Your What does respa mean in real estate images are available. What does respa mean in real estate are a topic that is being searched for and liked by netizens today. You can Get the What does respa mean in real estate files here. Download all free images.

If you’re looking for what does respa mean in real estate pictures information connected with to the what does respa mean in real estate interest, you have pay a visit to the right blog. Our website frequently gives you hints for downloading the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

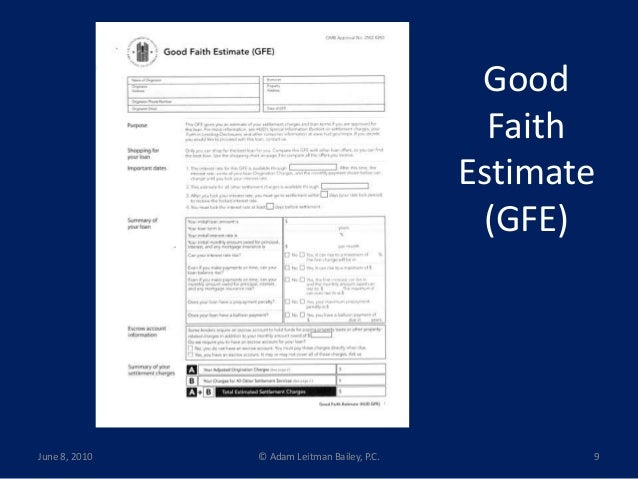

What Does Respa Mean In Real Estate. 1 Disclosures regarding nature and costs in the real estate settlement process by delivery of a statutory form commonly known as the HUD-1 2 Prohibiting kickbacks in the settlement of real estate transactions. Servicer means a person responsible for the servicing of a federally related mortgage loan including the person who makes or holds such loan if such person also services the loan. The term does not include. Resources to help industry participants understand implement and comply with the Real Estate Settlement Procedures Act RESPA and Regulation X.

Trid Tila Respa Integrated Disclosure Mls Mortgage Real Estate Agent Branding Real Estate Tips Mortgage Advice From fr.pinterest.com

Trid Tila Respa Integrated Disclosure Mls Mortgage Real Estate Agent Branding Real Estate Tips Mortgage Advice From fr.pinterest.com

The Real Estate Settlement Procedures Act RESPA provides consumers with improved disclosures of settlement costs and to reduce the costs of closing by the elimination of referral fees and kickbacks. Protections For Home Buyers Against Caveat Emptor Transactions. RESPA was signed into law in December 1974 and became effective on June 20 1975. 1 the consumers name 2 the consumers income 3 the consumers Social Security number to obtain a credit report or other unique identifier if the consumer has no Social Security number 4 the property address 5 an estimate of the. When deciding to buy or build a home anywhere in the US. Regulation Z protects consumers from misleading practices by the credit industry and provides them with reliable information about the costs of credit.

Likewise what is covered by Regulation Z.

Senior Vice President of Compliance Sheila Strong. Likewise what is covered by Regulation Z. RESPA the Real Estate Settlement Procedures Act regulates the disclosure of costs and affiliated business arrangements or AfBAs in a real estate settlement transaction. The Real Estate Settlement Procedures Act a federal consumer protection statute first enacted in 1974. Watch the videos below with the AmeriFirst Financial Corp. The purpose of RESPA is to govern real estate settlement processes.

Source: pinterest.com

Source: pinterest.com

The purpose of RESPA is to govern real estate settlement processes. 1 Disclosures regarding nature and costs in the real estate settlement process by delivery of a statutory form commonly known as the HUD-1 2 Prohibiting kickbacks in the settlement of real estate transactions. The purpose of RESPA is to govern real estate settlement processes. Senior Vice President of Compliance Sheila Strong. By using the lenders for their regulation Congress was able to bypass a myriad of state laws and differing statutes relating to real estate transactions across the country.

Source: quickenloans.com

Source: quickenloans.com

Real Estate Settlement Procedures Act is one option – get in to view more The Webs largest and most authoritative acronyms and abbreviations resource. Real estate settlement procedures act View all real estate house for rent homes for sales sell house Real Estate Settlement Procedures Act RESPA Consumer Real Estate Details. Good mortgage lenders are key in the home buying or building process especially under the Real Estate Settlement Procedures Act RESPA. RESPA was also introduced to eliminate. The most common protection for homebuyers is the Closing Disclosure.

