Your St clair county real estate taxes images are ready. St clair county real estate taxes are a topic that is being searched for and liked by netizens today. You can Download the St clair county real estate taxes files here. Download all free vectors.

If you’re looking for st clair county real estate taxes pictures information connected with to the st clair county real estate taxes keyword, you have visit the right blog. Our site frequently gives you hints for viewing the maximum quality video and image content, please kindly hunt and find more enlightening video articles and images that match your interests.

St Clair County Real Estate Taxes. Visa Debit - Convenience Fee 395. Taxpayers may pay these taxes online with a credit card. Due to the fact that tax payments have been received by this office after the copy was forwarded to the newspaper on. Clair County ADA Information Events County Code Phone Directory Careers FOIA Committees Board Elected Officials Departments 911 ETSB Auditor Board of Review Building Zoning Circuit Clerk.

The median property tax on a 12240000 house is 211752 in Illinois. The median property tax on a 12240000 house is 128520 in the United States. The map tools will allow you to visually find parcels and data. Real Estate Tax Collection Dates. Clair County Revenue Office is public information data. Fees are not collected by the County Treasurer.

Clair County is ranked 319th of the 3143 counties for property taxes as a percentage of median income.

2020 Real Estate Tax Collection dates 2021 TBD. Clair County Treasurers Office or at many financial institutions complete list below throughout the county. The average yearly property tax paid by St. Clair County Collectors office provides taxpayers the option of paying their taxes on line. Taxpayers may pay these taxes onlne with a credit card. Fees are not collected by the County Treasurer.

IF THROUGH SOME UNAVOIDABLE ERROR YOUR PROPERTY IS ADVERTISED PLEASE CONTACT THE COUNTY TREASURERS OFFICE IMMEDIATELY. Dates anticipated to be set mid-May. SEE Detailed property tax report for 102 E Main St Saint Clair County IL Property tax in Illinois is imposed by local government taxing districts eg school districts municipalities counties and administered by local officials. Please note - your tax payment may take three to five business days to process. The map tools will allow you to visually find parcels and data.

Source: thetimesherald.com

Source: thetimesherald.com

Credit Card debit card and electronic check payments may be made on-line. The most delinquent year tax must be paid before the current year. Delinquent Real Estate Taxes. Clair County Collectors office provides taxpayers the option of paying their taxes on line. Please note that the most delinquent year tax must be paid before current years.

Our commitment is to provide excellence in public services. Taxpayers may pay these taxes online with a credit card. Payments for current delinquent real estate and personal property taxes are accepted on line. You can pay your taxes by cash check money order or cashiers check. Our commitment is to provide excellence in public services.

Clair County Treasurers office exists simply as a resource which enables the public to. Clair County ADA Information Events County Code Phone Directory Careers FOIA Committees Board Elected Officials Departments 911 ETSB Auditor Board of Review Building Zoning Circuit Clerk. The median property tax on a 12240000 house is 228888 in St. Fees are not collected by the County Treasurer. Taxpayers may pay these taxes online with a credit card.

Source: realtor.com

Source: realtor.com

The most delinquent year tax must be paid before the current year. The most delinquent year tax must be paid before the current year. Dates anticipated to be set mid-May. A convenience charge will be applied. Clair County Collectors office provides taxpayers the option of paying their taxes on line.

Real Property Taxes are due and payable through December 31. Clair County Collectors office provides taxpayers the option of paying their taxes on line. IF THROUGH SOME UNAVOIDABLE ERROR YOUR PROPERTY IS ADVERTISED PLEASE CONTACT THE COUNTY TREASURERS OFFICE IMMEDIATELY. You can pay your taxes by cash check money order or cashiers check. Clair County has announced it will delay mailing out property tax bills to provide residents some relief during the COVID-19 pandemic.

Please note - your tax payment may take three to five business days to process. Last day to make payments via check. Currently the assessment ratio applicable for real estate property in Saint Clair County is 50. ACH Electronic Check Convenience Fee 200. Fees are not collected by the County Treasurer.

Source: realtor.com

Source: realtor.com

The median property tax on a 12240000 house is 128520 in the United States. The median property tax on a 12240000 house is 128520 in the United States. Clair County residents amounts to about 369 of their yearly income. Dates anticipated to be set mid-May. The map tools will allow you to visually find parcels and data.

