Your When are real estate taxes due in fairfax county va images are available. When are real estate taxes due in fairfax county va are a topic that is being searched for and liked by netizens today. You can Get the When are real estate taxes due in fairfax county va files here. Find and Download all free photos.

If you’re looking for when are real estate taxes due in fairfax county va images information linked to the when are real estate taxes due in fairfax county va keyword, you have come to the ideal site. Our site frequently provides you with suggestions for viewing the highest quality video and image content, please kindly surf and find more informative video articles and images that fit your interests.

When Are Real Estate Taxes Due In Fairfax County Va. Your mortgage company then sends the taxes directly to Fairfax County. Prince William County- Similar to other jurisdictions tax payments are divided into two equal installments. First Half Real Estate Taxes Due Treasurers Office June 15. Estimated Tax Payment 2 Due Treasurers Office June 30.

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements From smartsettlements.com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements From smartsettlements.com

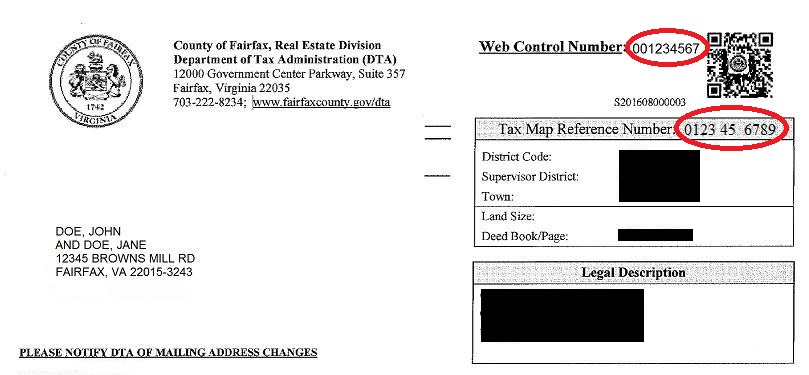

The real estate assessment indicated on the notice represents the estimated fair market value of your property as of January 1 of each year. For information pertaining to the calculation of supplemental assessments please call the Real Estate Assessment Office at 7033857840. If the due date falls on a weekend the due date moves to the next business day. DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. The deadline to report changes in personal property ownership was also extended to June 1. Using the 2021 tax year as an example the bill is normally due on October 5th.

For 2020 taxes only the Board of Supervisors extended the due date for real estate 1st installment bills from July 28 to August 28.

Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Click here to read download forms regarding this program or call 7033592486. The real estate assessment notice is not a bill. 5 of each year. DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year.

Source: in.pinterest.com

Source: in.pinterest.com

The Fairfax County Board of Supervisors voted Tuesday to delay the deadline for individuals and businesses to file property tax returns. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. First installment real estate tax payment due. The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2021 real estate assessment notices to County taxpayers today. Real Estate tax bills are due in two installments on July 28 and December 5 of each calendar year.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

3 rd quarter Virginia Estimated Income Tax. Houses 8 days ago The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax County. However some homeowners pay their real estate taxes directly due July 28 and Dec. Most homeowners pay real estate tax as part of a monthly mortgage payment. Personal Property Tax Bills mailed.

Source: testfairfaxcounty.gov

Source: testfairfaxcounty.gov

The median property tax in Fairfax County Virginia is 4543 per year for a home worth the median value of 507800. Using the 2021 tax year as an example the bill is normally due on October 5th. If you have questions about personal property tax or real estate tax contact your local tax office. Fairfax County mails these bills out between three and four weeks before each installment is due. Business License Tax Due Treasurers Office September 15.

Source: testfairfaxcounty.gov

Source: testfairfaxcounty.gov

If you have questions about personal property tax or real estate tax contact your local tax office. The notices will be sent to all County real estate owners. 2 nd quarter Virginia Estimated Income Tax. Information and Due Dates The 2020 real property tax rate was set by the City Council when they adopted the. Tax Relief Program City of Fairfaxs Finance Office administers this program.

Source: pinterest.com

Source: pinterest.com

Your mortgage company then sends the taxes directly to Fairfax County. If the due date falls on a weekend the due date moves to the next business day. Fairfax County mails all Real Estate Assessment notices to residents each February. Most homeowners pay real estate tax as part of a monthly mortgage payment. The due dates are July 28 and December 5 each year.

Source: pinterest.com

Source: pinterest.com

Most homeowners pay real estate tax as part of a monthly mortgage payment. The Fairfax County Board of Supervisors then sets county property tax rates by May 1 of each year. Tax Relief Program City of Fairfaxs Finance Office administers this program. DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. Prince William County- Similar to other jurisdictions tax payments are divided into two equal installments.

