Your Sebastian county real estate taxes images are ready in this website. Sebastian county real estate taxes are a topic that is being searched for and liked by netizens now. You can Get the Sebastian county real estate taxes files here. Get all royalty-free photos and vectors.

If you’re searching for sebastian county real estate taxes images information connected with to the sebastian county real estate taxes keyword, you have pay a visit to the right blog. Our website frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

Sebastian County Real Estate Taxes. 35000 is deducted from that 52 making the tax bill only 17500. The Sebastian County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Sebastian County. Ad-valorem taxes are based on the value of the real estate and any improvements structures buildings etc on the property. On and after January 1 1991 taxpayers shall annually assess.

Sebastian County Government Property Taxes From sebastiancountyar.gov

Sebastian County Government Property Taxes From sebastiancountyar.gov

If your home is valued at 25000 assessed at 5000 X 0525 your tax bill would be 26250. 6th St Fort Smith or 6515 Phoenix Ave Fort Smith or 301 E Center St Greenwood. Make an Appointment. Sebastian County Government PropertyTaxes. Median property tax payments in the county are just 798 per year. Proudly serving the citizens of Indian River County and the State of Florida.

Appointments are required for any in-office services.

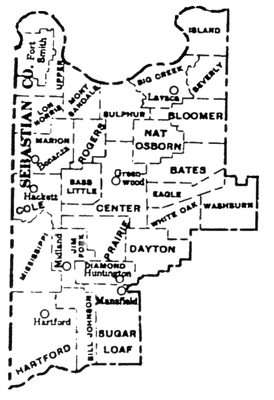

On and after January 1 1991 taxpayers shall annually assess. Proudly serving the citizens of Indian River County and the State of Florida. 35000 is deducted from that 52 making the tax bill only 17500. 6th St Fort Smith or 6515 Phoenix Ave Fort Smith or 301 E Center St Greenwood. Payment for personal and real property taxes by the following methods. Sebastian County located in the West Central part of Arkansas was established by a legislative act on January 6 1851.

Source: sebastiancountyar.gov

Source: sebastiancountyar.gov

6th St Fort Smith or 6515 Phoenix Ave Fort Smith or 301 E Center St Greenwood. Find Sebastian County residential property records including property owners sales transfer history deeds titles property taxes. Fort Smith AR 72902 Email. Ad-valorem taxes are based on the value of the real estate and any improvements structures buildings etc on the property. Yearly median tax in Sebastian County The median property tax in Sebastian County Arkansas is 639 per year for a home worth the median value of 108000.

Source: arcountydata.com

Source: arcountydata.com

The Sebastian County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. 6th St Fort Smith or 6515 Phoenix Ave Fort Smith or 301 E Center St Greenwood. 35000 is deducted from that 52 making the tax bill only 17500. Property Tax Real Estate Homestead Deferral Plan Delinquent Property Taxes Tangible Personal Property Installment Payment Plan Ad Valorem Taxes Non-Ad Valorem Taxes Search Records Motorist Services Titles Registration License Plate Disabled Placards Mobile Home Military Personnel Vessel. Taxes become delinquent April 1st and additional charges become due.

Source: point2homes.com

Source: point2homes.com

The real estate tax bill is a combined notice of ad-valorem taxes and non ad-valorem assessments. Find Sebastian County residential property records including property owners sales transfer history deeds titles property taxes. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. To the Tax Collectors Office. 2 if paid in January.

Source: zillow.com

Source: zillow.com

Sebastian County Government PropertyTaxes. Sebastian County offers a multitude of resources to address your property and tax questions and needs. 1 if paid in February. 3 if paid in December. Sebastian County Government PropertyTaxes.

Sebastian County collects on average 059 of a propertys assessed fair market value as property tax. Find Sebastian County residential property records including property owners sales transfer history deeds titles property taxes. Click NEXT to Pay Your Personal Property and Real Estate Taxes in Sebastian County Arkansas. Good Friday Office Closure. These records commonly include ownership and property information market and assessed values taxes land use ownership transfers structure information outbuilding and yard improvements where available.

Source: sebastiancountyar.gov

Source: sebastiancountyar.gov

Our offices are closed on April 2 2021 for Good Friday. Proudly serving the citizens of Indian River County and the State of Florida. 6th St Fort Smith or 6515 Phoenix Ave Fort Smith or 301 E Center St Greenwood. Sebastian County located in the West Central part of Arkansas was established by a legislative act on January 6 1851. Real Property records are obtained from the Assessors office.