Source: realtor.com

Source: realtor.com

Clair County ADA Information Events County Code Phone Directory Careers FOIA Committees Board Elected Officials Departments 911 ETSB Auditor Board of Review Building Zoning Circuit Clerk. The most delinquent year tax must be paid before the current year. The St Clair County Collectors Office provides taxpayers the option of paying their taxes online. Taxpayers may pay these taxes online with a credit card. Clair County has announced it will delay mailing out property tax bills to provide residents some relief during the COVID-19 pandemic.

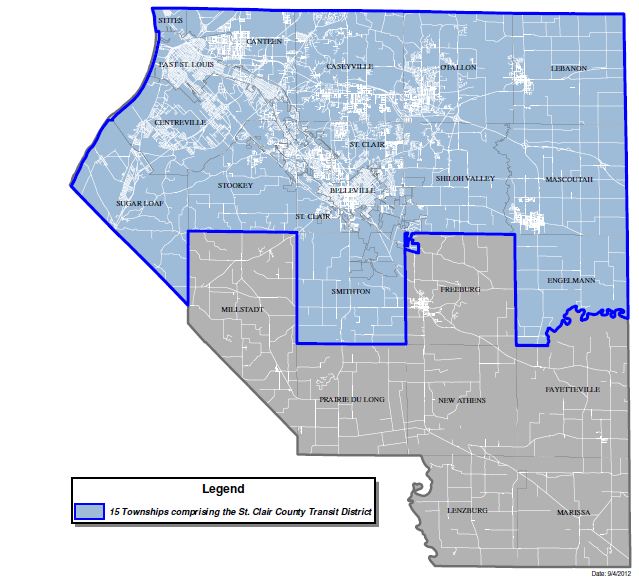

Source: scctd.org

Source: scctd.org

Due to the fact that tax payments have been received by this office after the copy was forwarded to the newspaper on. Clair County has announced it will delay mailing out property tax bills to provide residents some relief during the COVID-19 pandemic. This data was primarily collected for the purpose of creating a Property Tax File according to Alabama laws. Currently the assessment ratio applicable for real estate property in Saint Clair County is 50. These records can include St.

Source: realtor.com

Source: realtor.com

The median property tax on a 12240000 house is 228888 in St. Last day to make payments via check. Due to the fact that tax payments have been received by this office after the copy was forwarded to the newspaper on. These records can include St. Click Parcel Search to add additional tax payments.

Source: co.st-clair.il.us

Source: co.st-clair.il.us

Clair County Treasurers office exists simply as a resource which enables the public to. The average yearly property tax paid by St. Real Property Taxes are due and payable through December 31. Click Parcel Search to add additional tax payments. The Parcel Inquiry will allow you to access information directly from the Assessors and Treasurers parcel database.

