Your Washington dc real estate tax rate images are available in this site. Washington dc real estate tax rate are a topic that is being searched for and liked by netizens today. You can Get the Washington dc real estate tax rate files here. Find and Download all royalty-free vectors.

If you’re searching for washington dc real estate tax rate pictures information related to the washington dc real estate tax rate interest, you have visit the right blog. Our website always provides you with hints for refferencing the highest quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

Washington Dc Real Estate Tax Rate. Counties in Washington collect an average of 092 of a propertys assesed fair market value as property tax per year. The estate tax in Washington applies to estates worth 2193 million and up. In Washington DC the average effective property tax rate is 056. For residential properties under 400000 the rate is.

2339 Massachusetts Ave Nw Unit 4 Washington Dc 20008 Realtor Com From realtor.com

2339 Massachusetts Ave Nw Unit 4 Washington Dc 20008 Realtor Com From realtor.com

Estate tax rates in Washington state are progressive and range from 10 to 20. Homeowners in the nations capital pay some of the lowest property tax rates in the country. Deed taxes are imposed on the recording or transfer of deeds on all DC real estate. In Washington DC the average effective property tax rate is 056. For homeowners the tax burden ranges from percent 47 2347 at the. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds.

Requires only 7 inputs into a simple Excel spreadsheet.

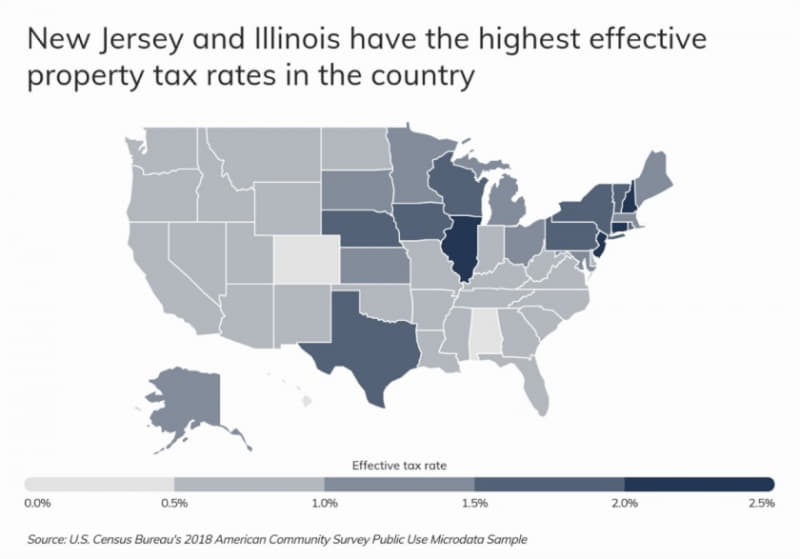

Counties in Washington collect an average of 092 of a propertys assesed fair market value as property tax per year. All real and personal property in Washington is subject to property tax based on 100 percent of its true and fair market value unless the law provides a specific exemption. The current rate for these taxes stands at 11 percent of fair market value for residential property transfers below 400000 and 145 percent for. Not in District of Columbia. Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country. For deaths in 2021 Estates with a total value of more than 4 million may be subject to the District of Columbia estate tax which is separate and in addition to the federal estate tax.

Source: realtor.com

Source: realtor.com

The estate tax in Washington applies to estates worth 2193 million and up. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. Not in District of Columbia. For homeowners the tax burden ranges from percent 47 2347 at the. These tax amounts are calculated based on the purchase price of the home.

Source: aarp.org

Source: aarp.org

092 of home value Tax amount varies by county The median property tax in Washington is 263100 per year for a home worth the median value of 28720000. Real Property Tax The real property tax burden for District of Columbia residents fall. Deed taxes are imposed on the recording or transfer of deeds on all DC real estate. After one month from the date of sale a penalty of 5 of the amount of the tax due. After two months from the date of sale an additional penalty of 5 of the tax due total of ten percent.

Source: taxfoundation.org

Source: taxfoundation.org

S below the areawide averages for homeowners at all incom- e levels. Counties in Washington collect an average of 092 of a propertys assesed fair market value as property tax per year. The estate tax in Washington applies to estates worth 2193 million and up. The current rate for these taxes stands at 11 percent of fair market value for residential property transfers below 400000 and 145 percent for. Currently the law imposes a uniform state tax rate of 128 of the value of real property triggered by either 1 the sale of real property or 2 the transfer of a controlling interest 50 or more in an entity that owns Washington real property.

Source: taxfoundation.org

Source: taxfoundation.org

The estate tax in Washington applies to estates worth 2193 million and up. Homeowners in the nations capital pay some of the lowest property tax rates in the country. Currently the law imposes a uniform state tax rate of 128 of the value of real property triggered by either 1 the sale of real property or 2 the transfer of a controlling interest 50 or more in an entity that owns Washington real property. The current rate for these taxes stands at 11 percent of fair market value for residential property transfers below 400000 and 145 percent for. Counties in Washington collect an average of 092 of a propertys assesed fair market value as property tax per year.

Source: baltimore.citybizlist.com

Source: baltimore.citybizlist.com

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. S below the areawide averages for homeowners at all incom- e levels. Delinquent penalty is due if the tax is not paid timely as noted above. 5 The DC Deed Tax on security instruments secured by commercial or mixed-use real property is increased from 145 to 25. The District of Columbias sales tax is imposed on all sales of tangible property as well as on certain services.

