Your Who pays real estate fees ontario images are available. Who pays real estate fees ontario are a topic that is being searched for and liked by netizens today. You can Find and Download the Who pays real estate fees ontario files here. Get all free images.

If you’re searching for who pays real estate fees ontario pictures information linked to the who pays real estate fees ontario topic, you have come to the ideal site. Our website always provides you with suggestions for viewing the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that fit your interests.

Who Pays Real Estate Fees Ontario. Your real estate agent works very hard to market stage and sell your home. In Ontario its the Buyer who pays the land transfer tax not the Seller. Precisely who pays a real estate agents commission is where things get a little tricky. Until the HST took effect consumers only paid the 5 Goods and Services Tax GST on these services.

Did You Know Commission Is Paid Out By The Seller Typical Commissions Around The Gta Are 5 Selling Real Estate Getting Into Real Estate Real Estate Training From pinterest.com

Did You Know Commission Is Paid Out By The Seller Typical Commissions Around The Gta Are 5 Selling Real Estate Getting Into Real Estate Real Estate Training From pinterest.com

Brokers can work independently or start a brokerage while real estate agents are required to work for a broker. 385 of purchase price PST. Real estate commissions are the fees that you pay to your real estate agent for their services. 90 to 95 of purchase price. And those fees are due whether they sell ten properties or zero properties. Standard practice is that the seller pays the fee.

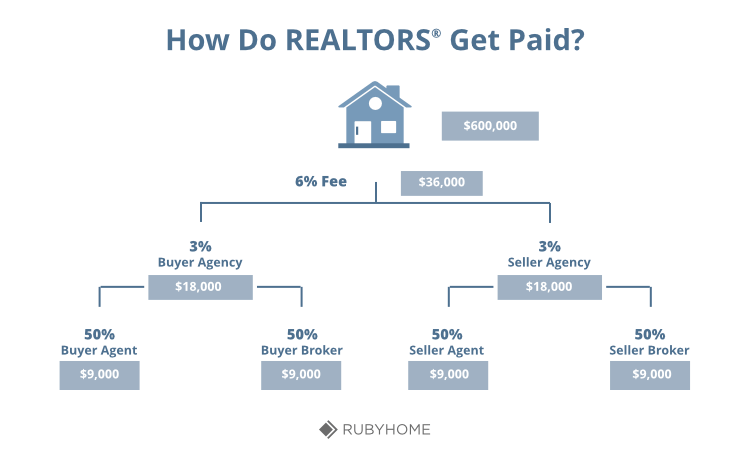

How real estate commission is split can vary depending on what the seller arranges with their agent.

The real estate commission rate in Ontario is 5. But HST DOES apply to services such as moving cost legal fees home inspection fees appraisal fees labour for renovations landscaping and REALTOR commissions if applicable. Keep in mind too that mortgage default insurance fees will. Generally buyers dont pay realtors directly. Provincial land transfer tax is paid on closing and calculated on a sliding scale as follows. Humbers New Real Estate Salesperson Program.

Source: pinterest.com

Source: pinterest.com

Provincial land transfer tax is paid on closing and calculated on a sliding scale as follows. A realtor can help purchasers find the right home for the right price and guide them through the entire home buying process. Precisely who pays a real estate agents commission is where things get a little tricky. But HST DOES apply to services such as moving cost legal fees home inspection fees appraisal fees labour for renovations landscaping and REALTOR commissions if applicable. How much in real estate commissions do home sellers pay.

Source: br.pinterest.com

Source: br.pinterest.com

After 60 years of OREA College delivering Real Estate education through their courses in 2019 The Real Estate Council of Ontario RECO has partnered up with Humber College and NIIT to offer a new Real Estate Program. Real estate commissions are the fees that you pay to your real estate agent for their services. After 60 years of OREA College delivering Real Estate education through their courses in 2019 The Real Estate Council of Ontario RECO has partnered up with Humber College and NIIT to offer a new Real Estate Program. 360 of mortgage PST. The Canadian Real Estate Association CREA reported that there were 58645 homes sold in Augustan increase of 335 vs.

Source: pinterest.com

Source: pinterest.com

A realtor can help purchasers find the right home for the right price and guide them through the entire home buying process. 90 to 95 of purchase price. And when you sell the real estate commission is likely going to be the biggest fee youll ever pay in your lifetime. 05 of the value of the property up to. Humbers New Real Estate Salesperson Program.

Source: pinterest.com

Source: pinterest.com

Lawyers fees are also subject to the 13 percent HST. The agent fee is typically paid by the seller to the listing broker who in turn shares part of it with the agent who brings a buyer to the table explains Adam Reliantra a real estate agent in. 360 of mortgage PST. Provincial land transfer tax is paid on closing and calculated on a sliding scale as follows. How much in real estate commissions do home sellers pay.

Source: pinterest.com

Source: pinterest.com

But HST DOES apply to services such as moving cost legal fees home inspection fees appraisal fees labour for renovations landscaping and REALTOR commissions if applicable. Real estate commissions are the fees you pay to your real estate agent for their services. Standard practice is that the seller pays the fee. Precisely who pays a real estate agents commission is where things get a little tricky. 05 of the value of the property up to.

