Your What is a w9 used for in real estate images are available. What is a w9 used for in real estate are a topic that is being searched for and liked by netizens today. You can Download the What is a w9 used for in real estate files here. Download all free vectors.

If you’re searching for what is a w9 used for in real estate pictures information linked to the what is a w9 used for in real estate interest, you have pay a visit to the right site. Our site always provides you with suggestions for seeing the maximum quality video and image content, please kindly surf and locate more informative video content and graphics that fit your interests.

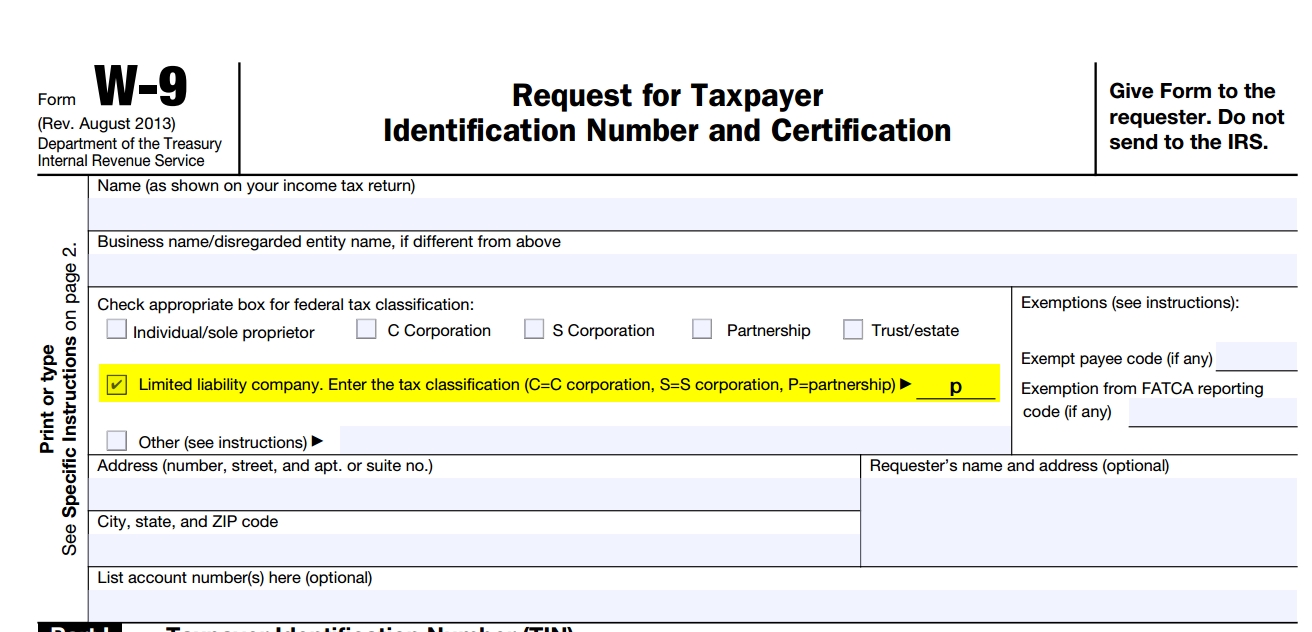

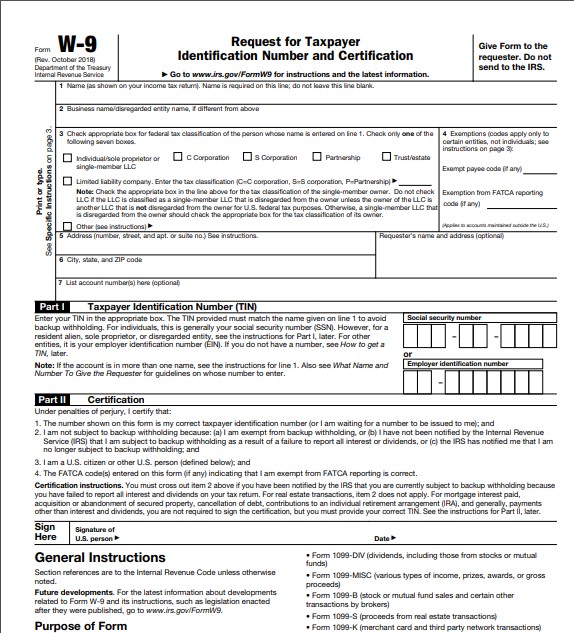

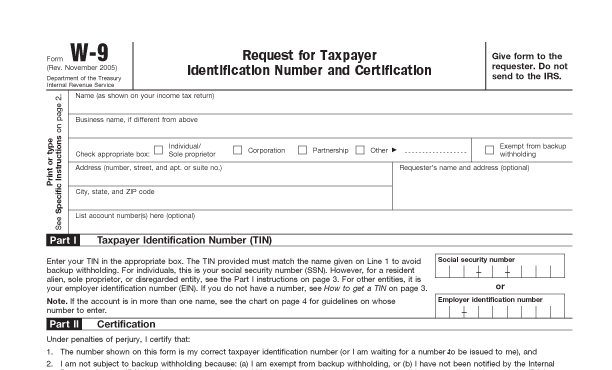

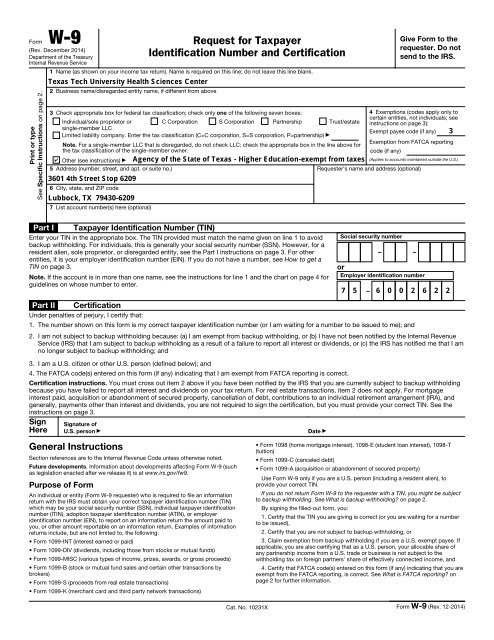

What Is A W9 Used For In Real Estate. Thanks to QuickBooks Payroll for sponsoring this post. Trustestate Limited liability company. As a landlord royalties paid to you as a copyright owner etc. I find it humorous that many people ask for.

Let S Do W 9s And 1099 S Better In 2019 Berkshirerealtors From berkshirerealtors.net

Let S Do W 9s And 1099 S Better In 2019 Berkshirerealtors From berkshirerealtors.net

I find it humorous that many people ask for. It is good to have a working understanding of the terms often used in the industry. These include real estate transfer documents home loan documents and. A life estate provides that the life tenant and the remainderman hold joint ownership of the property but the remainderman has no right to possess it as long as the life tenant is alive. 10-2018 Page 2 By signing the filled-out form you. Buying a new home is exciting but the owner will need to prepare several documents before closing.