Source: pinterest.com

Source: pinterest.com

Real estate taxes are paid annually in two installments due July 28 and December 5. Fairfax County mails all Real Estate Assessment notices to residents each February. The Fairfax County Board of Supervisors voted Tuesday to delay the deadline for individuals and businesses to file property tax returns. Houses 8 days ago The Department of Tax Administrations DTA Real Estate Division is tasked with collecting data for all real property in Fairfax County. Business License Tax Due Treasurers Office September 15.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

For residential properties in Fairfax County tax payments work in a series of two installments due on July 28 and Dec. Real estate taxes are paid annually in two installments due July 28 and December 5. Taxpayers who missed this deadline are subject to the normal 10 penalty however. The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2021 real estate assessment notices to County taxpayers today. DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

Estimated Tax Payment 3 Due Treasurers Office October 5. New Applications for Tax Relief for Elderly Due Commissioner of the Revenues Office July 1. Information and Due Dates The 2020 real property tax rate was set by the City Council when they adopted the. Fairfax County has one of the highest median property taxes in the United States and is ranked 41st of the 3143 counties in. The notices will be sent to all County real estate owners.

Source: smartsettlements.com

Source: smartsettlements.com

1 st half Real Estate Taxes Due. For information pertaining to the calculation of supplemental assessments please call the Real Estate Assessment Office at 7033857840. Most homeowners pay real estate tax as part of a monthly mortgage payment. If your mortgage holder does not commit to pay your Real Estate taxes the tax bills will be mailed to your current mailing address. Fairfax County mails these bills out between three and four weeks before each installment is due.

Source: pinterest.com

Source: pinterest.com

For 2020 taxes only the Board of Supervisors extended the due date for real estate 1st installment bills from July 28 to August 28. The Fairfax County Board of Supervisors then sets county property tax rates by May 1 of each year. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. If the due date falls on a weekend the due date moves to the next business day. The assessed value is the basis for your real estate taxes which will be due on June 21 and December 5.

Source: it.pinterest.com

Source: it.pinterest.com

DTA uses that data to annually assess real property in a fair and uniform manner at estimated fair market value as of January 1 of each year. Contact your mortgage company if you are not sure how your. New Applications for Tax Relief for Elderly Due Commissioner of the Revenues Office July 1. Fairfax County has one of the highest median property taxes in the United States and is ranked 41st of the 3143 counties in. Personal Property Tax Bills mailed.

Source: nl.pinterest.com

Source: nl.pinterest.com

Contact your mortgage company if you are not sure how your. Vehicles purchased or moved into Fairfax County on or after July 1st of 2021 will be due on February 15th 2022. Real estate taxes are paid annually in two installments due July 28 and December 5. Information and Due Dates The 2020 real property tax rate was set by the City Council when they adopted the. First Half Real Estate Taxes Due Treasurers Office June 15.

Source: pinterest.com

Source: pinterest.com

If you have questions about personal property tax or real estate tax contact your local tax office. 3 rd quarter Virginia Estimated Income Tax. Tax rates differ depending on where you live. Of the Countys 356171 taxable parcels 326263 experienced a value change for Tax Year 2021. The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2021 real estate assessment notices to County taxpayers today.

Source: fairfaxcountyeda.org

Source: fairfaxcountyeda.org

4 days ago. New Applications for Tax Relief for Elderly Due Commissioner of the Revenues Office July 1. Fairfax County mails all Real Estate Assessment notices to residents each February. 2021 Real Estate Assessment Notices Mailed Feb. Of the Countys 356171 taxable parcels 326263 experienced a value change for Tax Year 2021.

Source: alexandrialivingmagazine.com

Source: alexandrialivingmagazine.com

2 nd quarter Virginia Estimated Income Tax. 2 nd quarter Virginia Estimated Income Tax. The second installment of real estate tax payments are due on Dec. This notice is not a tax bill. Of the Countys Countys.

Source: fairfaxcounty.gov

Source: fairfaxcounty.gov

Fairfax County mails these bills out between three and four weeks before each installment is due. Fairfax County- Tax bills are mailed out 3 to 4 weeks prior to the due dates. The notices will be sent to all County real estate owners. The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2021 real estate assessment notices to County taxpayers today. 5 of each year.

Source: pinterest.com

Source: pinterest.com

Fairfax County mails these bills out between three and four weeks before each installment is due. Real Estate Taxes Tax Administration. 4 days ago. Personal property taxes and real estate taxes are local taxes which means theyre administered by cities counties and towns in Virginia. Estimated Tax Payment 3 Due Treasurers Office October 5.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title when are real estate taxes due in fairfax county va by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.