Your Sangamon county real estate taxes images are available. Sangamon county real estate taxes are a topic that is being searched for and liked by netizens today. You can Get the Sangamon county real estate taxes files here. Find and Download all royalty-free photos.

If you’re searching for sangamon county real estate taxes pictures information related to the sangamon county real estate taxes interest, you have visit the ideal blog. Our site frequently provides you with suggestions for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

Sangamon County Real Estate Taxes. Sangamon County Property Tax Exemptions Report Link httpscosangamonilusdepartmentss-zsupervisor-of-assessmentsexemptions View Sangamon County Illinois property tax exemption information including homestead exemptions low income assistance senior and veteran exemptions applications and program details. This site has been developed as a convenience to those who are interested in viewing the status of property tax payments and assessments. This exemption amounts to a reduction of the equalized assessed value of up to 6000. County Clerks Office or 217 753-6725 Property assessment.

Search For Parcels From tax.co.sangamon.il.us

Search For Parcels From tax.co.sangamon.il.us

Senior Citizens Real Estate Tax Deferral Information from the Sangamon County Treasurer. In Person Payment Tax payments are accepted in the Treasurers Office Monday thru Friday 830 to 500 at 200 S. This exemption amounts to a reduction of the equalized assessed value of up to 6000. Matt Brown Ball Township PO. This site has been developed as a convenience to those who are interested in viewing the status of property tax payments and assessments. The Sangamon County Clerk provides a variety of services to voters record keeping of proceedings of the County Board record keeper for births marriages and deaths and responsible for setting values of Capital Township property in.

The State of Illinois does not have a statewide property tax.

These records can include Sangamon County property tax assessments and assessment challenges appraisals and income taxes. No personal or business checks or credit cards can be accepted. Matt Brown Ball Township PO. A drop box is located in the lobby of the Sangamon County Building to the left of the Treasurers office door. Sangamon County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Sangamon County Illinois. The exemption amount is calculated by subtracting the equalized assessed value in 1977 from the present equalized assessed value and may be prorated from date of occupancy to December 31 if.

Source: homes.com

Source: homes.com

SEE Detailed property tax report for 5144 Cockrell Ln Sangamon County IL. Affordability of Living in Sangamon County IL Homes are typically worth 142sqft. The State of Illinois does not have a statewide property tax. The Sangamon County Clerk provides a variety of services to voters record keeping of proceedings of the County Board record keeper for births marriages and deaths and responsible for setting values of Capital Township property in. Office Hours are 830 AM to 500 PM Monday thru Friday except Holidays.

Source: nprillinois.org

Source: nprillinois.org

County Clerks Office or 217 753-6701 Tax sale. Senior Citizens Real Estate Tax Deferral Information from the Sangamon County Treasurer. Scheduled 2020 Pay 2021 Important Tax Dates First. DeedsEasementsLeases may require Transfer Tax Stamps - 50 per 500 value for State plus 25 per 500 value for County refer to. The median property tax in Sangamon County Illinois is 2219 per year for a home worth the median value of 118900.

Source: illinoistimes.com

Source: illinoistimes.com

The median property tax in Sangamon County Illinois is 2219 per year for a home worth the median value of 118900. County Clerks Office or 217 753-6701 Tax sale. Property taxes are determined at local levels and pay for services such as schools libraries park districts fire protection districts and others. Current Year Real Estate and Property Tax Information from the Sangamon County Treasurer Illinois. No refunds will be given until the bills have been charged against the prepayment in late April.

Source:

Source:

You can pay up to 105 of the previous years tax amount and no more unless the prior bill was a partial year bill. Sangamon County Property Tax Exemptions Report Link httpscosangamonilusdepartmentss-zsupervisor-of-assessmentsexemptions View Sangamon County Illinois property tax exemption information including homestead exemptions low income assistance senior and veteran exemptions applications and program details. Tax sales must be paid with certified funds a cashiers check money order or cash and is payable to the Sangamon County Clerk. Current year taxes can be paid. 217 747-5180 Welcome to the Sangamon County Property Tax and E-Payment Information webpage.