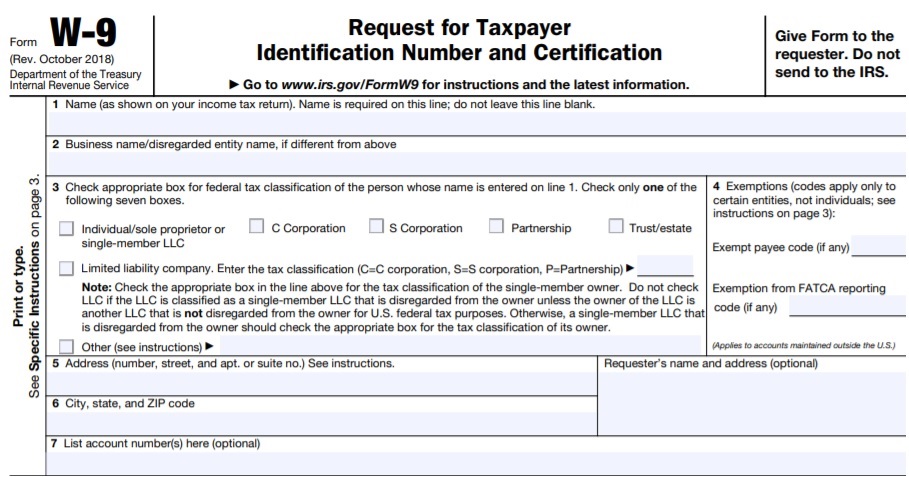

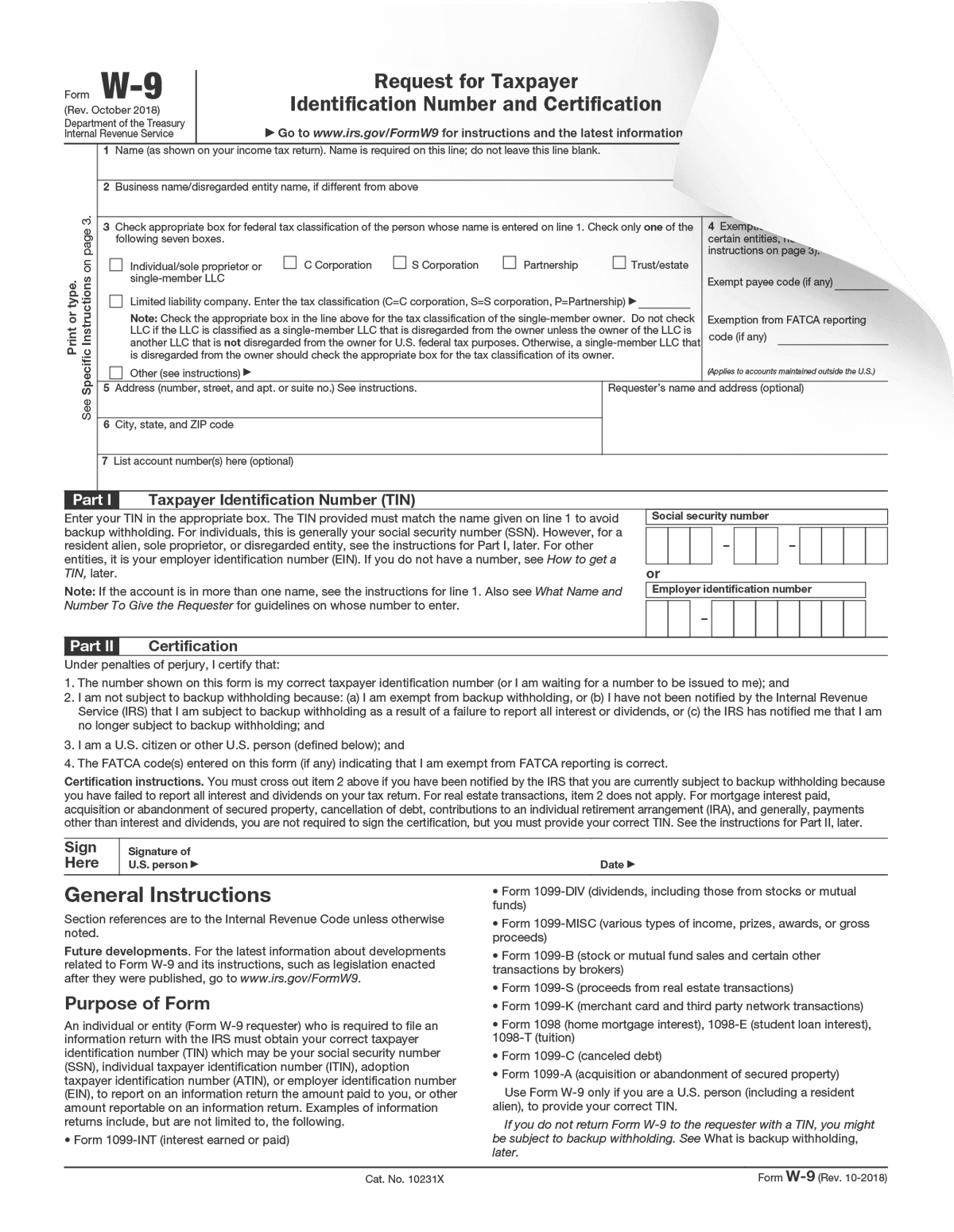

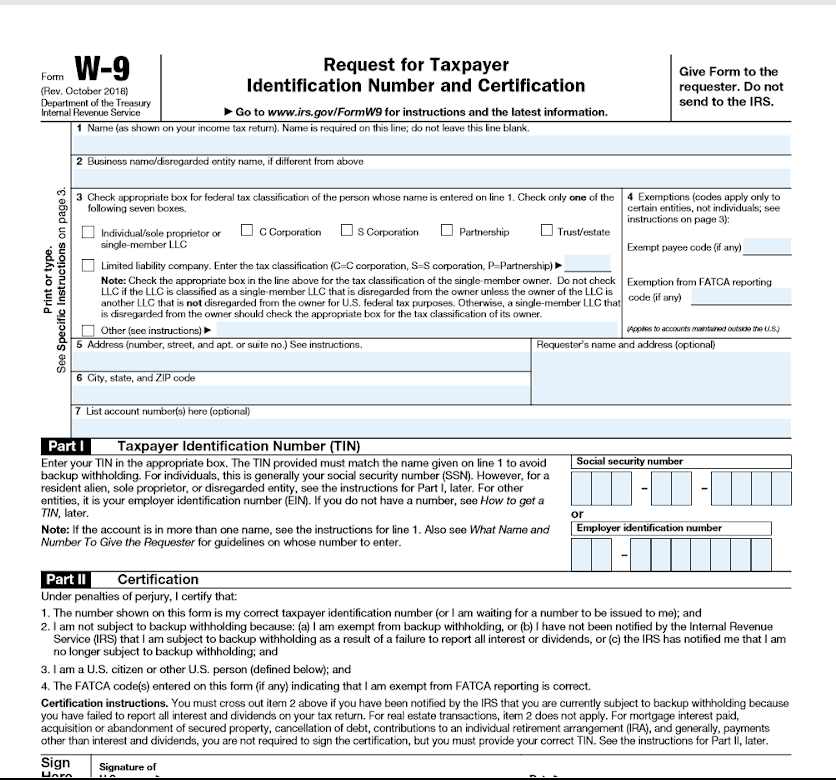

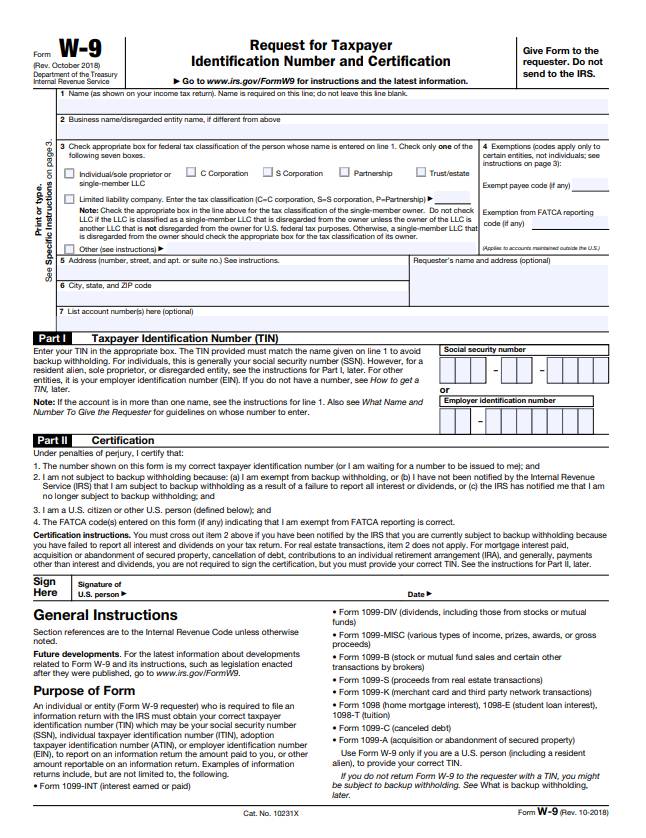

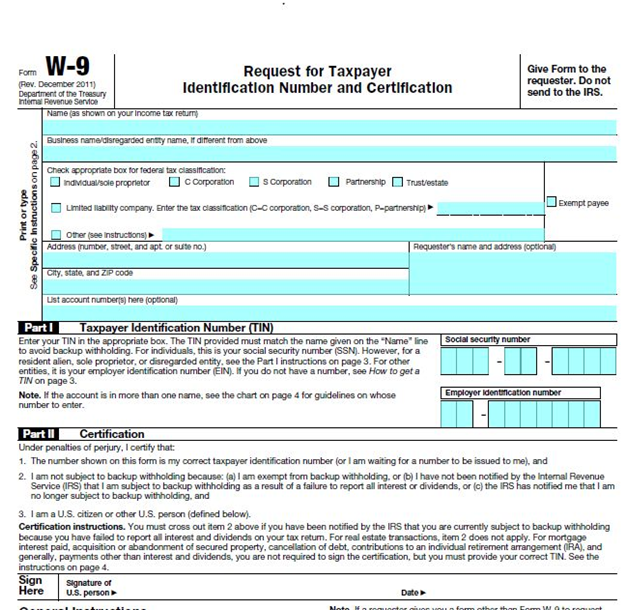

Use Form W-9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example.

Download a blank W9 from the official IRS website or get it from an institution responsible for providing it. What happens if Im asked to complete Form W9 and Im not a. I sold an ad for 30. If they were not used the ads for a home could get quite lengthy. This part will also ask you how youre. I like the down and dirty snippets of the meaning of various commercial real estate terms.

