Your Sangamon county real estate tax bill images are available. Sangamon county real estate tax bill are a topic that is being searched for and liked by netizens now. You can Get the Sangamon county real estate tax bill files here. Find and Download all royalty-free photos and vectors.

If you’re searching for sangamon county real estate tax bill pictures information connected with to the sangamon county real estate tax bill keyword, you have come to the right blog. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly search and find more informative video articles and images that fit your interests.

Sangamon County Real Estate Tax Bill. Tax sales must be paid with certified funds a cashiers check money order or cash and is payable to the Sangamon County Clerk. Supervisor of Assessments Office or 217 753-6805 Tax rate. Tax payment or bills. See sample report.

Schs From sancohis.org

Schs From sancohis.org

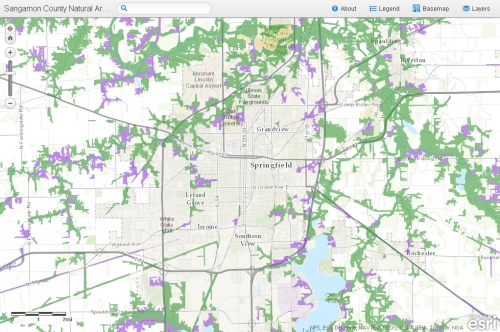

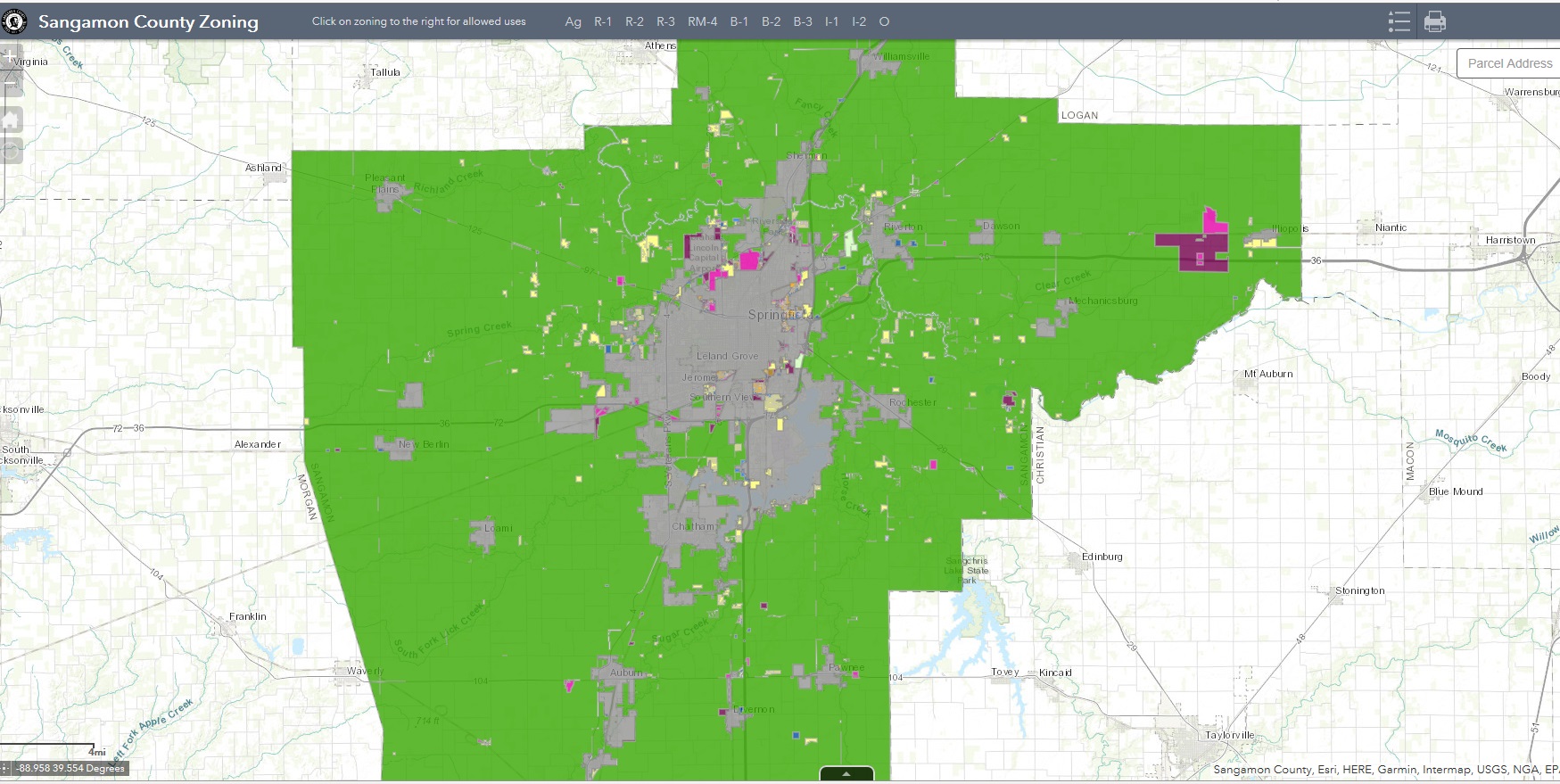

The required assessment level for tax purposes on any parcel of real property in any county is 33 13 percent of the propertys fair market value excluding farm land and farm buildings. Per 35 ILCS 20021-15 interest of 15 per month applied to payments paidpostmarked after July 17 0717. Welcome to the Sangamon County Property Tax and E-Payment Information webpage. Tax sales must be paid with certified funds a cashiers check money order or cash and is payable to the Sangamon County Clerk. Must be postmarked no later than the tax due dates to avoid late penalty. Sangamon County collects on average 187 of a propertys assessed fair market value as property tax.

Supervisor of Assessments Office or 217 753-6805 Tax rate.

We hope you will find this information to be helpful. In-depth Sangamon County IL Property Tax Information. Supervisor of Assessments Office or 217 753-6805 Tax rate. The State of Illinois does not have a statewide property tax. Per 35 ILCS 20021-15 interest of 15 per month applied to payments paidpostmarked after July 17 0717. UCC Filing - Real Estate - 34 Termination - 14 Handling Fee - Documents lacking statutory or county requirements will be returned and 2 per document is required.