Source: equitablegrowth.org

Source: equitablegrowth.org

After two months from the date of sale an additional penalty of 5 of the tax due total of ten percent. S below the areawide averages for homeowners at all incom- e levels. For deaths in 2021 Estates with a total value of more than 4 million may be subject to the District of Columbia estate tax which is separate and in addition to the federal estate tax. All real and personal property in Washington is subject to property tax based on 100 percent of its true and fair market value unless the law provides a specific exemption. Washington DC recently lowered the district sales tax by a quarter of a percent from 6 to 575.

Source: taxfoundation.org

Source: taxfoundation.org

Delinquent penalty is due if the tax is not paid timely as noted above. Homeowners in the nations capital pay some of the lowest property tax rates in the country. DCs exemption of 4 million will rise each year with inflation however it is markedly lower than the federal estate tax exemption amount. 092 of home value Tax amount varies by county The median property tax in Washington is 263100 per year for a home worth the median value of 28720000. S below the areawide averages for homeowners at all incom- e levels.

Source: washingtonpost.com

Source: washingtonpost.com

For homeowners the tax burden ranges from percent 47 2347 at the. Estate tax rates in Washington state are progressive and range from 10 to 20. Market value of property compared to statewide rate. S below the areawide averages for homeowners at all incom- e levels. 092 of home value Tax amount varies by county The median property tax in Washington is 263100 per year for a home worth the median value of 28720000.

Source: otr.cfo.dc.gov

Source: otr.cfo.dc.gov

Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. The current rate for these taxes stands at 11 percent of fair market value for residential property transfers below 400000 and 145 percent for. Estate tax rates in Washington state are progressive and range from 10 to 20. Requires only 7 inputs into a simple Excel spreadsheet. For example while the state of Washingtons citizens dont pay income tax they still end up spending over 8 of their annual income on sales and excise taxes.

Source: smartasset.com

Source: smartasset.com

Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country. The current rate for these taxes stands at 11 percent of fair market value for residential property transfers below 400000 and 145 percent for. Current Tax Rate s 11 of consideration or fair market value for residential property transfers less than 400000 and 145 of consideration or fair market value on the entire amount if transfer is greater than 400000. Beginning January 1 2020 the state rate will be imposed at different tiers as follows. The estate tax in Washington applies to estates worth 2193 million and up.

Source: smartasset.com

Source: smartasset.com

1101 4th Street SW Suite 270 West Washington DC 20024 Phone. After two months from the date of sale an additional penalty of 5 of the tax due total of ten percent. Homeowners in the nations capital pay some of the lowest property tax rates in the country. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. Your annual tax is 4250 before the homestead deduction senior citizen tax relief andor trash credits.

Source: lipseyandassociates.com

Source: lipseyandassociates.com

However the median real estate property tax payment is 3647 which is higher than the national average. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Real Property Tax The real property tax burden for District of Columbia residents fall. The current rate for these taxes stands at 11 percent of fair market value for residential property transfers below 400000 and 145 percent for. Estate tax rates in Washington state are progressive and range from 10 to 20.

Source: itep.org

Source: itep.org

In Washington DC the average effective property tax rate is 056. For residential properties under 400000 the rate is. In Washington DC the average effective property tax rate is 056. S below the areawide averages for homeowners at all incom- e levels. Currently the law imposes a uniform state tax rate of 128 of the value of real property triggered by either 1 the sale of real property or 2 the transfer of a controlling interest 50 or more in an entity that owns Washington real property.

Source: baltimore.citybizlist.com

Source: baltimore.citybizlist.com

The estate tax in Washington applies to estates worth 2193 million and up. If youre a Washington resident and youre starting to think about. Part of the rate 035 of the rate does not apply to instruments recorded for residential real property with consideration less than 400000. After two months from the date of sale an additional penalty of 5 of the tax due total of ten percent. All real and personal property in Washington is subject to property tax based on 100 percent of its true and fair market value unless the law provides a specific exemption.

Source: taxfoundation.org

Source: taxfoundation.org

For homeowners the tax burden ranges from percent 47 2347 at the. These tax amounts are calculated based on the purchase price of the home. Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. The current rate for these taxes stands at 11 percent of fair market value for residential property transfers below 400000 and 145 percent for. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021.

Source: bungalow.com

Source: bungalow.com

If your commercial property is classified as Class 2 and your property is assessed at a total value of 5000000 or less your tax rate is 165. The current rate for these taxes stands at 11 percent of fair market value for residential property transfers below 400000 and 145 percent for. For deaths in 2021 Estates with a total value of more than 4 million may be subject to the District of Columbia estate tax which is separate and in addition to the federal estate tax. The District of Columbias sales tax is imposed on all sales of tangible property as well as on certain services. Part of the rate 035 of the rate does not apply to instruments recorded for residential real property with consideration less than 400000.

Source: realtor.com

Source: realtor.com

In Washington DC the average effective property tax rate is 056. 5 The DC Deed Tax on security instruments secured by commercial or mixed-use real property is increased from 145 to 25. For residential properties under 400000 the rate is. These tax amounts are calculated based on the purchase price of the home. Part of the rate 035 of the rate does not apply to instruments recorded for residential real property with consideration less than 400000.

Source: realtor.com

Source: realtor.com

If youre a Washington resident and youre starting to think about. Requires only 7 inputs into a simple Excel spreadsheet. If the sale is 399999 or less then the DC transfer and recordation tax rate is 11. S below the areawide averages for homeowners at all incom- e levels. Current Tax Rate s 11 of consideration or fair market value for residential property transfers less than 400000 and 145 of consideration or fair market value on the entire amount if transfer is greater than 400000.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title washington dc real estate tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.