Source: w9-forms-printable.com

Source: w9-forms-printable.com

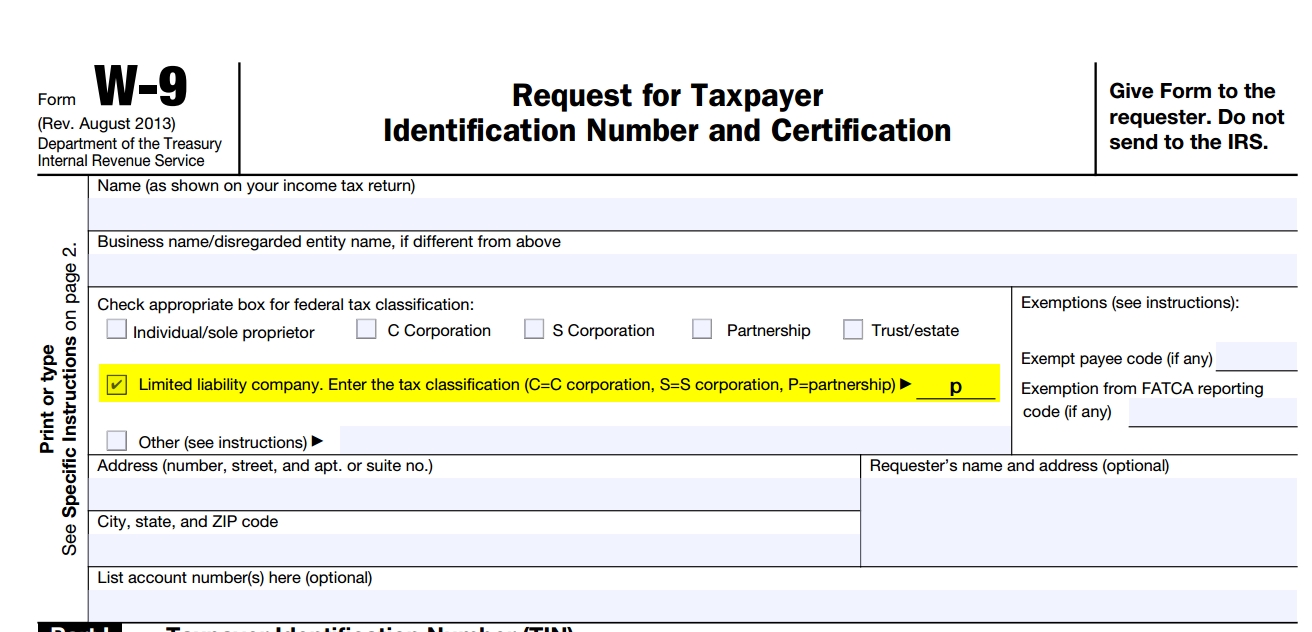

I like the down and dirty snippets of the meaning of various commercial real estate terms. If you are an employerseller you collect the W9. Do I need to go. Just be sure youre not really an employee who should fill out a W-4. If you behave like a corporation at the state level but are taxed like a partnership or sole proprietorship at the federal level you might just be an LLC.

Source: w9manager.com

Source: w9manager.com

I find it humorous that many people ask for. These include real estate transfer documents home loan documents and. Buying a new home is exciting but the owner will need to prepare several documents before closing. A W9 is an Internal Revenue Service IRS form thats used to gather information about a contractor so that their earnings can be reported at year-end. Real estate abbreviations are important to save time and money.

Source: uslegalforms.com

Source: uslegalforms.com

To complete a W9 form fill out. Download a blank W9 from the official IRS website or get it from an institution responsible for providing it. This includes freelance or contract income but also real estate sales earnings debt cancellation pension contributions and more. Use Form W-9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example. The W-9 form provides key data clients need if youre an independent contractor.

Source: delawareinc.com

Source: delawareinc.com

If you behave like a corporation at the state level but are taxed like a partnership or sole proprietorship at the federal level you might just be an LLC. The W9 is used to create a 1099. If youre new to commercial real estate you may be more familiar with the lease structure used with residential real estate. The same applies to Real Estate Brokers assisting you with the sale or purchase of US real property. A typical real estate transaction is never as simple as submitting an offer and buying a property.

Source: yumpu.com

Source: yumpu.com

If you behave like a corporation at the state level but are taxed like a partnership or sole proprietorship at the federal level you might just be an LLC. As a landlord royalties paid to you as a copyright owner etc. If you are an employerseller you collect the W9. Real estate sales and purchases Mortgage interest paid by the taxpayer Purchase or sales of secured property Write-off of debt Taxpayer investments to an IRA Form W-9 is commonly used in the following business settings. What happens if Im asked to complete Form W9 and Im not a.

Source: sec.gov

Source: sec.gov

Unlike other legal forms used in the United States Form W9 is relatively easy to complete. A life estate provides that the life tenant and the remainderman hold joint ownership of the property but the remainderman has no right to possess it as long as the life tenant is alive. There are 18 different 1099 forms each one relating to the nature of the income. Use Form W-9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example. What Is a Life Estate.

Source: pdffiller.com

Source: pdffiller.com

Buying a new home is exciting but the owner will need to prepare several documents before closing. Usually the realtors website will give a good description without the real estate abbreviations. Do I need to go. I sold an ad for 30. A W9 is an Internal Revenue Service IRS form thats used to gather information about a contractor so that their earnings can be reported at year-end.

Source: fileoldtaxreturns.com

Source: fileoldtaxreturns.com

The W9 is used to create a 1099. Specifically when you rent an apartment the rent youll pay is. The W-9 form provides key data clients need if youre an independent contractor. 10-2018 Page 2 By signing the filled-out form you. To complete a W9 form fill out.

