Your Rock county real estate taxes images are available in this site. Rock county real estate taxes are a topic that is being searched for and liked by netizens now. You can Find and Download the Rock county real estate taxes files here. Find and Download all free vectors.

If you’re searching for rock county real estate taxes pictures information connected with to the rock county real estate taxes interest, you have visit the ideal blog. Our website always provides you with hints for refferencing the highest quality video and picture content, please kindly search and find more enlightening video articles and images that match your interests.

Rock County Real Estate Taxes. Real Estate Personal Property. Rock County collects on average 081 of a propertys assessed fair market value. Property Taxes Recently Passed Resolutions Surplus Items for Sale Voter Information. These records can include Rock County property tax assessments and assessment challenges appraisals and income taxes.

Eyd5osdc07gy M From

Eyd5osdc07gy M From

If information is needed regarding the current year payable Real Property Taxes please contact the Otter Tail County Treasurers Office. Rock County collects on average 081 of a propertys assessed fair market value. USE OF THIS SITE CONSTITUTES ACCEPTANCE OF THESE TERMS AND CONDITIONS. Real Estate documents available include but are not limited to Deeds Mortgages Certified Survey Maps and Federal Tax Leins. The median property tax in Rock County Minnesota is 800 per year for a home worth the median value of 99200. We are pleased to announce that the 2020 payable 2021 tax books are open.

Cards school permits etc.

If you are one of the seven municipalities that does not send your first installment payment to Rock County you CANNOT use the GovTech website for first installment payments. We are pleased to announce that the 2020 payable 2021 tax books are open. Rock Island IL 61201. This office also calculates the county payroll and employee benefits. USE OF THIS SITE CONSTITUTES ACCEPTANCE OF THESE TERMS AND CONDITIONS. To issue driver licenses CDLs learner permits ID.

Source: century21core.com

Source: century21core.com

If Rock County collects your first installment or if you are paying real estate taxes after January 31 you may pay by credit card or electronic check using the GovTech Services Inc website. Real Estate Personal Property. Do delinquent taxpayers have to pay costs of the certified delinquent notice or of publication. Installment due dates are set by the Treasurers Office. USE OF THIS SITE CONSTITUTES ACCEPTANCE OF THESE TERMS AND CONDITIONS.

Source: co.rock.mn.us

Source: co.rock.mn.us

Friday 12182020 was our last day. As each installment due date passes interest is added if the installment was not paid on time until the installment is paid. Appraised Value x Assessment Ratio. To bill and collect all real estate and personal taxes in the County. The median property tax in Rock County Minnesota is 800 per year for a home worth the median value of 99200.

Source: co.rock.mn.us

Source: co.rock.mn.us

Most of these records are available by Document Number. To bill and collect all real estate and personal taxes in the County. Property Taxes Recently Passed Resolutions Surplus Items for Sale Voter Information. On Wednesday morning December 30 2020. Or call 1-855-912-7625 follow the voice prompts.

