Your Stafford county real estate tax records images are available in this site. Stafford county real estate tax records are a topic that is being searched for and liked by netizens today. You can Find and Download the Stafford county real estate tax records files here. Download all free photos and vectors.

If you’re searching for stafford county real estate tax records images information related to the stafford county real estate tax records interest, you have pay a visit to the right site. Our site frequently gives you hints for refferencing the maximum quality video and image content, please kindly search and locate more enlightening video content and graphics that match your interests.

Stafford County Real Estate Tax Records. Use the myStafford Portal to search or pay Real Estate Taxes online Payments can be made. For tax purposes January 1 is considered tax day and will ultimately be used to determine your real property tax. These records can include Stafford County property tax assessments and assessment challenges appraisals and income taxes. 8 days ago Real Estate Taxes Stafford County VA.

Stafford County Va Recently Sold Homes Realtor Com From realtor.com

Stafford County Va Recently Sold Homes Realtor Com From realtor.com

Property taxes are determined at local levels being used for schools fire and police protection public parks and other benefits. Stafford County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Stafford County Virginia. We encourage citizens to visit our myStafford Customer Portal for account information to make a payment on Utility accounts Real Estate or Personal Property taxes or to purchase a lifetime Dog license. The Land Records Division of the Stafford County Circuit Court is located on the 1st floor of the Stafford County Judicial Center at 1300 Courthouse Road. The purpose of the assessment notice is to notify you what the value of your property was on January 1 2020. In Office or by Phone.

The purpose of the assessment notice is to notify you what the value of your property was on January 1 2020.

Enter your account number exactly as it appears on your tax bill including letters and dashes. In Office or by Phone. Using your banks online bill pay. These records can include Stafford County property tax assessments and assessment challenges appraisals and income taxes. Stafford County Real Estate SearchPayment To begin payment OR to view taxes paid please enter your full account number as it appears on your bill the Map Number or the Legal Street Address do not include the suffix eg. The 2015 tax rate was 2247 per hundred.

Source: realtor.com

Source: realtor.com

Stafford County Public Records are any documents that are available for public inspection and retrieval in Stafford County VA. In Office or by Phone. Enter your account number exactly as it appears on your tax bill including letters and dashes. The Commissioners office is charged with obtaining from the Clerk of Court deed transfers deeds of. The 2016 tax rate was 2329 per hundred.

Source: realtor.com

Source: realtor.com

Thank you for your interest in Stafford Countys 2021 assessment. Many Public Records are available at local Stafford County Clerks Recorders and Assessors Offices. They are maintained by various government offices in Stafford County Virginia State and at the Federal level. Certain types of Tax Records are available to the general public while some Tax Records are only. The Land Records Division of the Stafford County Circuit Court is located on the 1st floor of the Stafford County Judicial Center at 1300 Courthouse Road.

Payments can be made. These records can include Stafford County property tax assessments and assessment challenges appraisals and income taxes. Enter your account number exactly as it appears on your tax bill including letters and dashes. 8 days ago Real Estate Taxes Stafford County VA. VA-STAFFORD-Assessor Property Search.

Source: realtor.com

Source: realtor.com

Search View and Pay Taxes Treasurer agents are available to assist citizens through Live Chat email or by phone on 540 658-8700 Monday - Friday between the hours of 900am - 300pm. These records can include Stafford County property tax assessments and assessment challenges appraisals and income taxes. Stafford County Public Records are any documents that are available for public inspection and retrieval in Stafford County VA. Stafford County Real Estate Tax Records. They are a valuable tool for the real estate.

Source: slideshare.net

Source: slideshare.net

Stafford County Real Estate SearchPayment To begin payment OR to view taxes paid please enter your full account number as it appears on your bill the Map Number or the Legal Street Address do not include the suffix eg. For example if your map number appears on the notice as 65W 1 14 please enter 65W114 in the Property Lookup Search box below. The Virginia Tax Code represents the main legal document regarding taxation. Stafford County Property Records are real estate documents that contain information related to real property in Stafford County Virginia. Stafford VA 22555-0098 Map Ph.

Source: wjla.com

Source: wjla.com

VA-STAFFORD-Assessor Property Search. Please enter the map number without any spaces. 540 658-4132 Hours Monday - Friday 800 am - 430 pm. The 2015 tax rate was 2247 per hundred. Online using the myStafford Portal.

Source: realtor.com

Source: realtor.com

Use the myStafford Portal to search or pay Real Estate Taxes online. Stafford County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Stafford County Kansas. The search function works best if you use the Tax Map Number located on your reassessment notice. Many Public Records are available at local Stafford County Clerks Recorders and Assessors Offices. Enter your account number exactly as it appears on your tax bill including letters and dashes.

The search function works best if you use the Tax Map Number located on your reassessment notice. In Office or by Phone. They are maintained by various government offices in Stafford County Virginia State and at the Federal level. The search function works best if you use the Tax Map Number located on your reassessment notice. For example if your map number appears on the notice as 65W 1 14 please enter 65W114 in the Property Lookup Search box below.

The purpose of the assessment notice is to notify you what the value of your property was on January 1 2020. 8 days ago Real Estate Taxes Stafford County VA. The Virginia Tax Code represents the main legal document regarding taxation. They are maintained by various government offices in Stafford County Virginia State and at the Federal level. Real Estate The Real Estate Division of the Commissioners office is responsible for maintaining all real property records for the purpose of assessment and taxation.