Source: sebastiancountyar.gov

Source: sebastiancountyar.gov

Sebastian County Government PropertyTaxes. 1 if paid in February. Senator and judge of the first circuit court for several years after the state was. These records commonly include ownership and property information market and assessed values taxes land use ownership transfers structure information outbuilding and yard improvements where available. The rate there is 42058 mills.

Source: digitalheritage.arkansas.gov

Source: digitalheritage.arkansas.gov

Our goal is to assist county residents in maintaining up-to-date real estate property tax information assessment data and other complimentary services. Make an Appointment. If your home is valued at 25000 assessed at 5000 X 0525 your tax bill would be 26250. Fort Smith AR 72902 Email. Free Sebastian County Property Tax Records Search.

Source: realtor.com

Source: realtor.com

Free Sebastian County Property Records Search. Our offices are closed on April 2 2021 for Good Friday. Sebastian County offers a multitude of resources to address your property and tax questions and needs. By internet - Click Here. Sebastian County collects on average 059 of a propertys assessed fair market value as property tax.

Source:

Source:

Make an Appointment. Payment for personal and real property taxes by the following methods. Sebastian County offers a multitude of resources to address your property and tax questions and needs. Sebastian County located in the West Central part of Arkansas was established by a legislative act on January 6 1851. Senator and judge of the first circuit court for several years after the state was.

Source: zillow.com

Source: zillow.com

2 if paid in January. Select Your Record Type. Sebastian County located in the West Central part of Arkansas was established by a legislative act on January 6 1851. 3 if paid in December. Click NEXT to Pay Your Personal Property and Real Estate Taxes in Sebastian County Arkansas.

Source: sebastiancountyar.gov

Source: sebastiancountyar.gov

3 if paid in December. Sebastian County sits on the Arkansas River along the state border with Oklahoma. Payment for personal and real property taxes by the following methods. 35000 is deducted from that 52 making the tax bill only 17500. It was created from territory which previously comprised Crawford Scott and Polk Counties and was named after William K.

Source: zillow.com

Source: zillow.com

Sebastian County offers a multitude of resources to address your property and tax questions and needs. To the Tax Collectors Office. 1 if paid in February. Appointments are required for any in-office services. On and after January 1 1991 taxpayers shall annually assess.

Source: point2homes.com

Source: point2homes.com

The rate there is 42058 mills. Good Friday Office Closure. The real estate tax bill is a combined notice of ad-valorem taxes and non ad-valorem assessments. 1 if paid in February. Sebastian County sits on the Arkansas River along the state border with Oklahoma.

Source: arcountydata.com

Source: arcountydata.com

These records commonly include ownership and property information market and assessed values taxes land use ownership transfers structure information outbuilding and yard improvements where available. Senator and judge of the first circuit court for several years after the state was. Free Sebastian County Property Tax Records Search. Click NEXT to Pay Your Personal Property and Real Estate Taxes in Sebastian County Arkansas. Yearly median tax in Sebastian County The median property tax in Sebastian County Arkansas is 639 per year for a home worth the median value of 108000.

Source: sebastiancountyar.gov

Source: sebastiancountyar.gov

Sebastian County sits on the Arkansas River along the state border with Oklahoma. Good Friday Office Closure. Once the taxes are delinquent payment date is determined by the date payment is received. Payment of personal and real estate property taxes can be made by the following methods. Sebastian County located in the West Central part of Arkansas was established by a legislative act on January 6 1851.

Source:

Source:

The 10000 will be multiplied by the millage rate 0525 for Fort Smith School District making your tax bill 52500. Property Taxes are now due by March 31st. Sebastian County Tax Collector PO Box 1358 Fort Smith AR 72902. Once the taxes are delinquent payment date is determined by the date payment is received. Sebastian County located in the West Central part of Arkansas was established by a legislative act on January 6 1851.

Source: realtor.com

Source: realtor.com

Sebastian County sits on the Arkansas River along the state border with Oklahoma. Free Sebastian County Property Records Search. Free Sebastian County Property Tax Records Search. Make an Appointment. To the Tax Collectors Office.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title sebastian county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.