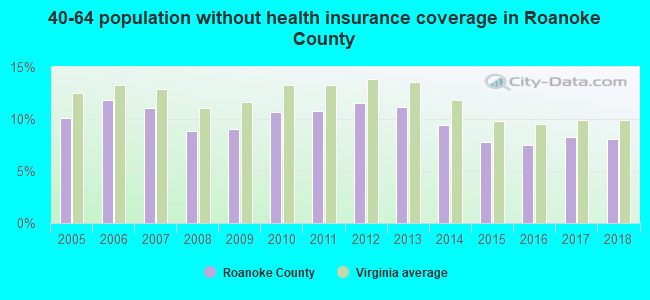

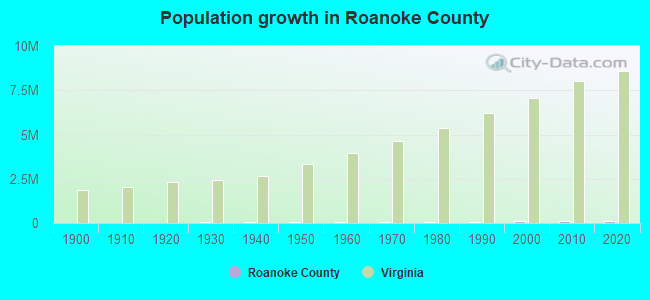

Source: city-data.com

Source: city-data.com

Tax Map Real Estate Parcel. Roanoke - Real Estate GIS. A business or individual pays taxes only to the city or county not both. Several government offices in Roanoke and Virginia state maintain Property Records. 27 days ago roanoke county real estate assessment s continued to decline this year which will result in loss of about 176 million in tax revenue for 2013.

Source: realtor.com

Source: realtor.com

Roanoke Countys Office of Real Estate Valuation 5204 Bernard Drive SW Suite 200D Roanoke Virginia 24018-0798 Phone. Roanoke Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Roanoke Virginia. See the Roanoke County Treasurers Office for tax payment methods via walk-in phone or online. The Roanoke County Revenue Commission located in Roanoke Virginia determines the value of all taxable property in Roanoke VA. The appraisals are used to calculate the annual real estate tax bill.

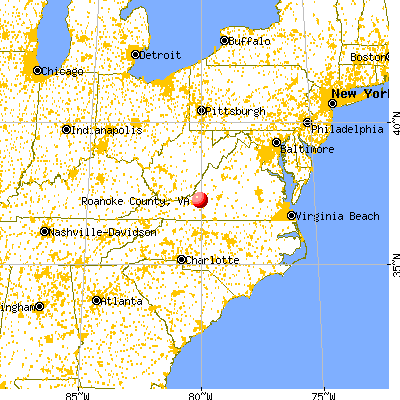

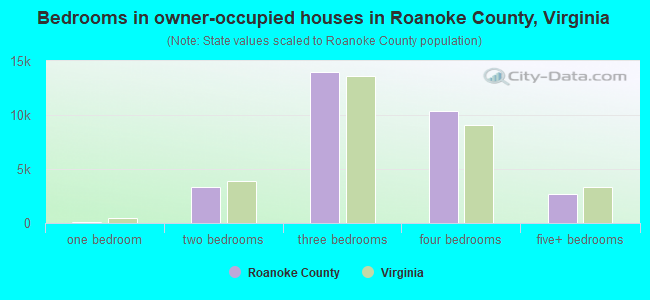

Source: city-data.com

Source: city-data.com

The tax rate for real estate is 122 per 100 of the assessed value of the property. Neither the County of Roanoke nor its representatives shall be held responsible for any expenses costs damages or injuries that arises from the use of the data as shown. Roanoke Property Records are real estate documents that contain information related to real property in Roanoke Virginia. Residents of incorporated towns may pay taxes to both the county and town if both provide services. System Maintenance will take place on Friday April 23rd from 500 PM until Monday April 26th at 800 AM.

