Your St louis county tax assessor real estate images are available. St louis county tax assessor real estate are a topic that is being searched for and liked by netizens today. You can Get the St louis county tax assessor real estate files here. Download all royalty-free images.

If you’re looking for st louis county tax assessor real estate images information connected with to the st louis county tax assessor real estate interest, you have visit the ideal site. Our website frequently gives you hints for downloading the highest quality video and image content, please kindly search and locate more enlightening video articles and images that match your interests.

St Louis County Tax Assessor Real Estate. The St Louis County Assessors Office located in Clayton Missouri determines the value of all taxable property in St. Property valuation or assessment is conducted by the Assessors Office every two years. Property valuation or assessment is conducted by the Assessors Office every two years. Real Estate Tax Collector of Revenue City of St.

St Louis Mo March 28 2017 Stlrealestate News Though As A Whole St Louis Has Been Performing Incredibly W National Building Home Buying Real Estate News From au.pinterest.com

St Louis Mo March 28 2017 Stlrealestate News Though As A Whole St Louis Has Been Performing Incredibly W National Building Home Buying Real Estate News From au.pinterest.com

All Time 45 New Post Past 24 Hours Past Week Past month. Recently Searched Assessor st louis county real estate Real estate loan matrix bcc Bill justice real estate lexington Nj real estate broker requirements Indiana real. You can also call us at 314-615-7311 for your request. You can also call us at 314-615-7311 for your request. Louis County Missouri Government ready to serve. Custodian of Records Emergency Communications Emergency Management Municipal Court Prosecuting Attorney.

800 am - 500 pm Monday - Friday More Contact Info The Real Estate Records Section of the Assessors Office records the transfer of real property ownership when a property sells and is.

Real Property Appraisal Menu. Coldwell Banker Gundaker can help you find St. A list of available properties is published in late July. Louis Includes Merchants and Manufacturers and Special Business Districts Property Search by Address Street Address or Parcel. Real estate market forecast 2023 Craigslist clearwater homes for rent Jacksonville houses for rent Wiseman real estate listings gallipolis ohio. Louis County homes for sale rentals and open housesRefine your St.

Source: stlouiscountymn.gov

Source: stlouiscountymn.gov

Louis County Assessors Department is responsible for the equalization of property assessments throughout St. Louis County homes for sale rentals and open housesRefine your St. Custodian of Records Emergency Communications Emergency Management Municipal Court Prosecuting Attorney. LRA Neighborhood Standard Price List. Louis County MO Homes For Sale Real Estate.