Source: sancohis.org

Source: sancohis.org

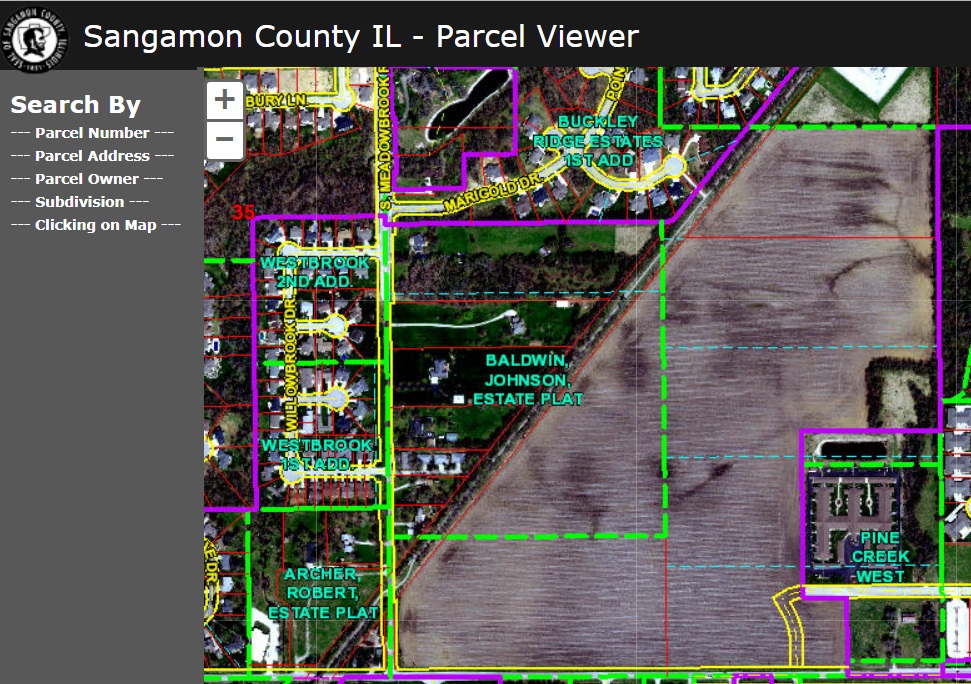

The required assessment level for tax purposes on any parcel of real property in any county is 33 13 percent of the propertys fair market value excluding farm land and farm buildings. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the full property report. Search and Other Non-Recording Requests Non-Certified. The State of Illinois does not have a statewide property tax. The median property tax also known as real estate tax in Sangamon County is 221900 per year based on a median home value of 11890000 and a median.

Source: co.sangamon.il.us

Source: co.sangamon.il.us

Real Estate tax bills scheduled to be mailed. Must be postmarked no later than the tax due dates to avoid late penalty. Property tax payments can also be made electronically using this website. Treasurers Office or 217 753-6800 Tax exemptions. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property.

Source: co.sangamon.il.us

Source: co.sangamon.il.us

The required assessment level for tax purposes on any parcel of real property in any county is 33 13 percent of the propertys fair market value excluding farm land and farm buildings. 1st installment tax due. SANGAMON COUNTY REAL ESTATE TAX BILL THOMAS K. Property tax owners in Sangamon County will get some relief in light of the COVID-19 pandemic. SEE Detailed property tax report for 5144 Cockrell Ln Sangamon IL.

Source: co.sangamon.il.us

Source: co.sangamon.il.us

SEE Detailed property tax report for 5144 Cockrell Ln Sangamon IL. Checks should be made out to Tax Collector Payments in the form of check should be mailed to. SANGAMON COUNTY REAL ESTATE TAX BILL THOMAS K. County Clerks Office or 217 753-6701 Tax sale. Most functions on this website including paying your current taxes and filing an assessment complaint require you to first search for a parcel by parcel number owner name or property address.

Source: sj-r.com

Source: sj-r.com

Once you have found the parcel that you are interested in use the drop down navigation in the Action field on the results screen to get started. No personal or business checks or credit cards can be accepted. Current year taxes can be paid. Welcome to the Sangamon County Property Tax and E-Payment Information webpage. UCC Filing - Real Estate - 34 Termination - 14 Handling Fee - Documents lacking statutory or county requirements will be returned and 2 per document is required.

Source: sancohis.org

Source: sancohis.org

Property tax payments can also be made electronically using this website. Sangamon County Collector PO Box 19400 Springfield Il 62794-9400 E -check Payments On Line Via the Internet E-checkTaxCo. No refunds will be given until the bills have been charged against the prepayment in late April. This site has been developed as a convenience to those who are interested in viewing the status of property tax payments and assessments. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the full property report.

Source: co.sangamon.il.us

Source: co.sangamon.il.us

187 of home value Yearly median tax in Sangamon County The median property tax in Sangamon County Illinois is 2219 per year for a home worth the median value of 118900. Checks should be made out to Tax Collector Payments in the form of check should be mailed to. In-depth Sangamon County IL Property Tax Information. 187 of home value Yearly median tax in Sangamon County The median property tax in Sangamon County Illinois is 2219 per year for a home worth the median value of 118900. Sangamon County collects on average 187 of a propertys assessed fair market value as property tax.