Source: owebacktaxesproperty.com

Source: owebacktaxesproperty.com

Sangamon County Township Assessors Auburn Township Matt Brown Independent 14837 Kennedy Road Auburn IL 62615 Phone. Sangamon County Township Assessors Auburn Township Matt Brown Independent 14837 Kennedy Road Auburn IL 62615 Phone. Tax sales must be paid with certified funds a cashiers check money order or cash and is payable to the Sangamon County Clerk. County Clerks Office or 217 753-6701 Tax sale. We require you to pay at least 25 of last years bill as the minimum payment amount.

Source: tax.co.sangamon.il.us

Source: tax.co.sangamon.il.us

Sangamon County Property Tax Exemptions Report Link httpscosangamonilusdepartmentss-zsupervisor-of-assessmentsexemptions View Sangamon County Illinois property tax exemption information including homestead exemptions low income assistance senior and veteran exemptions applications and program details. You can pay up to 105 of the previous years tax amount and no more unless the prior bill was a partial year bill. The median property tax in Sangamon County Illinois is 2219 per year for a home worth the median value of 118900. Sangamon County Property Tax Exemptions Report Link httpscosangamonilusdepartmentss-zsupervisor-of-assessmentsexemptions View Sangamon County Illinois property tax exemption information including homestead exemptions low income assistance senior and veteran exemptions applications and program details. These records can include Sangamon County property tax assessments and assessment challenges appraisals and income taxes.

Source: zillow.com

Source: zillow.com

You can pay up to 105 of the previous years tax amount and no more unless the prior bill was a partial year bill. Sangamon County Property Information Line - Ph. The exemption amount is calculated by subtracting the equalized assessed value in 1977 from the present equalized assessed value and may be prorated from date of occupancy to December 31 if. Office Hours are 830 AM to 500 PM Monday thru Friday except Holidays. Sangamon County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Sangamon County Illinois.

Source: realtor.com

Source: realtor.com

These records can include Sangamon County property tax assessments and assessment challenges appraisals and income taxes. This site has been developed as a convenience to those who are interested in viewing the status of property tax payments and assessments. No refunds will be given until the bills have been charged against the prepayment in late April. This exemption amounts to a reduction of the equalized assessed value of up to 6000. PropertyReal Estate Taxes Pay a fine Traffic Ticket Request Birth Record Civil Union Record Death Record FOIAPublic Records Marriage Record Courts Court Organizations Seventh Judicial Circuit Court Jury Commissions.

Source: zillow.com

Source: zillow.com

The required assessment level for tax purposes on any parcel of real property in any county is 33 13 percent of the propertys fair market value excluding farmland and farm buildings. Property taxes are determined at local levels and pay for services such as schools libraries park districts fire protection districts and others. Office Hours are 830 AM to 500 PM Monday thru Friday except Holidays. Scheduled 2020 Pay 2021 Important Tax Dates First. The Sangamon County Clerk provides a variety of services to voters record keeping of proceedings of the County Board record keeper for births marriages and deaths and responsible for setting values of Capital Township property in.

Source: homes.com

Source: homes.com

The exemption amount is calculated by subtracting the equalized assessed value in 1977 from the present equalized assessed value and may be prorated from date of occupancy to December 31 if. This site has been developed as a convenience to those who are interested in viewing the status of property tax payments and assessments. Affordability of Living in Sangamon County IL Homes are typically worth 142sqft. County Clerks Office or 217 753-6701 Tax sale. Sangamon County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Sangamon County Illinois.

Source: owebacktaxesproperty.com

Source: owebacktaxesproperty.com

No refunds will be given until the bills have been charged against the prepayment in late April. Tax sales must be paid with certified funds a cashiers check money order or cash and is payable to the Sangamon County Clerk. Sangamon County Property Information Line - Ph. County Clerks Office or 217 753-6725 Property assessment. Local Township Assessor.

