Your Wisconsin real estate transfer fee calculator images are available in this site. Wisconsin real estate transfer fee calculator are a topic that is being searched for and liked by netizens today. You can Find and Download the Wisconsin real estate transfer fee calculator files here. Get all free photos.

If you’re searching for wisconsin real estate transfer fee calculator pictures information related to the wisconsin real estate transfer fee calculator topic, you have visit the right blog. Our site always gives you hints for downloading the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

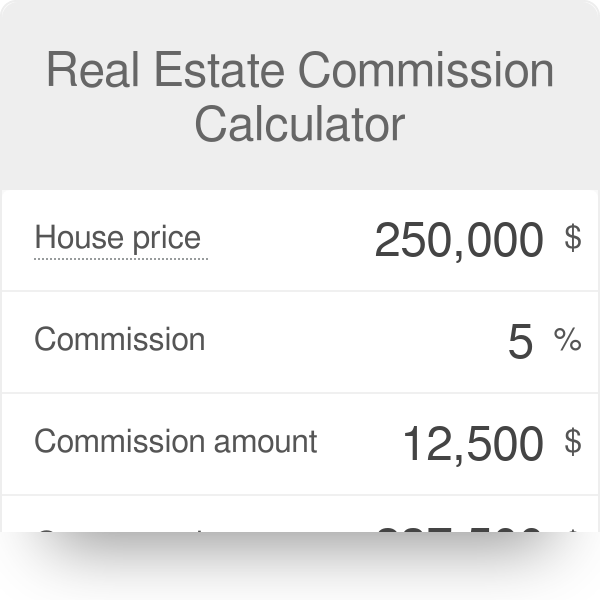

Wisconsin Real Estate Transfer Fee Calculator. Please let me know if the calculator is out of date or you have an interest in this calculator - Email. No recording fee in Wisconsin. Do not adjust the fair market value by the amount of any liens on the property. The Wisconsin transfer tax is 3 per 1000.

Revisiting The Pinch Me Moment For Madison Wisconsin Home Values Madison Real Estate Refinance Mortgage Home Refinance Home Loans From ar.pinterest.com

Revisiting The Pinch Me Moment For Madison Wisconsin Home Values Madison Real Estate Refinance Mortgage Home Refinance Home Loans From ar.pinterest.com

In Wisconsin the state charges real estate transfer taxes of 300 per 1000 of the homes selling price. When recording a property conveyance deed and other instruments a seller of real estate is required to file a Real Estate Transfer Return RETR with the county Register of Deeds. Please let me know if the calculator is out of date or you have an interest in this calculator - Email. Local transfer taxes could vary and the assessors office may levy a title recording fee. This may happen when the real estate value is greater than the other assets and the payment to the estate boot creates equal shares. WISCONSIN REAL ESTATE TRANSFER FEES.

However the seller pays this fee in Wisconsin.

Total 1-3 2000 to 6000 Based on a 202000 home a typical home value in Wisconsin Zillow Research data October 2020 Closing costs are a blanket term for the various fees and expenses not including realtor commission paid by both parties. However if the heir receiving the real estate has to pay the estate or siblings any consideration that amount is subject to transfer fee. This may happen when the real estate value is greater than the other assets and the payment to the estate boot creates equal shares. Additional charges could be assessed in varying circumstances including when unusual conditions of title are encountered special risks are insured against special services are requested. The state of Wisconsin charges the transfer tax based on the sale price. The property value is determined by each propertys fair market value per state law sec7721 3 Wis.

Source: riverbankfinance.com

Source: riverbankfinance.com

Transfer taxes. Additional charges could be assessed in varying circumstances including when unusual conditions of title are encountered special risks are insured against special services are requested. Local transfer taxes could vary and the assessors office may levy a title recording fee. Thus if the sale price is 250000 a transfer tax of 750 is due. Do not adjust the fair market value by the amount of any liens on the property.

Source: pinterest.com

Source: pinterest.com

In Wisconsin the state charges real estate transfer taxes of 300 per 1000 of the homes selling price. Wisconsin Real Estate Transfer Taxes. The sale price or value should always be rounded up to the nearest hundred dollars before computing the tax then multiply by 003. Agent commission fees are negotiable at the. WISCONSIN REAL ESTATE TRANSFER FEES.

Source: deeds.com

Source: deeds.com

In Wisconsin the state charges real estate transfer taxes of 300 per 1000 of the homes selling price. Wisconsin Real Estate Transfer Taxes. In Wisconsin the state charges real estate transfer taxes of 300 per 1000 of the homes selling price. In this case when completing the Fee computation page in the return the total real estate value conveyed is the. However the seller pays this fee in Wisconsin.

Source: pinterest.com

Source: pinterest.com

The sale price or value should always be rounded up to the nearest hundred dollars before computing the tax then multiply by 003. The property value is determined by each propertys fair market value per state law sec7721 3 Wis. Prior to 1969 the United States government had a revenue stamp with a rate of 055 on each 50000 or fractional part thereof of the sale price or value of the property conveyed. Agent commission fees are negotiable at the. 3 days ago The state of Wisconsin charges the transfer tax based on the sale price.

Source: pinterest.com

Source: pinterest.com

The fee is 30 cents per 100 300 per 1000. Transfer fee due The grantor of real estate must pay a real estate transfer fee at the rate of 30 cents for each 100 of value or fraction thereof on every conveyance not exempted or excluded under state law sec. Amended Real Estate Transfer Return - PE-500x. The fee calculates to the amount based on the rate of 001. However if the heir receiving the real estate has to pay the estate or siblings any consideration that amount is subject to transfer fee.