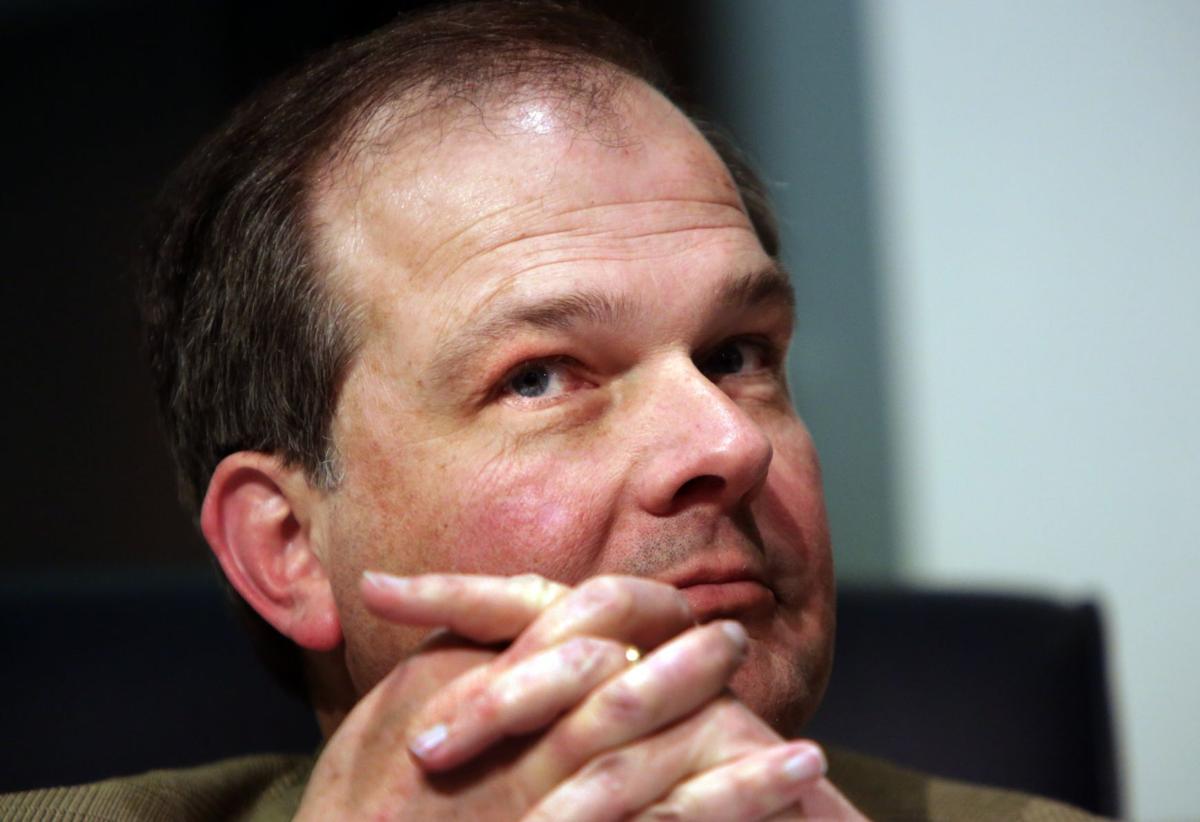

Source: news.stlpublicradio.org

Source: news.stlpublicradio.org

St Louis County Missouri Real Estate Tax Just Now Real Estate Tax Collector of Revenue City of St. Subject required Your name. Louis County homeowners can now look up the 2021 assessors preliminary value of their property on the countys website County Assessor Jake. 7 days ago The St Louis County Assessors Office located in Clayton Missouri determines the value of all taxable property in St. Current Tax Rates for City of St.

Source: stltoday.com

Source: stltoday.com

Houses 6 days ago In-depth St. Tax amount varies by county The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. 800 am - 500 pm Monday - Friday More Contact Info The Real Estate Records Section of the Assessors Office records the transfer of real property ownership when a property sells and is. The Saint Louis County Collector of Revenues office conducts its annual real estate property tax sale on the fourth Monday in August. Property valuation or assessment is conducted by the Assessors Office every two years.

Source: stlouiscountymn.gov

Source: stlouiscountymn.gov

Counties in Missouri collect an average of 091 of a propertys assesed fair market value as. St Louis County Missouri Real Estate Tax Just Now Real Estate Tax Collector of Revenue City of St. Current Tax Rates for City of St. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax. Louis County homeowners can now look up the 2021 assessors preliminary value of their property on the countys website County Assessor Jake.

Source: stlouiscountymo.gov

Source: stlouiscountymo.gov

It is the Assessors responsibility to ensure each property is equally and uniformly assessed. Louis County Missouri Government ready to serve. Sam Page thanks the community for working to stop the spread of coronavirus. Property valuation or assessment is conducted by the Assessors Office every two years. Property valuation or assessment is conducted by the Assessors Office every two years.

Source: stlouiscountymo.gov

Source: stlouiscountymo.gov

To reach the Assessors Office call 314 622-3212 The Real Estate Department collects taxes for each of the approximately 220000 parcels of property within city limits. Current Tax Rates for City of St. To reach the Assessors Office call 314 622-3212 The Real Estate Department collects taxes for each of the approximately 220000 parcels of property within city limits. A list of available properties is published in late July. Louis County homeowners can now look up the 2021 assessors preliminary value of their property on the countys website County Assessor Jake.

Source: realtor.com

Source: realtor.com

1200 Market St Room 114 Hours. To reach the Assessors Office call 314 622-3212 The Real Estate Department collects taxes for each of the approximately 220000 parcels of property within city limits. Houses 6 days ago In-depth St. The Saint Louis County Collector of Revenues office conducts its annual real estate property tax sale on the fourth Monday in August. For more information please.

Source: realtor.com

Source: realtor.com

Missouri Property Taxes By County. Property valuation or assessment is conducted by the Assessors Office every two years. View Department Menu Contact Info. The Saint Louis County Collector of Revenues office conducts its annual real estate property tax sale on the fourth Monday in August. You can also call us at 314-615-7311 for your request.

Source: stlouiscountymn.gov

Source: stlouiscountymn.gov

Louis County homeowners can now look up the 2021 assessors preliminary value of their property on the countys website County Assessor Jake. Real Estate Tax Personal Property Tax and Mobile Home Property Tax. All Time 45 New Post Past 24 Hours Past Week Past month. Louis County Missouri Government ready to serve. Custodian of Records Emergency Communications Emergency Management Municipal Court Prosecuting Attorney.