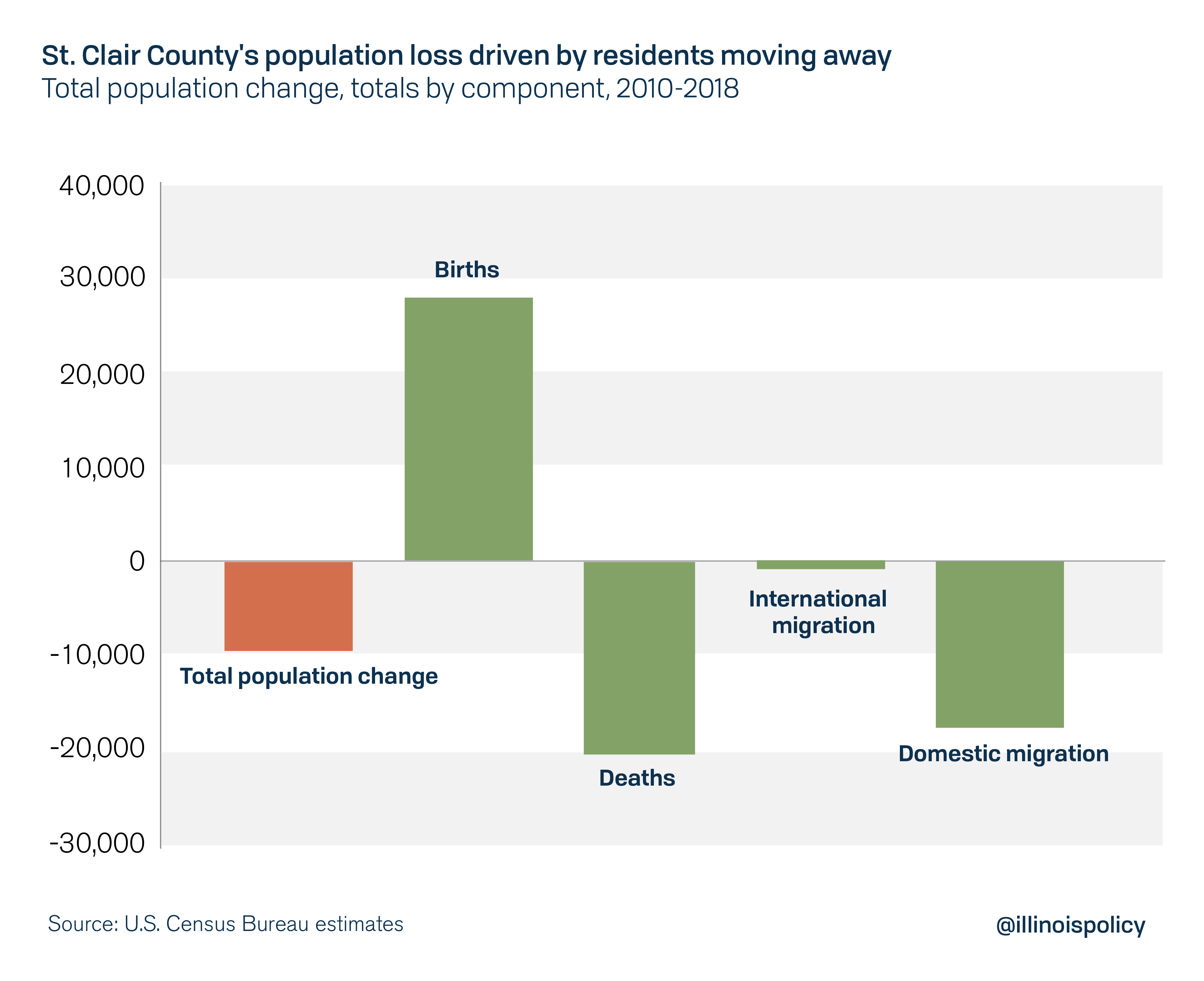

Source: illinoispolicy.org

Source: illinoispolicy.org

Dates anticipated to be set mid-May. Clair County Collectors office provides taxpayers the option of paying their taxes on line. Payments on or after this date will be charged delinquent tax fees plus 12 annual interest. 2020 Real Estate Tax Collection dates 2021 TBD. The most delinquent year tax must be paid before the current year.

You can get data on parcel assessments taxes and ownership. Currently the assessment ratio applicable for real estate property in Saint Clair County is 50. This data was primarily collected for the purpose of creating a Property Tax File according to Alabama laws. Payments for current delinquent real estate and personal property taxes are accepted on line. The map tools will allow you to visually find parcels and data.

Source: stclairil.devnetwedge.com

Source: stclairil.devnetwedge.com

The Parcel Inquiry will allow you to access information directly from the Assessors and Treasurers parcel database. Payments for current and delinquent real estate and personal property taxes are accepted online. There are also maps with other valuable information. SEE Detailed property tax report for 102 E Main St Saint Clair County IL Property tax in Illinois is imposed by local government taxing districts eg school districts municipalities counties and administered by local officials. The Treasurers Office is responsible to safeguard maintain and invest more than 185 million in County funds.

Source: co.st-clair.il.us

Source: co.st-clair.il.us

The Parcel Inquiry will allow you to access information directly from the Assessors and Treasurers parcel database. Currently the assessment ratio applicable for real estate property in Saint Clair County is 50. You may pay your real estate taxes by mail at the St. Clair County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in St. Clair County Treasurers Office or at many financial institutions complete list below throughout the county.

Source: realtor.com

Source: realtor.com

Clair County Treasurers office exists simply as a resource which enables the public to. Clair County Treasurers Office or at many financial institutions complete list below throughout the county. Clair County property tax assessments and assessment challenges appraisals and income taxes. The most delinquent year tax must be paid before the current year. ACH Electronic Check Convenience Fee 200.

Source: co.st-clair.il.us

Source: co.st-clair.il.us

The median property tax on a 12240000 house is 228888 in St. Clair County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in St. Real Property Taxes are due and payable through December 31. Delinquent Real Estate Taxes. Clair County Collectors office provides taxpayers the option of paying their taxes on line.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title st clair county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.