Source: nprillinois.org

Source: nprillinois.org

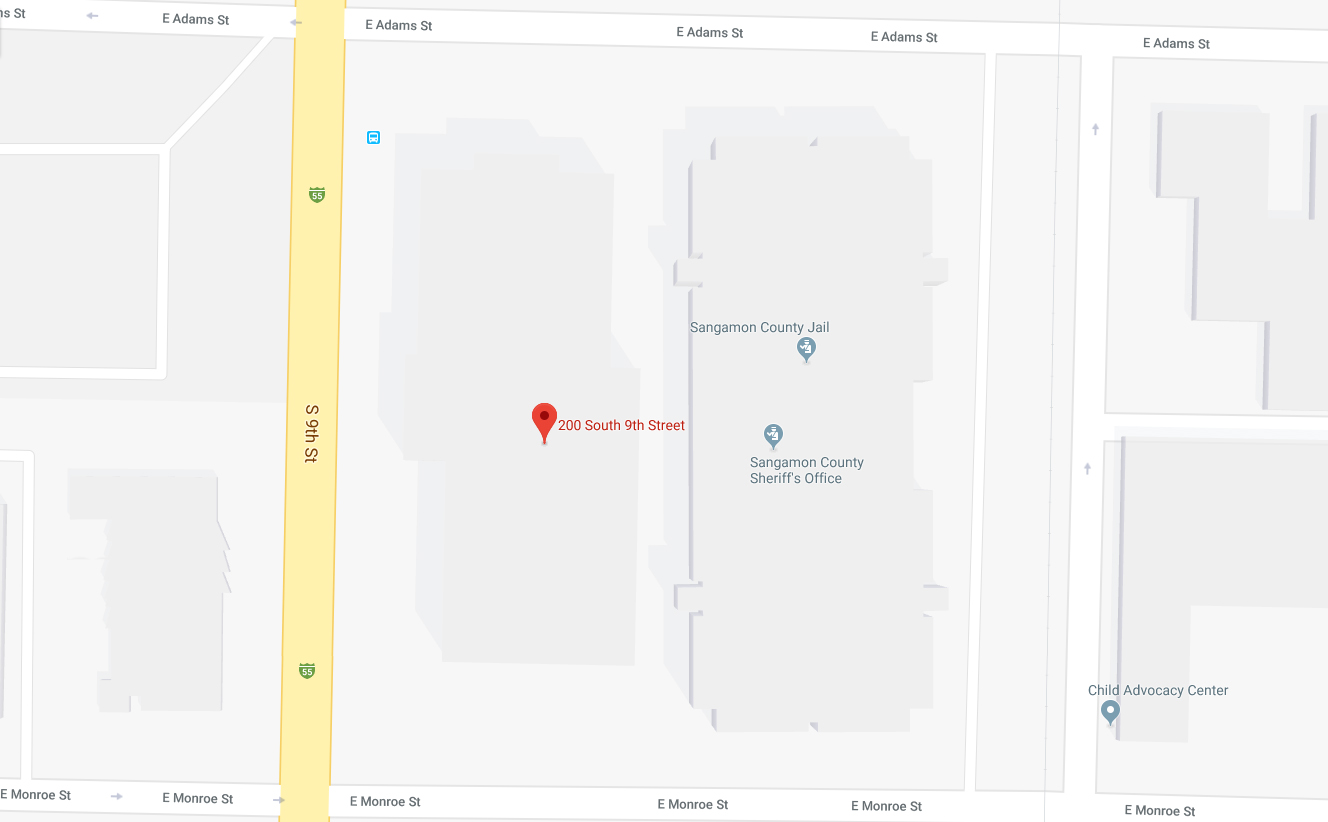

Applications must be received by March 1 in order to defer the upcoming tax bill. Most functions on this website including paying your current taxes and filing an assessment complaint require you to first search for a parcel by parcel number owner name or property address. SANGAMON COUNTY REAL ESTATE TAX BILL THOMAS K. Payments in the form of check should be mailed to. CAVANAGH TREASURER AND COLLECTOR Mail checks to PO BOX 19400 Springfield IL 62794 - 9400 After September 04 2014 mail checks to 200 S Ninth St.

Source: co.sangamon.il.us

Source: co.sangamon.il.us

Must be postmarked no later than the tax due dates to avoid late penalty. SANGAMON COUNTY REAL ESTATE TAX BILL THOMAS K. SANGAMON COUNTY REAL ESTATE TAX BILL THOMAS K. Checks should be made out to Tax Collector Payments in the form of check should be mailed to. This site has been developed as a convenience to those who are interested in viewing the status of property tax payments and assessments.