Source: stlouiscountymn.gov

Source: stlouiscountymn.gov

Real estate market forecast 2023 Craigslist clearwater homes for rent Jacksonville houses for rent Wiseman real estate listings gallipolis ohio. Credit Cards For all Tax Payments when credit cards are used customer will pay Official Payments a Service Fee of 250 of the payment amount for each Payment Transaction with a minimum Service Fee of 395 for the following payment types. The St Louis County Assessors Office located in Clayton Missouri determines the value of all taxable property in St. View Department Menu Contact Info. Deadlines and Dates.

Source: stlouiscountymo.gov

Source: stlouiscountymo.gov

Personal Property Real Property Appraisal Records and Mapping Documents and Forms About Contact Contact Information. Louis County including the City of Duluth. Counties in Missouri collect an average of 091 of a propertys assesed fair market value as. County Assessor County Auditor County Clerk County Council County Executive. A list of available properties is published in late July.

You can now request government services online through our 311 request portal. You can now request government services online through our 311 request portal. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax. Louis County homeowners can now look up the 2021 assessors preliminary value of their property on the countys website County Assessor Jake. Timely Uniform Fair The St.

Counties in Missouri collect an average of 091 of a propertys assesed fair market value as. Coldwell Banker Gundaker can help you find St. Tax amount varies by county The median property tax in Missouri is 126500 per year for a home worth the median value of 13970000. Custodian of Records Emergency Communications Emergency Management Municipal Court Prosecuting Attorney. LRA Neighborhood Standard Price List.

Source: realtor.com

Source: realtor.com

Louis County MO Property Tax Information. You can now request government services online through our 311 request portal. To reach the Assessors Office call 314 622-3212 The Real Estate Department collects taxes for each of the approximately 220000 parcels of property within city limits. County Assessor County Auditor County Clerk County Council County Executive. Louis County homeowners can now look up the 2021 assessors preliminary value of their property on the countys website County Assessor Jake.

Source: robergtaxsolutions.com

Source: robergtaxsolutions.com

You can also call us at 314-615-7311 for your request. Property assessments performed by the Assessor are used to determine. Custodian of Records Emergency Communications Emergency Management Municipal Court Prosecuting Attorney. Louis 1 days ago To reach the Assessors Office call 314 622-3212 The Real Estate Department collects taxes for each of the approximately 220000 parcels of property within city limits. Credit Cards For all Tax Payments when credit cards are used customer will pay Official Payments a Service Fee of 250 of the payment amount for each Payment Transaction with a minimum Service Fee of 395 for the following payment types.

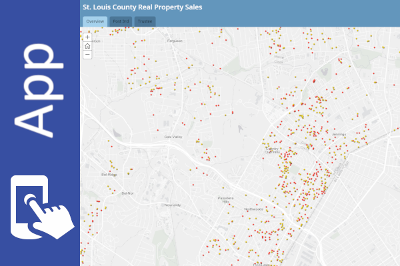

Source: data.stlouisco.com

Source: data.stlouisco.com

LRA Neighborhood Standard Price List. To reach the Assessors Office call 314 622-3212 The Real Estate Department collects taxes for each of the approximately 220000 parcels of property within city limits. St Louis County Missouri Real Estate Tax Just Now Real Estate Tax Collector of Revenue City of St. View Department Menu Contact Info. 800 am - 500 pm Monday - Friday More Contact Info The Real Estate Records Section of the Assessors Office records the transfer of real property ownership when a property sells and is.

Source: stlouiscountymo.gov

Source: stlouiscountymo.gov

To reach the Assessors Office call 314 622-3212 The Real Estate Department collects taxes for each of the approximately 220000 parcels of property within city limits. Current Tax Rates for City of St. 800 am - 500 pm Monday - Friday More Contact Info The Real Estate Records Section of the Assessors Office records the transfer of real property ownership when a property sells and is. Property valuation or assessment is conducted by the Assessors Office every two years. Louis County homes for sale rentals and open housesRefine your St.

Source: stlouiscountymo.gov

Source: stlouiscountymo.gov

County Assessor County Auditor County Clerk County Council County Executive. Personal Property Real Property Appraisal Records and Mapping Documents and Forms About Contact Contact Information. Real estate market forecast 2023 Craigslist clearwater homes for rent Jacksonville houses for rent Wiseman real estate listings gallipolis ohio. Louis County Missouri Government ready to serve. County Assessor County Auditor County Clerk County Council County Executive.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title st louis county tax assessor real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.