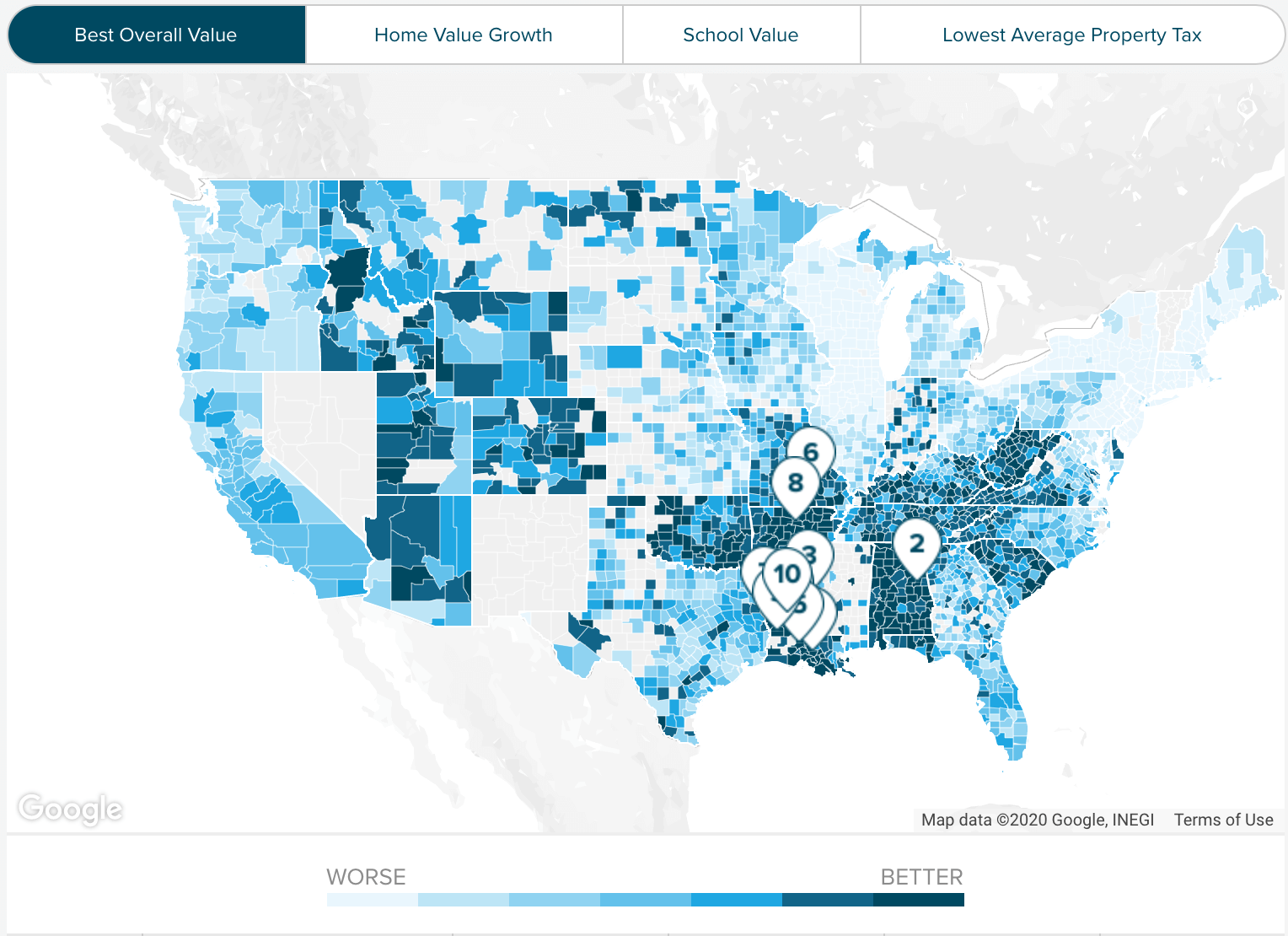

Source: smartasset.com

Source: smartasset.com

The last day to pay Rock Island County Real Estate Taxes in person will be December 29 2020. For questions on displayed information contact Rock County Treasurer. Do delinquent taxpayers have to pay costs of the certified delinquent notice or of publication. 800 AM to 430 PM - Monday thru Friday. Appraised Value x Assessment Ratio.

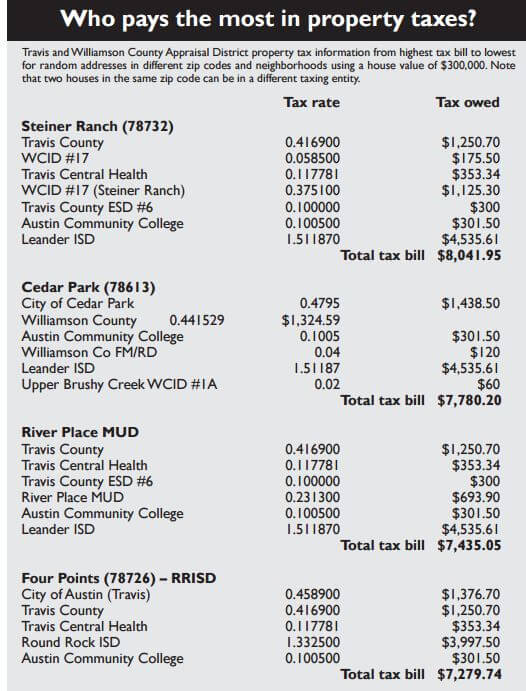

Source: fourpointsnews.com

Source: fourpointsnews.com

Click on Paying Property Taxes Payment Options GovTech Services Inc. If a parcel contains multiple years of delinquency and if you are unable to pay the delinquency in full then you must pay the most current delinquent year first. Rock County collects on average 081 of a propertys assessed fair market value. Cards school permits etc. Do delinquent taxpayers have to pay costs of the certified delinquent notice or of publication.

Source:

Source:

Rock Island County Office Building map First Floor - 1504 Third Avenue Rock Island IL 61201. Rock Island County Treasurer. If information is needed regarding the current year payable Real Property Taxes please contact the Otter Tail County Treasurers Office. Rock County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Rock County Wisconsin. If Rock County collects your first installment or if you are paying real estate taxes after January 31 you may pay by credit card or electronic check using the GovTech Services Inc website.

Source: co.rock.wi.us

Source: co.rock.wi.us

The basic formula for calculating real estate tax is as follows. Rock Island IL 61201. Real Estate in Rockbridge County is taxed at 100 percent of fair market value as required by the state constitution. These records can include Rock County property tax assessments and assessment challenges appraisals and income taxes. The median property tax in Rock County Minnesota is 800 per year for a home worth the median value of 99200.