Source: landmarkabstract.com

Source: landmarkabstract.com

TILA is the Truth in Lending Act and RESPA is the Real Estate Settlement Procedures Act. Regulation Z protects consumers from misleading practices by the credit industry and provides them with reliable information about the costs of credit. RESPA was designed to protect home purchasers and owners shopping for settlement services by mandating certain disclosures and prohibiting referral fees and kickbacks. Good mortgage lenders are key in the home buying or building process especially under the Real Estate Settlement Procedures Act RESPA. Servicer means a person responsible for the servicing of a federally related mortgage loan including the person who makes or holds such loan if such person also services the loan.

Source: fr.pinterest.com

Source: fr.pinterest.com

The Real Estate Settlement Procedures Act RESPA provides consumers with improved disclosures of settlement costs and to reduce the costs of closing by the elimination of referral fees and kickbacks. RESPA was also introduced to eliminate. A Closing Disclosure is a legal document where the seller lists known damage defects repairs and concerns with the home. Based on the new regulations that went into effect in October 2015 your mortgage lender will be one of the most important people on your team. TILA is the Truth in Lending Act and RESPA is the Real Estate Settlement Procedures Act.

Source: massrealestatelawblog.com

Source: massrealestatelawblog.com

Referral fees in the real estate business are fees charged by one agent or broker to another for a client referred. TILA stands for Truth in Lending Act and RESPA stands for the Real Estate Settlement Procedures Act. The term does not include. The Real Estate Settlement Procedures Act RESPA was enacted by Congress in 1975 to provide homebuyers and sellers with complete settlement cost disclosures. 24 days ago 2 days ago RESPA means the Real Estate Settlement Procedures Act of 1974 12 USC.

Source: vivaescrow.com

Source: vivaescrow.com

RESPA the Real Estate Settlement Procedures Act regulates the disclosure of costs and affiliated business arrangements or AfBAs in a real estate settlement transaction. The Real Estate Settlement Procedures Act RESPA was enacted by Congress in 1975 to provide homebuyers and sellers with complete settlement cost disclosures. Real Estate Settlement Procedures Act is one option – get in to view more The Webs largest and most authoritative acronyms and abbreviations resource. Servicer means a person responsible for the servicing of a federally related mortgage loan including the person who makes or holds such loan if such person also services the loan. TILA stands for Truth in Lending Act and RESPA stands for the Real Estate Settlement Procedures Act.

Source: thelendersnetwork.com

Source: thelendersnetwork.com

A Closing Disclosure is a legal document where the seller lists known damage defects repairs and concerns with the home. The most common protection for homebuyers is the Closing Disclosure. 24 days ago 2 days ago RESPA means the Real Estate Settlement Procedures Act of 1974 12 USC. An application is defined as the submission of six pieces of information. 1 Disclosures regarding nature and costs in the real estate settlement process by delivery of a statutory form commonly known as the HUD-1 2 Prohibiting kickbacks in the settlement of real estate transactions.

Source: br.pinterest.com

Source: br.pinterest.com

What Does Respa Mean In Real Estate. What Does Respa Mean In Real Estate. They are most common when a seller client is leaving the area and their agent refers them to an agent or broker in the new area to which theyre moving. The purpose of RESPA is to govern real estate settlement processes. RESPA the Real Estate Settlement Procedures Act regulates the disclosure of costs and affiliated business arrangements or AfBAs in a real estate settlement transaction.

Source: slideshare.net

Source: slideshare.net

That still doesnt answer your question does it. Different disclosure rules kick in at. TILA stands for Truth in Lending Act and RESPA stands for the Real Estate Settlement Procedures Act. Senior Vice President of Compliance Sheila Strong. 1 the consumers name 2 the consumers income 3 the consumers Social Security number to obtain a credit report or other unique identifier if the consumer has no Social Security number 4 the property address 5 an estimate of the.

Source: texasfivestarrealty.com

Source: texasfivestarrealty.com

Good mortgage lenders are key in the home buying or building process especially under the Real Estate Settlement Procedures Act RESPA. The CFPB modified both rules in its TRID final ruling. The term does not include. A Closing Disclosure is a legal document where the seller lists known damage defects repairs and concerns with the home. RESPA was designed to protect home purchasers and owners shopping for settlement services by mandating certain disclosures and prohibiting referral fees and kickbacks.