Source: worrell-landservices.com

Source: worrell-landservices.com

Senior Citizens Real Estate Tax Deferral Information from the Sangamon County Treasurer. Sangamon County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Sangamon County Illinois. Office Hours are 830 AM to 500 PM Monday thru Friday except Holidays. The Sangamon County Clerk provides a variety of services to voters record keeping of proceedings of the County Board record keeper for births marriages and deaths and responsible for setting values of Capital Township property in. SEE Detailed property tax report for 5144 Cockrell Ln Sangamon County IL.

Source: newschannel20.com

Source: newschannel20.com

Tax sales must be paid with certified funds a cashiers check money order or cash and is payable to the Sangamon County Clerk. County Clerks Office or 217 753-6725 Property assessment. Office Hours are 830 AM to 500 PM Monday thru Friday except Holidays. Local Township Assessor. No refunds will be given until the bills have been charged against the prepayment in late April.

Source: zillow.com

Source: zillow.com

The median property tax in Sangamon County Illinois is 2219 per year for a home worth the median value of 118900. The Sangamon County Clerk provides a variety of services to voters record keeping of proceedings of the County Board record keeper for births marriages and deaths and responsible for setting values of Capital Township property in. PropertyReal Estate Taxes Pay a fine Traffic Ticket Request Birth Record Civil Union Record Death Record FOIAPublic Records Marriage Record Courts Court Organizations Seventh Judicial Circuit Court Jury Commissions. Sangamon County Township Assessors Auburn Township Matt Brown Independent 14837 Kennedy Road Auburn IL 62615 Phone. SEE Detailed property tax report for 5144 Cockrell Ln Sangamon County IL.

Source: owebacktaxesproperty.com

Source: owebacktaxesproperty.com

County Clerks Office or 217 753-6725 Property assessment. Scheduled 2020 Pay 2021 Important Tax Dates First. The State of Illinois does not have a statewide property tax. Sangamon County Township Assessors Auburn Township Matt Brown Independent 14837 Kennedy Road Auburn IL 62615 Phone. Affordability of Living in Sangamon County IL Homes are typically worth 142sqft.

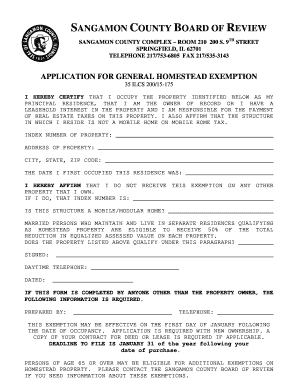

Source: pdffiller.com

Source: pdffiller.com

Property taxes are determined at local levels and pay for services such as schools libraries park districts fire protection districts and others. This site has been developed as a convenience to those who are interested in viewing the status of property tax payments and assessments. These records can include Sangamon County property tax assessments and assessment challenges appraisals and income taxes. The State of Illinois does not have a statewide property tax. Sangamon County collects on average 187 of a propertys assessed fair market value as property tax.

Source: sj-r.com

Source: sj-r.com

A drop box is located in the lobby of the Sangamon County Building to the left of the Treasurers office door. Current Year Real Estate and Property Tax Information from the Sangamon County Treasurer Illinois. Sangamon County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Sangamon County Illinois. County Clerks Office or 217 753-6725 Property assessment. The required assessment level for tax purposes on any parcel of real property in any county is 33 13 percent of the propertys fair market value excluding farmland and farm buildings.

Source: realtor.com

Source: realtor.com

No refunds will be given until the bills have been charged against the prepayment in late April. A drop box is located in the lobby of the Sangamon County Building to the left of the Treasurers office door. DeedsEasementsLeases may require Transfer Tax Stamps - 50 per 500 value for State plus 25 per 500 value for County refer to. Scheduled 2020 Pay 2021 Important Tax Dates First. This site has been developed as a convenience to those who are interested in viewing the status of property tax payments and assessments.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sangamon county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.