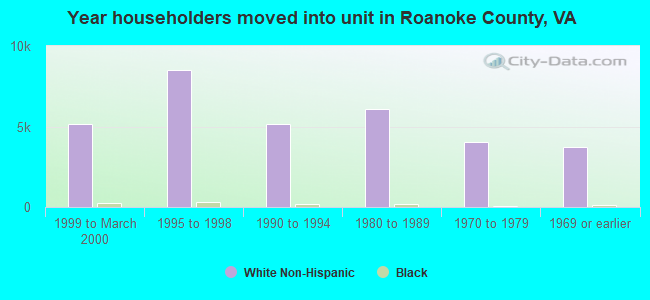

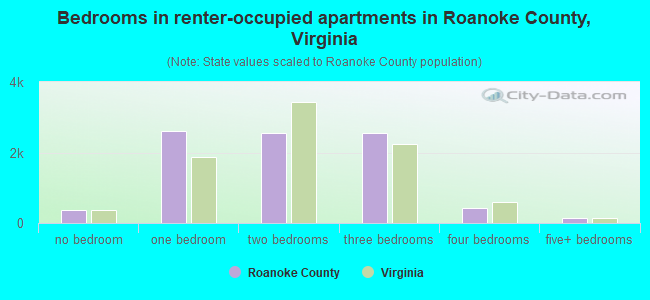

Source: city-data.com

Source: city-data.com

A business or individual pays taxes only to the city or county not both. Roanoke Property Records are real estate documents that contain information related to real property in Roanoke Virginia. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The City of Roanoke Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. System Maintenance will take place on Friday April 23rd from 500 PM until Monday April 26th at 800 AM.

Source: city-data.com

Source: city-data.com

Tax Map Real Estate Parcel. This tax is assessed by the Commissioner of the Revenue while taxes are paid to the Treasurers Office. The City of Roanoke Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in City of Roanoke. Several government offices in Roanoke and Virginia state maintain Property Records. Roanoke Property Records are real estate documents that contain information related to real property in Roanoke Virginia.

Source: realtor.com

Source: realtor.com

How to Pay Taxes. Roanoke County collects on average 092 of a propertys assessed fair market value as property tax. The appraisals are used to calculate the annual real estate tax bill. It is the taxpayers responsibility to notify the Treasurers Office of address changes. Real Estate Valuation - real estate assessments.

Source: city-data.com

Source: city-data.com

Tax Payment Dates and Deadlines. The Real Estate Tax Relief program for Roanoke County is administered by the Commissioner of Revenue. This tax is assessed by the Commissioner of the Revenue while taxes are paid to the Treasurers Office. The City of Roanoke Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in City of Roanoke. Type of Rate Rate.

Tax Payment Dates and Deadlines. A Roanoke Property Records Search locates real estate documents related to property in Roanoke Virginia. Tax Map Real Estate Parcel. For more details on assessments please contact the Roanoke County Real Estate Valuation office at 540-772-2035. 4 days ago Assessments are performed annually on properties located in the Town of Vinton by the Roanoke County Real Estate Valuation office and values are effective as of January 1 each year.

Type of Rate Rate. Roanoke Property Records are real estate documents that contain information related to real property in Roanoke Virginia. Real estate assessments are determined by Real Estate Valuation each year based upon the fair market value as of January 1 of that year. The appraisals are used to calculate the annual real estate tax bill. You may search for real estate bills using the owners name parcel address or parcel ID.

Source: city-data.com

Source: city-data.com

Roanoke - Real Estate GIS. View Real Estate Data Online. The Office of Real Estate Valuation is the City department responsible for appraising all real property at 100 of market value each year. Roanoke County collects on average 092 of a propertys assessed fair market value as property tax. This program freezes Real Estate taxes for qualifying elderly or disabled homeowners within Roanoke County.

Source: roanoke.org

Source: roanoke.org

View Roanoke Countys real estate data with our WebPro Application or select the button below to get started. View Roanoke Countys real estate data with our WebPro Application or select the button below to get started. These records can include Roanoke property tax assessments and assessment challenges appraisals and income taxes. Real Estate Tax Rates. 4 days ago Assessments are performed annually on properties located in the Town of Vinton by the Roanoke County Real Estate Valuation office and values are effective as of January 1 each year.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Neither the County of Roanoke nor its representatives shall be held responsible for any expenses costs damages or injuries that arises from the use of the data as shown. A business or individual pays taxes only to the city or county not both. Real Estate Valuation appraises all eligible properties within the county for tax purposes. Billy Driver the countys director of real estate.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title roanoke county real estate tax assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.