Source: co.sangamon.il.us

Source: co.sangamon.il.us

CAVANAGH TREASURER AND COLLECTOR Mail checks to PO BOX 19400 Springfield IL 62794 - 9400 After September 04 2014 mail checks to 200 S Ninth St. Checks should be made out to Tax Collector Payments in the form of check should be mailed to. CAVANAGH TREASURER AND COLLECTOR Mail checks to PO BOX 19400 Springfield IL 62794 - 9400 After September 04 2014 mail checks to 200 S Ninth St. Applications must be received by March 1 in order to defer the upcoming tax bill. Must be postmarked no later than the tax due dates to avoid late penalty.

Source: pantagraph.com

Source: pantagraph.com

The median property tax also known as real estate tax in Sangamon County is 221900 per year based on a median home value of 11890000 and a median. County Clerks Office or 217 753. SEE Detailed property tax report for 5144 Cockrell Ln Sangamon IL. Tax sales must be paid with certified funds a cashiers check money order or cash and is payable to the Sangamon County Clerk. Applications must be received by March 1 in order to defer the upcoming tax bill.

Source: co.sangamon.il.us

Source: co.sangamon.il.us

You can see all factors used to determine the tax bill and find more information on your property of interest by opening the full property report. Property tax owners in Sangamon County will get some relief in light of the COVID-19 pandemic. Must be postmarked no later than the tax due dates to avoid late penalty. The median property tax also known as real estate tax in Sangamon County is 221900 per year based on a median home value of 11890000 and a median. County Clerks Office or 217 753-6701 Tax sale.

Source: sancohis.org

Source: sancohis.org

You can pay up to 105 of the previous years tax amount and no more unless the prior bill was a partial year bill. Most functions on this website including paying your current taxes and filing an assessment complaint require you to first search for a parcel by parcel number owner name or property address. Tax sales must be paid with certified funds a cashiers check money order or cash and is payable to the Sangamon County Clerk. SEE Detailed property tax report for 5144 Cockrell Ln Sangamon IL. Per 35 ILCS 20021-15 interest of 15 per month applied to payments paidpostmarked after July 17 0717.

Property tax payments can also be made electronically using this website. Payments in the form of check should be mailed to. Property tax payments can also be made electronically using this website. Current year taxes can be paid. Must be postmarked no later than the tax due dates to avoid late penalty.

Source: co.sangamon.il.us

Source: co.sangamon.il.us

No refunds will be given until the bills have been charged against the prepayment in late April. Current year taxes can be paid. County Clerks Office or 217 753. Search for a Parcel. Sangamon County collects on average 187 of a propertys assessed fair market value as property tax.

Source: co.sangamon.il.us

Source: co.sangamon.il.us

You can pay up to 105 of the previous years tax amount and no more unless the prior bill was a partial year bill. Treasurers Office or 217 753-6800 Tax exemptions. Sangamon County Collector PO Box 19400 Springfield Il 62794-9400 E -check Payments On Line Via the Internet E-checkTaxCo. No refunds will be given until the bills have been charged against the prepayment in late April. Payments in the form of check should be mailed to.

Source: co.sangamon.il.us

Source: co.sangamon.il.us

Search and Other Non-Recording Requests Non-Certified. County Clerks Office or 217 753. UCC Filing - Real Estate - 34 Termination - 14 Handling Fee - Documents lacking statutory or county requirements will be returned and 2 per document is required. The State of Illinois does not have a statewide property tax. 2 days ago 0511.

Source: niche.com

Source: niche.com

Property tax payments can also be made electronically using this website. In-depth Sangamon County IL Property Tax Information. Tax payment or bills. County Clerks Office or 217 753. To find out more about the program please read this down loadable pamphlet or contact the Treasurers office at 217-753-6800.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sangamon county real estate tax bill by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.