Source: anytimeestimate.com

Source: anytimeestimate.com

September 1 1981 through the present. In this case when completing the Fee computation page in the return the total real estate value conveyed is the. Agent commission fees are negotiable at the. Since 2012 the fee collected has increased each year from 578 million to 994 million in 2019. Rates and fees are subject to change depending on changes in title insurance rate filings by Knight Barry Title insurers andor the coverages and services requested and the accuracy of the data you have provided.

Source: pinterest.com

Source: pinterest.com

Since 2012 the fee collected has increased each year from 578 million to 994 million in 2019. The sale price or value should always be rounded up to the nearest hundred dollars before computing the tax then multiply by 003. The RTF is usually collected at the real estate closing by the legal. Since July 1 2009 a seller must electronically file e-file a return under state law. Wisconsin Department of Revenues Real Estate Transfer Return Data Site.

Source: rapidapi.com

Source: rapidapi.com

WISCONSIN REAL ESTATE TRANSFER FEES. Please let me know if the calculator is out of date or you have an interest in this calculator - Email. Additional charges could be assessed in varying circumstances including when unusual conditions of title are encountered special risks are insured against special services are requested. During the period between 2006 and 2011 however the amount declined sharply from 933 to 442 million. How To Transfer Real Estate in Wisconsin The transfer of real estate is a legal transaction.

Source:

Source:

However the seller pays this fee in Wisconsin. Prior to 1969 the United States government had a revenue stamp with a rate of 055 on each 50000 or fractional part thereof of the sale price or value of the property conveyed. Rates and fees are subject to change depending on changes in title insurance rate filings by Knight Barry Title insurers andor the coverages and services requested and the accuracy of the data you have provided. Additional charges could be assessed in varying circumstances including when unusual conditions of title are encountered special risks are insured against special services are requested. September 1 1981 through the present.

Source: digjamaica.com

Source: digjamaica.com

No recording fee in Wisconsin. Additionally you may be responsible to pay local transfer taxes as well. Do not adjust the fair market value by the amount of any liens on the property. The RTF is usually collected at the real estate closing by the legal. Agent commission fees are negotiable at the.

Source: pinterest.com

Source: pinterest.com

Thus if the sale price is 250000 a transfer tax of 750 is due. They charge at a rate of 030 for every 100 or fraction thereof of the purchase price. Additional charges could be assessed in varying circumstances including when unusual conditions of title are encountered special risks are insured against special services are requested. Thus if the sale price is 250000 a transfer tax of 750 is due. Real Estate Transfer Return.

Source: pinterest.com

Source: pinterest.com

Additional charges could be assessed in varying circumstances including when unusual conditions of title are encountered special risks are insured against special services are requested. Since the Value subject to fee is less than the Total value of real estate transferred select transfer fee Exemption 17 - Sat. If you need to find an attorney you can call the Lawyer Referral Service at 800-362-9082. Attorney fee not required. Prior to 1969 the United States government had a revenue stamp with a rate of 055 on each 50000 or fractional part thereof of the sale price or value of the property conveyed.

Source: anmtg.com

Source: anmtg.com

Transfer taxes. The Burnett County Register of Deeds office highly recommends that you enlist the services of an attorney to complete your transfer. Transfer taxes. Total Value of Real Estate transferred. WISCONSIN REAL ESTATE TRANSFER FEES.

Source: pinterest.com

Source: pinterest.com

How To Transfer Real Estate in Wisconsin The transfer of real estate is a legal transaction. Electronic Real Estate Transfer Waiver. During the period between 2006 and 2011 however the amount declined sharply from 933 to 442 million. Wisconsin Department of Revenues Real Estate Transfer Return Data Site. WISCONSIN REAL ESTATE TRANSFER FEES.

Source: time.com

Source: time.com

Electronic Real Estate Transfer Waiver. However the seller pays this fee in Wisconsin. The Wisconsin transfer tax is 3 per 1000. Electronic Real Estate Transfer Waiver. Since July 1 2009 a seller must electronically file e-file a return under state law.

Source: pinterest.com

Source: pinterest.com

The sale price or value should always be rounded up to the nearest hundred dollars before computing the tax then multiply by 003. Since the Value subject to fee is less than the Total value of real estate transferred select transfer fee Exemption 17 - Sat. The total amount of real estate transfer fee collected in Wisconsin showed steady increases from 540 million in 2000 to 999 million in 2005. Thus if the sale price is 250000 a transfer tax of 750 is due. 3 days ago The state of Wisconsin charges the transfer tax based on the sale price.

Source: pinterest.com

Source: pinterest.com

Do not adjust the fair market value by the amount of any liens on the property. Agent commission fees are negotiable at the. In this case when completing the Fee computation page in the return the total real estate value conveyed is the. Value subject to fee 13 the value of the original land contract. They charge at a rate of 030 for every 100 or fraction thereof of the purchase price.

Source: listwithclever.com

Source: listwithclever.com

If you need to find an attorney you can call the Lawyer Referral Service at 800-362-9082. 3000 payable by A for 10000 being one-half the 20000 value differential Exemption. Total Value of Real Estate transferred. Transfer fee due The grantor of real estate must pay a real estate transfer fee at the rate of 30 cents for each 100 of value or fraction thereof on every conveyance not exempted or excluded under state law sec. If you need to find an attorney you can call the Lawyer Referral Service at 800-362-9082.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title wisconsin real estate transfer fee calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.