Source: acronymsandslang.com

Source: acronymsandslang.com

1 Disclosures regarding nature and costs in the real estate settlement process by delivery of a statutory form commonly known as the HUD-1 2 Prohibiting kickbacks in the settlement of real estate transactions. RESPA the Real Estate Settlement Procedures Act regulates the disclosure of costs and affiliated business arrangements or AfBAs in a real estate settlement transaction. The term does not include. RESPA was signed into law in December 1974 and became effective on June 20 1975. Likewise what is covered by Regulation Z.

Source: pinterest.com

Source: pinterest.com

RESPA was designed to protect home purchasers and owners shopping for settlement services by mandating certain disclosures and prohibiting referral fees and kickbacks. The CFPB modified both rules in its TRID final ruling. 1 Disclosures regarding nature and costs in the real estate settlement process by delivery of a statutory form commonly known as the HUD-1 2 Prohibiting kickbacks in the settlement of real estate transactions. They are most common when a seller client is leaving the area and their agent refers them to an agent or broker in the new area to which theyre moving. What Does Respa Mean In Real Estate.

Source: patch.com

Source: patch.com

They are most common when a seller client is leaving the area and their agent refers them to an agent or broker in the new area to which theyre moving. 1 the consumers name 2 the consumers income 3 the consumers Social Security number to obtain a credit report or other unique identifier if the consumer has no Social Security number 4 the property address 5 an estimate of the. Real Estate Settlement Procedures Act is one option – get in to view more The Webs largest and most authoritative acronyms and abbreviations resource. Watch the videos below with the AmeriFirst Financial Corp. They are most common when a seller client is leaving the area and their agent refers them to an agent or broker in the new area to which theyre moving.

Source: metfund.com

Source: metfund.com

The purpose of RESPA is to govern real estate settlement processes. The Real Estate Settlement Procedures Act a federal consumer protection statute first enacted in 1974. RESPA was designed to protect home purchasers and owners shopping for settlement services by mandating certain disclosures and prohibiting referral fees and kickbacks. By using the lenders for their regulation Congress was able to bypass a myriad of state laws and differing statutes relating to real estate transactions across the country. Regulation Z protects consumers from misleading practices by the credit industry and provides them with reliable information about the costs of credit.

Source: pinterest.com

Source: pinterest.com

1 Disclosures regarding nature and costs in the real estate settlement process by delivery of a statutory form commonly known as the HUD-1 2 Prohibiting kickbacks in the settlement of real estate transactions. RESPA was also introduced to eliminate. A Closing Disclosure is a legal document where the seller lists known damage defects repairs and concerns with the home. Featured topic On Oct. TRID refers to the new integrated disclosures for real estate transactions.

Source: kapre.com

Source: kapre.com

Real Estate Settlement Procedures Act is one option – get in to view more The Webs largest and most authoritative acronyms and abbreviations resource. TILA is the Truth in Lending Act and RESPA is the Real Estate Settlement Procedures Act. RESPA is a law which requires full disclosure of settlement costs. 1 the consumers name 2 the consumers income 3 the consumers Social Security number to obtain a credit report or other unique identifier if the consumer has no Social Security number 4 the property address 5 an estimate of the. The Real Estate Settlement Procedures Act a federal consumer protection statute first enacted in 1974.

Source: slideshare.net

Source: slideshare.net

TILA stands for Truth in Lending Act and RESPA stands for the Real Estate Settlement Procedures Act. RESPA was signed into law in December 1974 and became effective on June 20 1975. By using the lenders for their regulation Congress was able to bypass a myriad of state laws and differing statutes relating to real estate transactions across the country. TILA stands for Truth in Lending Act and RESPA stands for the Real Estate Settlement Procedures Act. TILA is the Truth in Lending Act and RESPA is the Real Estate Settlement Procedures Act.

Source: gr.pinterest.com

Source: gr.pinterest.com

So what is TRID. Good mortgage lenders are key in the home buying or building process especially under the Real Estate Settlement Procedures Act RESPA. The Real Estate Settlement Procedures Act a federal consumer protection statute first enacted in 1974. So what is TRID. Real estate settlement procedures act View all real estate house for rent homes for sales sell house Real Estate Settlement Procedures Act RESPA Consumer Real Estate Details.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what does respa mean in real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.