Source: co.rock.wi.us

Source: co.rock.wi.us

To bill and collect all real estate and personal taxes in the County. Do delinquent taxpayers have to pay costs of the certified delinquent notice or of publication. To issue driver licenses CDLs learner permits ID. Rock Island County Real Estate Taxes are initially billed by the Treasurers Office and can be paid in four 4 installments. If paid by mail the payment must be received by 830 AM.

Source:

Source:

This office also calculates the county payroll and employee benefits. Access to and use of the Rock County Web site is provided subject to the following terms and conditions. Click on Paying Property Taxes Payment Options GovTech Services Inc. The basic formula for calculating real estate tax is as follows. Real Estate Personal Property.

Source: smartasset.com

Source: smartasset.com

Cards school permits etc. USE OF THIS SITE CONSTITUTES ACCEPTANCE OF THESE TERMS AND CONDITIONS. Friday 12182020 was our last day. To issue driver licenses CDLs learner permits ID. Most of these records are available by Document Number.

Source:

Source:

Click here for information on LB1107 Nebraska Income Tax Credit for School District Taxes Paid Nebraska Property Tax Incentive Act Credit Tax Year. 800 AM to 430 PM - Monday thru Friday. For example if the millage rate is 200 mills and the assessed value of the property is 1000 the tax on that property is 200. The basic formula for calculating real estate tax is as follows. Click on Paying Property Taxes Payment Options GovTech Services Inc.

Source: summitdaily.com

Source: summitdaily.com

Friday 12182020 was our last day. If paid by mail the payment must be received by 830 AM. Do delinquent taxpayers have to pay costs of the certified delinquent notice or of publication. If information is needed regarding the current year payable Real Property Taxes please contact the Otter Tail County Treasurers Office. Rock Island County Real Estate Taxes are initially billed by the Treasurers Office and can be paid in four 4 installments.

Source:

Source:

The median property tax in Rock County Minnesota is 800 per year for a home worth the median value of 99200. Website to pay with a debit card credit card or e-check. By using this site you will be able to view parcel current tax and historical information. Please contact the Rock Island County Treasurers Office at 309 558-3510 if you have any questions. Friday 12182020 was our last day.

Source:

Source:

Website to pay with a debit card credit card or e-check. Real Estate Personal Property. Friday 12182020 was our last day. Rock Island IL 61201. Or call 1-855-912-7625 follow the voice prompts.

Source:

Source:

800 AM to 430 PM - Monday thru Friday. Friday 12182020 was our last day. Most of these records are available by Document Number. This office also calculates the county payroll and employee benefits. This is determined by conducting a thorough sales study immediately prior to each general reassessment of real property.

Source:

Source:

By Document Number Grantor Grantee Legal. The median property tax in Rock County Minnesota is 800 per year for a home worth the median value of 99200. Real Estate Personal Property. As each installment due date passes interest is added if the installment was not paid on time until the installment is paid. To bill and collect all real estate and personal taxes in the County.

Source: co.rock.mn.us

Source: co.rock.mn.us

If paid by mail the payment must be received by 830 AM. Do delinquent taxpayers have to pay costs of the certified delinquent notice or of publication. Rock Island County Real Estate Taxes are initially billed by the Treasurers Office and can be paid in four 4 installments. Rock County collects on average 081 of a propertys assessed fair market value. Real Estate in Rockbridge County is taxed at 100 percent of fair market value as required by the state constitution.

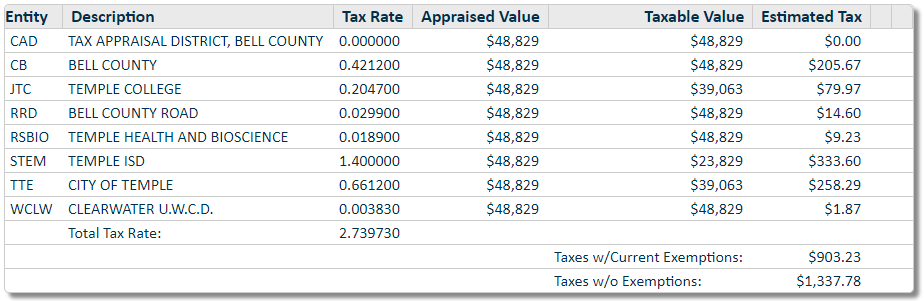

Source: hoodhomesblog.com

Source: hoodhomesblog.com

By using this site you will be able to view parcel current tax and historical information. These records can include Rock County property tax assessments and assessment challenges appraisals and income taxes. If a parcel contains multiple years of delinquency and if you are unable to pay the delinquency in full then you must pay the most current delinquent year first. 2019 Personal Property and Real Estate Taxes are now delinquent. Taxes not paid by December 29 will be sold at the Rock Island County Tax Sale on December 30 2020.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title rock county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.