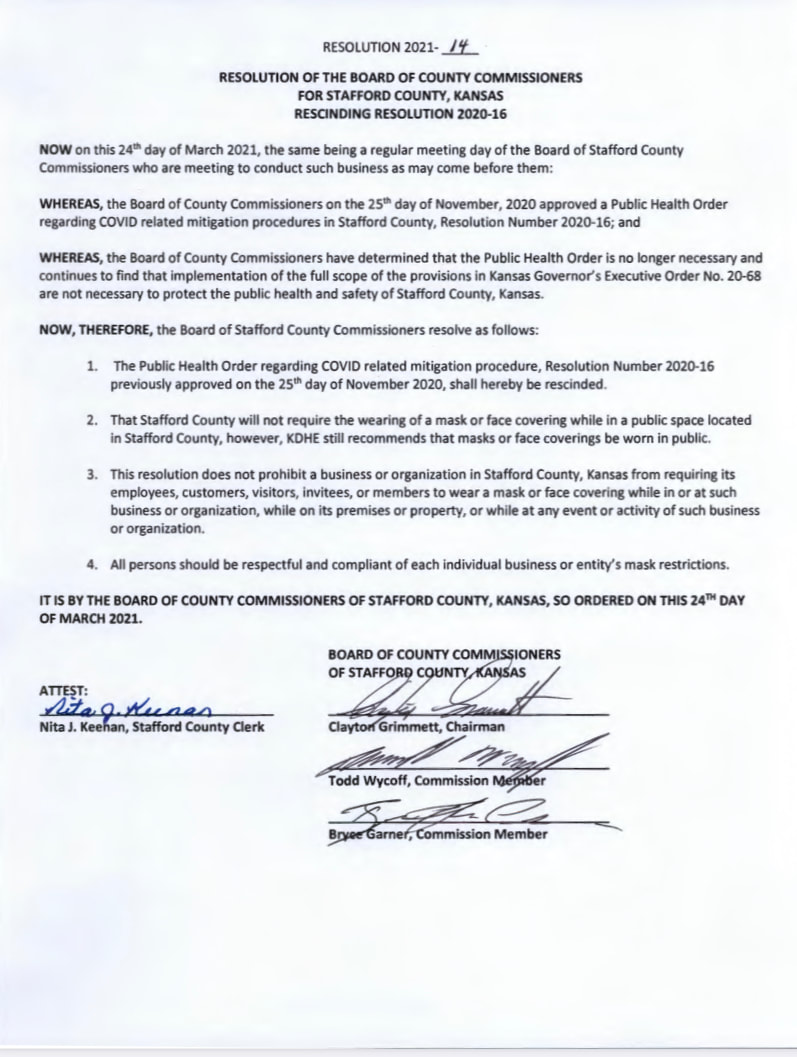

Source: kshs.org

Source: kshs.org

Search View and Pay Taxes Treasurer agents are available to assist citizens through Live Chat email or by phone on 540 658-8700 Monday - Friday between the hours of 900am - 300pm. The 2018 tax rate was 2278 per hundred. For tax purposes January 1 is considered tax day and will ultimately be used to determine your real property tax. Using your banks online bill pay. Certain types of Tax Records are available to the general public while some Tax Records are only.

Source: realtor.com

Source: realtor.com

Enter your account number exactly as it appears on your tax bill including letters and dashes. Using your banks online bill pay. Use the myStafford Portal to search or pay Real Estate Taxes online. Online using the myStafford Portal. Please enter the map number without any spaces.

Source: kshs.org

Source: kshs.org

Thank you for your interest in Stafford Countys 2021 assessment. Using your banks online bill pay. The search function works best if you use the Tax Map Number located on your reassessment notice. Checks should be made payable to Township of Stafford-Taxes. Stafford County Property Records are real estate documents that contain information related to real property in Stafford County Kansas.

Source: realtor.com

Source: realtor.com

The 2016 tax rate was 2329 per hundred. 540 658-4132 Hours Monday - Friday 800 am - 430 pm. Use the myStafford Portal to search or pay Real Estate Taxes online. In Office or by Phone. If you are paying through your bank online include your BlockLotQual number as your.

Source: slideshare.net

Source: slideshare.net

Houses 1 days ago The Real Estate Division of the Commissioners office is responsible for maintaining all real property records for the purpose of assessment and taxation. Use the myStafford Portal to search or pay Real Estate Taxes online Payments can be made. Stafford County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Stafford County Kansas. Payment Drop box located to the left. VA-STAFFORD-Assessor Property Search.

Source: slideshare.net

Source: slideshare.net

The Virginia Tax Code represents the main legal document regarding taxation. Stafford VA 22555-0098 Map Ph. The purpose of the assessment notice is to notify you what the value of your property was on January 1 2020. They are a valuable tool for the real estate. Houses 26 days ago Real Estate Stafford County VA - Official Website.

Source: staffordcounty.org

Source: staffordcounty.org

Property taxes are determined at local levels being used for schools fire and police protection public parks and other benefits. We encourage citizens to visit our myStafford Customer Portal for account information to make a payment on Utility accounts Real Estate or Personal Property taxes or to purchase a lifetime Dog license. Houses 26 days ago Real Estate Stafford County VA - Official Website. Search View and Pay Taxes Treasurer agents are available to assist citizens through Live Chat email or by phone on 540 658-8700 Monday - Friday between the hours of 900am - 300pm. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

The Land Records Division of the Stafford County Circuit Court is located on the 1st floor of the Stafford County Judicial Center at 1300 Courthouse Road. Checks should be made payable to Township of Stafford-Taxes. 8 days ago Real Estate Taxes Stafford County VA. SEE Detailed property tax report for 315 Heflin Rd Stafford County VA. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Source: realtor.com

Source: realtor.com

The search function works best if you use the Tax Map Number located on your reassessment notice. Stafford VA 22555-0098 Map Ph. Please enter the map number without any spaces. The 2016 tax rate was 2329 per hundred. Checks should be made payable to Township of Stafford-Taxes.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title stafford county real estate tax records by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.