Your St louis city real estate tax images are available in this site. St louis city real estate tax are a topic that is being searched for and liked by netizens today. You can Get the St louis city real estate tax files here. Get all free images.

If you’re looking for st louis city real estate tax pictures information connected with to the st louis city real estate tax keyword, you have pay a visit to the ideal blog. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

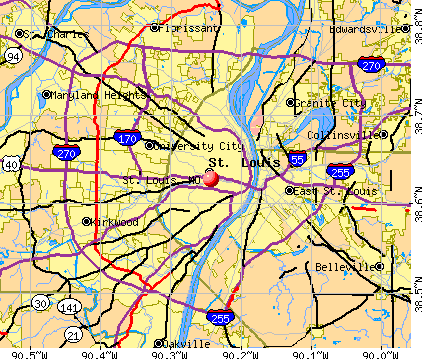

St Louis City Real Estate Tax. 41 South Central Avenue Clayton MO 63105. City real estate tax is separate from St. City Hall 1200 Market Street Room 110 St. 19 for residential properties 12 for agricultural properties and 32 for commercial properties.

St Louis Real Estate Market Trends And Forecasts 2020 From noradarealestate.com

St Louis Real Estate Market Trends And Forecasts 2020 From noradarealestate.com

The responsibility of the Collector of Revenue is to collect real estate taxes personal property taxes earnings taxes. Charles County real estate tax and other annual assessments due. Louis City Missouri is 1119 per year for a home worth the median value of 122200. City of St. City real estate tax is due from all city property owners annually at December 31 st. Louis County Missouri is 2238 per year for a home worth the median value of 179300.

2 days ago The median property tax in St. City real estate tax is due from all city property owners annually at December 31 st. Yearly median tax in St. 2020 City of St Louis Property Tax Rate 6875 KB 2020 City of St Louis Merchants and Manufacturers Tax Rate 6262 KB 2020 City of St Louis Special Business District Tax Rates 68983 KB Historical Listing of Property Tax Rates for City of St. Louis Missouri Collector of Revenues web page. Welcome to the City of St.

Source: wyndhamhotels.com

Source: wyndhamhotels.com

Louis residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. Louis County The median property tax in St. Please contact us by calling 314 622-4105 or you can send e-mails to. Currently the assessment ratios applicable for real estate property in the City of St. Welcome to the City of St.

Source: salawus.com

Source: salawus.com

19 for residential properties 12 for agricultural properties and 32 for commercial properties. 19 for residential properties 12 for agricultural properties and 32 for commercial properties. After winning a bid for a property in a Tax Sale payment must be made in the full amount by 200PM on the date of the sale no exceptions. Louis County The median property tax in St. 314 622-4413 Email Addresses Mon - Fri.

Source: stltoday.com

Source: stltoday.com

After winning a bid for a property in a Tax Sale payment must be made in the full amount by 200PM on the date of the sale no exceptions. 41 South Central Avenue Clayton MO 63105. There is a clear and efficient process in place that allows the Collector of Revenue to collect 100 percent of all real estate taxes due to the City of St. The official payment app of St. Late taxpayers are subject to fees penalties and a.

Source: stltoday.com

Source: stltoday.com

Continue to PayIt Login.

Source: stlouiscountymo.gov

Source: stlouiscountymo.gov

City real estate tax is due from all city property owners annually at December 31 st. Louis Missouri Collector of Revenues web page. Welcome to the City of St. Louis County The median property tax in St. Louis MO 63103 Phone.

Source: en.wikipedia.org

Source: en.wikipedia.org

Late taxpayers are subject to fees penalties and a. The Saint Louis County Collector of Revenues office conducts its annual real estate property tax sale on the fourth Monday in August. We have staff available Monday - Friday from 800 AM - 500 PM to answer calls and emails regarding your real-estate tax needs. Continue to PayIt Login. City Hall 1200 Market Street Room 110 St.

Source: city-data.com

Source: city-data.com

City of St. Louis residential property tax records including land real property tax assessments appraisals tax payments exemptions improvements valuations deeds mortgages titles more. 2 days ago The median property tax in St. The official payment app of St. Louis residential properties are taxed at a rate of 19 commercial properties are charged 32 and agricultural properties are charged 12.

Source: stlouis-mo.gov

Source: stlouis-mo.gov

City real estate tax is separate from St. Louis City Hall 1200 Market Street Saint Louis MO 63103 314-622-4800 Contact Us Departments and Agencies Request Government Information. Welcome to the City of St. Louis residential properties are taxed at a rate of 19 commercial properties are charged 32 and agricultural properties are charged 12. 2 days ago The median property tax also known as real estate tax in St.

Source: lakeexpo.com

Source: lakeexpo.com

Welcome to the City of St.

Source: stlmag.com

Source: stlmag.com

Please contact us by calling 314 622-4105 or you can send e-mails to. After winning a bid for a property in a Tax Sale payment must be made in the full amount by 200PM on the date of the sale no exceptions. Louis city is 111900 per year based on a median home value of 12220000 and a median effective property tax rate of 092 of property value. Continue to PayIt Login. We have staff available Monday - Friday from 800 AM - 500 PM to answer calls and emails regarding your real-estate tax needs.

Source: stltoday.com

Source: stltoday.com

Charles County real estate tax and other annual assessments due. City real estate tax is due from all city property owners annually at December 31 st. 314 622-4413 Email Addresses Mon - Fri. Louis Missouri Collector of Revenues web page. City of St.

Source: forbes.com

Source: forbes.com

2 days ago The median property tax in St.

Source: stlouis-mo.gov

Source: stlouis-mo.gov

Monday - Friday 8 AM - 5 PM.

Source: realtor.com

Source: realtor.com

Yearly median tax in St. Louis you can quickly and easily pay taxes manage water payments and take care of citations. 314 622-4413 Email Addresses Mon - Fri. 2 days ago The median property tax also known as real estate tax in St. The responsibility of the Collector of Revenue is to collect real estate taxes personal property taxes earnings taxes.

Source: forbes.com

Source: forbes.com

We have staff available Monday - Friday from 800 AM - 500 PM to answer calls and emails regarding your real-estate tax needs. Louis County The median property tax in St. A list of available properties is published in late July. Louis delinquent real estate tax sale attorneys at TdD Attorneys at Law LLC will guide you through the process of purchasing a property through a Missouri county tax sale including the St. Please contact us by calling 314 622-4105 or you can send e-mails to.

Source: noradarealestate.com

Source: noradarealestate.com

314 622-4413 Email Addresses Mon - Fri. Louis delinquent real estate tax sale attorneys at TdD Attorneys at Law LLC will guide you through the process of purchasing a property through a Missouri county tax sale including the St. 314 622-4413 Email Addresses Mon - Fri. 2020 City of St Louis Property Tax Rate 6875 KB 2020 City of St Louis Merchants and Manufacturers Tax Rate 6262 KB 2020 City of St Louis Special Business District Tax Rates 68983 KB Historical Listing of Property Tax Rates for City of St. City real estate tax is separate from St.

Source: stlpartnership.com

Source: stlpartnership.com

Louis city is 111900 per year based on a median home value of 12220000 and a median effective property tax rate of 092 of property value. There is a clear and efficient process in place that allows the Collector of Revenue to collect 100 percent of all real estate taxes due to the City of St. Louis city is 111900 per year based on a median home value of 12220000 and a median effective property tax rate of 092 of property value. 41 South Central Avenue Clayton MO 63105. City of St.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title st louis city real estate tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.