Source: br.pinterest.com

Source: br.pinterest.com

05 of the value of the property up to. Generally buyers dont pay realtors directly. Most Canadians use a real estate agent when buying a home paying real estate agent commissions. Buying a home is likely going to be the largest purchase in your life. Only a real estate broker can pay a real estate commission and sign a listing agreement with a seller.

Source: pinterest.com

Source: pinterest.com

Provincial land transfer tax is paid on closing and calculated on a sliding scale as follows. 90 to 95 of purchase price. Until the HST took effect consumers only paid the 5 Goods and Services Tax GST on these services. A realtor can help purchasers find the right home for the right price and guide them through the entire home buying process. The highest cost for the sale of a property is the realtors.

Source: pinterest.com

Source: pinterest.com

But HST DOES apply to services such as moving cost legal fees home inspection fees appraisal fees labour for renovations landscaping and REALTOR commissions if applicable. In Ontario the standard real estate agent commission is 5 of the property price plus HST but in practice. After 60 years of OREA College delivering Real Estate education through their courses in 2019 The Real Estate Council of Ontario RECO has partnered up with Humber College and NIIT to offer a new Real Estate Program. 05 of the value of the property up to. And those fees are due whether they sell ten properties or zero properties.

Source: pinterest.com

Source: pinterest.com

Brokers can work independently or start a brokerage while real estate agents are required to work for a broker. Provincial land transfer tax is paid on closing and calculated on a sliding scale as follows. Until the HST took effect consumers only paid the 5 Goods and Services Tax GST on these services. How much in real estate commissions do home sellers pay. It is usually calculated as a percentage of the selling price of the property.

Source: pinterest.com

Source: pinterest.com

In Ontario its the Buyer who pays the land transfer tax not the Seller. Lawyers fees are also subject to the 13 percent HST. Your real estate agent works very hard to market stage and sell your home. And when you sell the real estate commission is likely going to be the biggest fee youll ever pay in your lifetime. Real estate commissions are the fees you pay to your real estate agent for their services.

Source: pinterest.com

Source: pinterest.com

Closing costs when selling a house in Ontario are mostly limited to three items 1Realtor commission 2Real Estate Lawyers Fees 3. Ontario Land Transfer Tax. And when you sell the real estate commission is likely going to be the biggest fee youll ever pay in your lifetime. The Canadian Real Estate Association CREA reported that there were 58645 homes sold in Augustan increase of 335 vs. The highest cost for the sale of a property is the realtors.

Source: in.pinterest.com

Source: in.pinterest.com

The highest cost for the sale of a property is the realtors. The highest cost for the sale of a property is the realtors. In a nutshell if you are a seller there is a 13 percent tax payable on the real estate commission you pay. The real estate commission rate in Ontario is 5. Generally buyers dont pay realtors directly.

Source: pinterest.com

Source: pinterest.com

It is usually divided evenly between the sellers agent and the buyers agent – typically 25 for each. How much in real estate commissions do home sellers pay. Provincial land transfer tax is paid on closing and calculated on a sliding scale as follows. And when you sell the real estate commission is likely going to be the biggest fee youll ever pay in your lifetime. All fees paid to a real estate agent must first pass through a broker.

Source: pinterest.com

Source: pinterest.com

The real estate commission rate in Ontario is 5. It is estimated the average home buyer will likely pay 1200 - 1500 additional cost in HST fees when moving. Real estate commissions are the fees that you pay to your real estate agent for their services. And when you sell the real estate commission is likely going to be the biggest fee youll ever pay in your lifetime. Humbers New Real Estate Salesperson Program.

Source: ar.pinterest.com

Source: ar.pinterest.com

The Canadian Real Estate Association CREA reported that there were 58645 homes sold in Augustan increase of 335 vs. In Ontario its the Buyer who pays the land transfer tax not the Seller. Real estate commissions are the fees you pay to your real estate agent for their services. Real estate commissions are the fees that you pay to your real estate agent for their services. Humbers New Real Estate Salesperson Program.

Source: in.pinterest.com

Source: in.pinterest.com

360 of mortgage PST. Most Canadians use a real estate agent when buying a home paying real estate agent commissions. Closing costs when selling a house in Ontario are mostly limited to three items 1Realtor commission 2Real Estate Lawyers Fees 3. The agent fee is typically paid by the seller to the listing broker who in turn shares part of it with the agent who brings a buyer to the table explains Adam Reliantra a real estate agent in. Lawyers fees are also subject to the 13 percent HST.

Source: rubyhome.com

Source: rubyhome.com

A realtor can help purchasers find the right home for the right price and guide them through the entire home buying process. Ontario Land Transfer Tax. Generally buyers dont pay realtors directly. In Ontario its the Buyer who pays the land transfer tax not the Seller. Only a real estate broker can pay a real estate commission and sign a listing agreement with a seller.

Source: in.pinterest.com

Source: in.pinterest.com

And those fees are due whether they sell ten properties or zero properties. Ontario Land Transfer Tax. Precisely who pays a real estate agents commission is where things get a little tricky. A In a typical scenario where the buyer and the seller are each represented by their own real-estate professional commission for both representatives is paid by the seller. Your real estate agent works very hard to market stage and sell your home.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title who pays real estate fees ontario by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.