Source: formpros.com

Source: formpros.com

5 ways AI is being used in real estate With that said its important to take a look at the ways in which artificial intelligence and machine learning are impacting the real estate industry. Any income earned on specific real estate transactions mortgage interest paid by an individual and dividends paid out to shareholders for example need to be listed on an IRS W-9. If you behave like a corporation at the state level but are taxed like a partnership or sole proprietorship at the federal level you might just be an LLC. Anon93874 July 6 2010 I run a web site and sell advertising. The W-9 form is an IRS tax form that is filled out by providing.

Source: berkshirerealtors.net

Source: berkshirerealtors.net

There can be negotiations and contingencies all of which can complicate the closing process. Just be sure youre not really an employee who should fill out a W-4. Do I need to go. If youre new to commercial real estate you may be more familiar with the lease structure used with residential real estate. Thanks to QuickBooks Payroll for sponsoring this post.

Source: hrblock.com

Source: hrblock.com

I find it humorous that many people ask for. Anon93874 July 6 2010 I run a web site and sell advertising. Any income earned on specific real estate transactions mortgage interest paid by an individual and dividends paid out to shareholders for example need to be listed on an IRS W-9. Income paid to you. As a landlord royalties paid to you as a copyright owner etc.

Source: youtube.com

Source: youtube.com

Real estate abbreviations are important to save time and money. The W-9 form is an IRS tax form that is filled out by providing. This part will also ask you how youre. The same applies to Real Estate Brokers assisting you with the sale or purchase of US real property. Thanks to QuickBooks Payroll for sponsoring this post.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

The W-9 form provides key data clients need if youre an independent contractor. Real estate sales and purchases Mortgage interest paid by the taxpayer Purchase or sales of secured property Write-off of debt Taxpayer investments to an IRA Form W-9 is commonly used in the following business settings. As a landlord royalties paid to you as a copyright owner etc. This includes freelance or contract income but also real estate sales earnings debt cancellation pension contributions and more. The W-9 form provides key data clients need if youre an independent contractor.

Source: sdirahandbook.com

Source: sdirahandbook.com

The W9 is used to create a 1099. There can be negotiations and contingencies all of which can complicate the closing process. This part will also ask you how youre. Income paid to you. I like the down and dirty snippets of the meaning of various commercial real estate terms.

A typical real estate transaction is never as simple as submitting an offer and buying a property. Real estate sales and purchases Mortgage interest paid by the taxpayer Purchase or sales of secured property Write-off of debt Taxpayer investments to an IRA Form W-9 is commonly used in the following business settings. What happens if Im asked to complete Form W9 and Im not a. Just be sure youre not really an employee who should fill out a W-4. Use Form W-9 to provide your correct Taxpayer Identification Number TIN to the person who is required to file an information return with the IRS to report for example.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Any income earned on specific real estate transactions mortgage interest paid by an individual and dividends paid out to shareholders for example need to be listed on an IRS W-9. A typical real estate transaction is never as simple as submitting an offer and buying a property. Anon93874 July 6 2010 I run a web site and sell advertising. A life estate can be used as a way to avoid probate but still provide the life tenant with a home for as long as they live. They refuse to pay without a W9.

Source: robergtaxsolutions.com

Source: robergtaxsolutions.com

What Is a Life Estate. Download a blank W9 from the official IRS website or get it from an institution responsible for providing it. However with as is real estate this isnt the case this isnt the case. Certify that the TIN you are giving is correct or you are waiting for a number to be issued 2. This includes freelance or contract income but also real estate sales earnings debt cancellation pension contributions and more.

Source: forbes.com

Source: forbes.com

5 ways AI is being used in real estate With that said its important to take a look at the ways in which artificial intelligence and machine learning are impacting the real estate industry. Just be sure youre not really an employee who should fill out a W-4. 10-2018 Page 2 By signing the filled-out form you. Thanks to QuickBooks Payroll for sponsoring this post. As a landlord royalties paid to you as a copyright owner etc.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title what is a w9 used for in real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.